Overvaluation, slowing viewership growth, and a one-off tax shock in Brazil caused Netflix’s (NFLX) stock price to spiral downwards in the second half of 2025.

The announcement of the Warner Bros. Discovery (WBD) acquisition last December added a fresh layer of uncertainty.

Investors grappled with the massive debt load, resulting in further pressure on the stock.

Since hitting an all-time high of US$134 in June 2025, Netflix has lost more than 36% of its market cap and now trades at around US$85.

As a long-time Netflix user and previous shareholder, the market’s reaction to the latest 4Q 2025 results caught my attention.

I recently spent time chatting with Gemini to unpack the financial implications of this acquisition story.

My conclusion?

The current price offers a compelling entry point for a potential turnaround in the next 24 to 36 months, regardless of the final acquisition outcome.

Here is the analysis that influenced me to take a small stake in Netflix on Wednesday.

Successful Acquisition: Short-term Pain, Long-term Gain

FY 2025 Results and FY 2026 Guidance

Before talking about the acquisition impact, let’s do a quick recap of the latest results.

Despite the stock’s “plunge,” Netflix’s actual business performance remains robust.

Revenue for 4Q 2025 grew 18% year-on-year (YOY) to US$12 billion, with diluted earnings-per-share (EPS) surged 31% YOY to US$0.56.

This strong quarter meant Netflix met or exceeded all 2025 goals, including a superb jump in its advertising revenue of US$1.5 billion — that’s 2.5 times higher than previous year!

For FY 2026, management projected 14% growth in sales, with operating margin of 31.5% (up from 29.5%).

Ad revenue is expected to double again to US$3 billion, which is a clear indication that the shift to an ad-supported model is clearly working.

Forward Valuation: Growth at a Deep Discount

At US$85 per share, the valuation metrics are becoming too attractive to ignore.

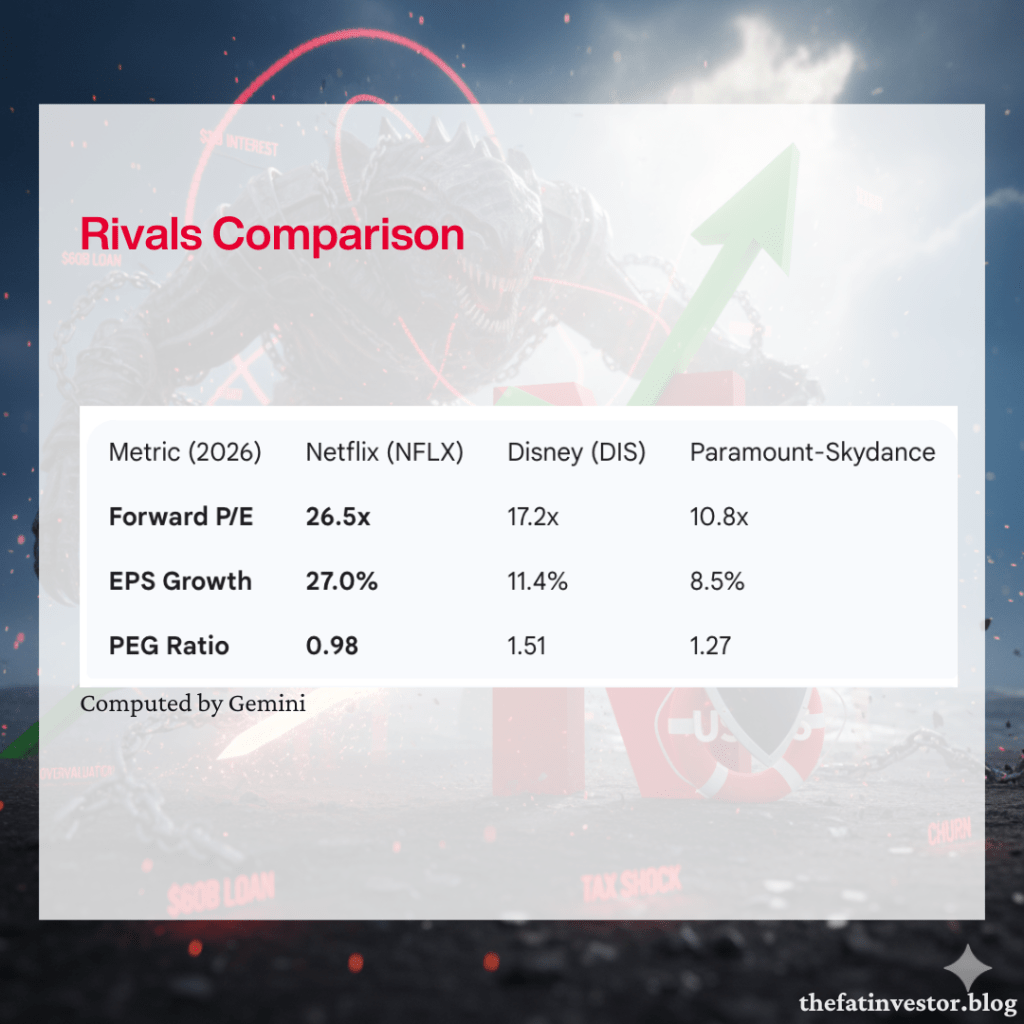

Based on 2026 EPS guidance of approximately US$3.2, forward P/E is about 27x.

This puts the PEG Ratio at just under 1.0x. You seldom find a high-growth market leader at a PEG of 1.0.

Even if growth slows after FY 2026 to a more conservative average of 20%, the PEG ratio of 1.3x is still very palatable, considering the long-term growth potential of its ad-supported model.

The US$60B Debt Concern

The headline risk is the massive US$60B bridge loan required to take WBD all-cash. This translates to nearly US$3B in interest annually.

However, Netflix is a cash-generating machine:

- Free Cash Flow (FCF): Expected to exceed US$11B in FY 2026.

- Debt Repayment: Netflix plans to use this cash to pare down principal quickly. As debt drops, interest payments fall, which automatically boosts future EPS growth.

- Rate Risk: While a hike would hurt, it’s unlikely in the current macro environment. Even a surprise 0.5% hike would only impact EPS by about US$0.06 — a manageable “speed bump.”

Best Value-for-Money Among Rivals

Finally, as show in the above table, Netflix offers the best “growth-per-dollar” spent when compared to its primary rivals.

Acquisition Aborted: Short-term Gain, Long-term ???

What if the deal falls through due to regulatory blocking or a Paramount counter-bid?

In the short term, this would likely be a “win” for the stock price.

Netflix would pay a US$5.8B breakup fee — a drop in the bucket representing less than six months of their free cash flow.

Without the WBD debt, Netflix would almost certainly resume its massive share buyback program. The market would view this as a “de-risking” event, likely sending the stock back toward US$100+ overnight.

The long-term outlook, however, becomes more of a riddle.

Without WBD, Netflix loses access to the HBO/Warner library and faces a newly consolidated “Paramount-Warner” rival.

To stay ahead, they’d have to ramp up spending on original content to keep subscribers from drifting.

How that gamble pays off is anyone’s guess.

Conclusion: A Good Deal at This Price

Regardless of the final acquisition outcome, I believe the current price of US$85 offers a high-probability entry point for a turnaround.

But as in any good drama, nothing is guaranteed.

Following my usual practice, I’ve initiated a minor position at 0.4% of my total portfolio. If the market offers further discounts, I plan to scale up to a 1% stake.

I’m not expecting Netflix to be a portfolio-defining “mega hit” like KPop Demon Hunters (the massive 2025 sleeper hit).

Instead, I’m viewing it as a reliable, high-quality performer, much like Stranger Things. It’s a seasoned veteran that has faced monsters before, and usually finds a way to win in the final act.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

Hi Sir, really enjoy reading your comments on the covered stocks. Thanks for 2025 Arista call that buys me some milk power, hope we huat 2026 the same way too!!

Great to know that you are enjoying my writing. But hor, they are NOT recommendations ok. Make sure you do your own due diligence.