My US portfolio has lost nearly half of the gain it made this year since I trimmed it a month ago.

“Lost nearly half” is the emotional anchor your brain processes first. It will immediately conjure up the image of US markets crashing, and link to what you have been reading about AI bubble bursting recently.

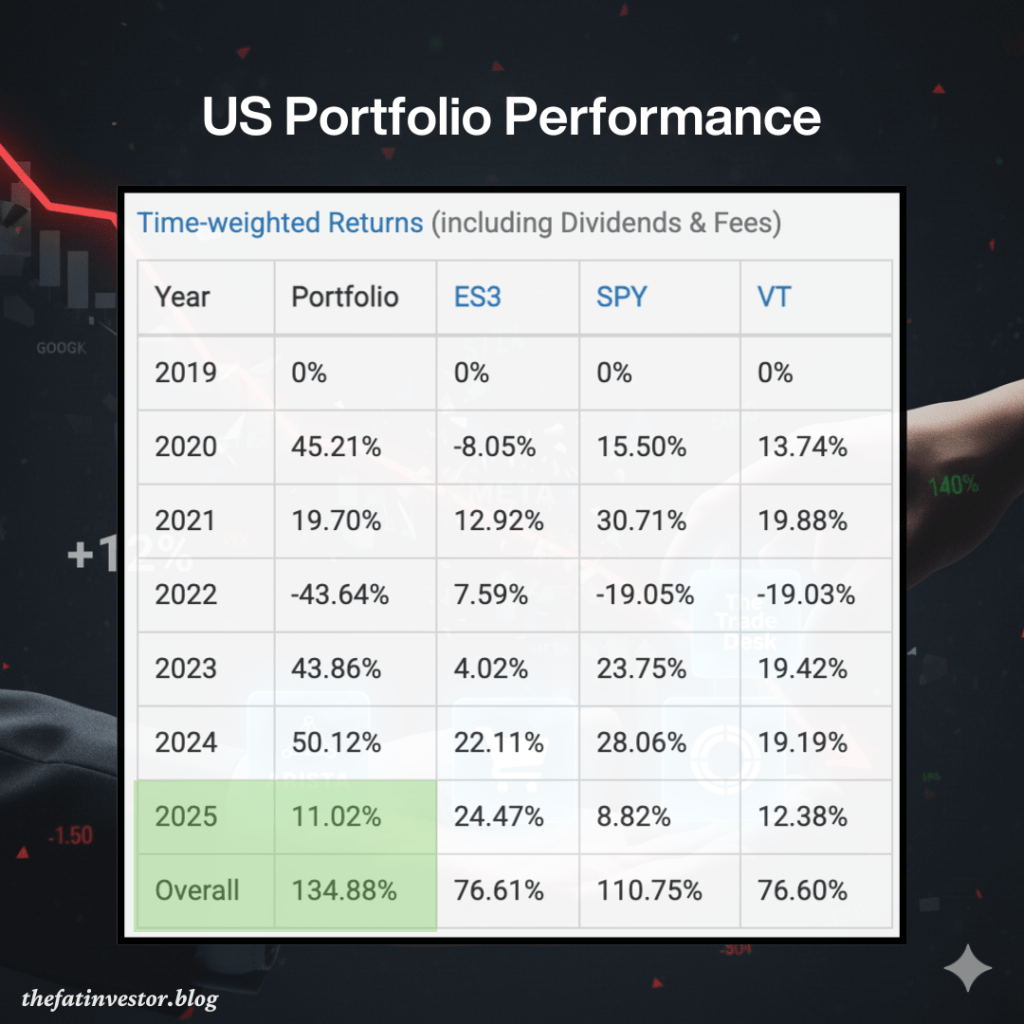

The truth is my US portfolio is still up around 16% year-to-date (YTD). Even if forex loss is included, it’s still a good 11% return.

And if I zoom out all the way to when the portfolio is incepted in 2020, it’s up by more than 130%. That’s compound annual growth rate (CAGR) of above 15%!

Don’t get me wrong.

What you felt is real. There’s no need to suppress it, and you shouldn’t attempt to.

I mean, what’s life if it isn’t filled with the colours of emotions?

But you need to be aware of how certain words and phrasing can trigger intense emotions, directly impacting your decisions.

In the long run, this emotional awareness and self-regulation is the single most important factor separating successful investors from the rest.

Pardon me for getting into my teacher mode and rambling about investing psychology.

Back to the reality on how I feel about losing half my gain and what I am doing about it.

My Perfect Timing?

The recent markets weaknesses and the dramatic one-day reversal of gain to sharp loss last Thursday, seem to suggest that I’ve timed my selling last month to perfection.

That’s far from the truth.

As mentioned, the sale was a part of my plan to replenish my future cash flow. Hence, how the markets move after my sale is irrelevant to that decision.

Even if you think I’m timing, it’s just 10% of my US portfolio, or less than 3% of the entire portfolio.

This means while I might feel good about getting it “right” for this small 10%, the vast majority of my portfolio still endured the market’s roller-coaster drop.

Scrutinising data, instead of relying on intuition, reveals the truth.

Yes, half the counters I sold: Arista Networks (NYSE: ANET), Veeva Systems (NYSE: VEEV), ZScaler (NASDAQ: ZS) saw a significant price decline since my sales.

However, Shopify’s (NASDAQ: SHOP) stock price hardly budged, and both Alphabet (NASDAQ: GOOG), and Apple (NASDAQ: AAPL) saw their prices soared!

While my minor portfolio adjustment appeared well-timed, the reality is that the market’s swings are simply inherent volatility.

For me, the real focus remains on the underlying business fundamentals, which, based on the latest quarterly updates, remain robust.

The Underlying Businesses are Still Strong

As illustrated by the above image, the companies I hold continue to demonstrate robust fundamentals in the last quarter.

Here’s my key takeaways from their recent earnings calls.

🚀 Arista Networks: The Long-Term AI Story vs Short-Term Jitters

Arista continues to benefit significantly from the secular tailwinds of cloud networking and the burgeoning AI infrastructure build-out.

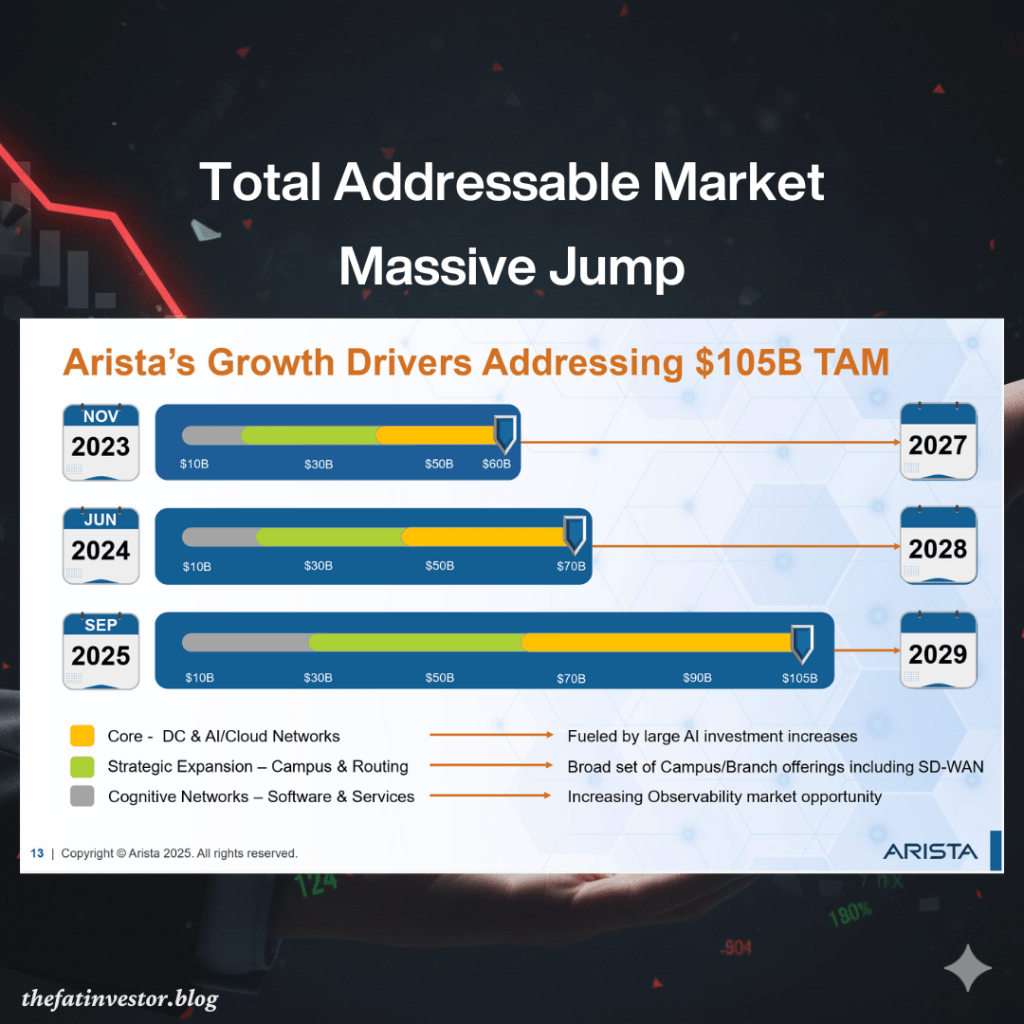

This long-term strength is why management substantially increased Arista’s Total Addressable Market (TAM) guidance further, jumping from the previous US$70 billion by 2028 to over US$100 billion by 2029!

With such an expanding growth runway and robust demand, why did the stock price plunge?

The short answer is: Markets simply dislike inconsistent growth and uncertainties.

The recent sequential lower quarterly growth and a cautious Q4 revenue outlook was sufficiently unnerving for market participants to sell down its shares.

As CEO & Chairperson Jayshree Ullal pointed out, while they are committing to at least a 20% revenue growth going forward, they cannot commit to the actual shipment timing. This means revenue will continue to experience quarterly (and even annual) variations.

To me, this is a non-issue since it is simply a matter of timing, especially when the underlying demand remains strong.

Over the next five years, Arista’s revenue and profit will be substantially larger, and markets will eventually recognise that the secular trends driving the business are more important than the temporary shipment schedule volatility.

🛍️ Shopify: Growth Engine Beyond E-Commerce

I always love Shopify’s business model, and it’s getting better.

It evolved from a simple e-commerce platform for entrepreneurs into a mission-critical infrastructure provider for brands of all sizes.

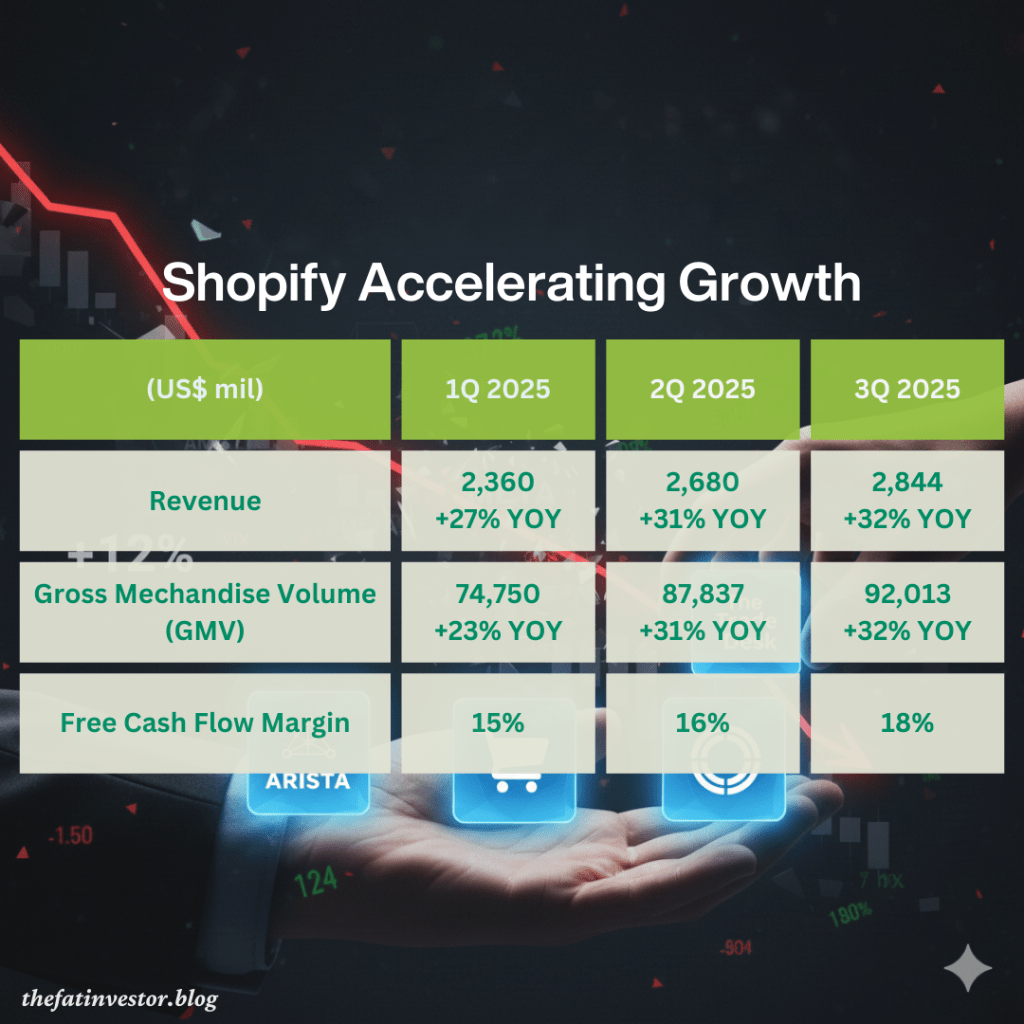

Shopify just delivered another fantastic quarter, affirming its enormous potential. Its accelerating and robust Gross Merchandise Volume (GMV) growth hit 32% YOY in the latest quarter.

This growth highlights Shopify’s rapid adaptation, particularly with the integration of AI tools like Sidekick, which drove an 11x increase in AI-driven orders since the start of the year, signalling its readiness for agentic commerce.

This momentum is particularly visible in its global markets, which account for 30% of sales. International GMV grew at a massive 41% YOY in Q3 2025, with the European segment accelerating to an astonishing 49% YOY.

How can you not be impressed by such growth?

The problem? It’s prohibitively expensive.

Valued at a forward P/E ratio exceeding 100x, this valuation makes it nearly impossible to justify pushing the buy button, despite my admiration for the company.

It feels like my experience at Don Don Donki yesterday.

The Shine Muscat grapes looked aesthetically beautiful, and while there was no doubt about their sweetness, I just couldn’t bear to pay S$25 to bring them home.

Given the inherent volatility of US markets and their unforgiving nature when expectations are missed, I am in no rush to add to the third largest position in my US portfolio.

🖥️ The Trade Desk: The Future of AdTech is Now (and it’s Cheaper)

Like Shopify, I admire The Trade Desk (TTD) for its visionary positioning.

Both companies built the backbone for the open internet, seizing opportunities others missed by resisting the “walled gardens” of giants like Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), and Meta (NASDAQ: META).

TTD is the premier independent platform shaping the future of programmatic advertising.

The company continues to demonstrate its dominance with another stellar quarterly report, defying broader economic slowdowns.

What truly distinguishes TTD is its relentless focus on the future of advertising.

By aggressively investing in innovative solutions like Unified ID 2.0 (UID2) and expanding its reach across premium Connected TV (CTV) inventory, it is defining the new standards of targeting and measurement.

This is similar to what Shopify’s President alluded to: “We’re not just growing our piece of the pie; we are growing the pie itself.”

Despite the strong Q3, the market was spooked by Q4 2025 revenue guidance, which implies a slight slowdown from the 18% YOY growth just reported.

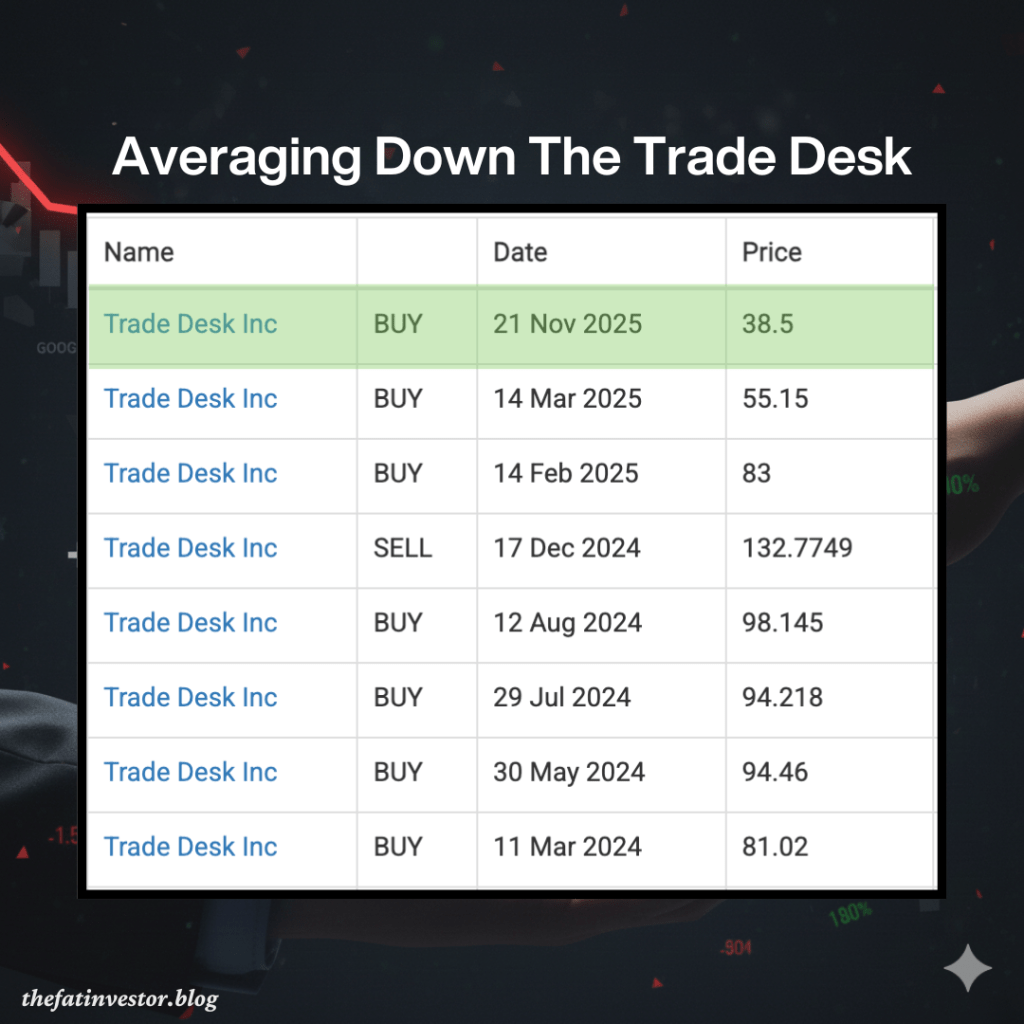

This presents an opportunity for me to further invest in this independent leader at a more reasonable price.

Crucially, I believe that this year (and likely next) is a transition as Founder and CEO Jeff Green undertakes a major organisational re-organization, positioning TTD to scale to the next level.

Moreover, even if growth merely stabilises at the current level, or even slightly lower at 15%, the company’s sales and profitability will at least double what they are now from here.

Therefore, when the price weakened further and fell below US$$40$ last Friday, I acted on this conviction, increasing my stake and bringing my average price to around US$70.

In essence, this market volatility is business as usual: it’s just noise. The real story lies in the robust fundamentals of companies like Arista, Shopify, and TTD.

Coming up, I’ll dive into the performance and outlook for Veeva and ZScaler, two counters whose recent decline makes them equally fascinating.

Related Posts

GOOGL 3Q 2025 vs MSFT 1Q 2026 Earnings: Is Vertical AI the Better Buy?

Why I Trimmed the US Portfolio: Emotionally Logical

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

Hi TFI, i appreciate your sharing a lot, can i know if Arista still in your portfolio? As for Shopify, since its high in valuation, do u think it’s good to use options strategy to rent time while waiting the price to moderate? such as selling call $120 and get paid premium?

Hi hi, thanks for reading. Yup, Arista still in my portfolio and among my top 5 positions.

As for options for Shopify, I can’t comment since I don’t do options at all.