Lately, it certainly feels like food expenses, especially when dining out, have been climbing. Is this just a perception, or do the numbers tell a similar story?

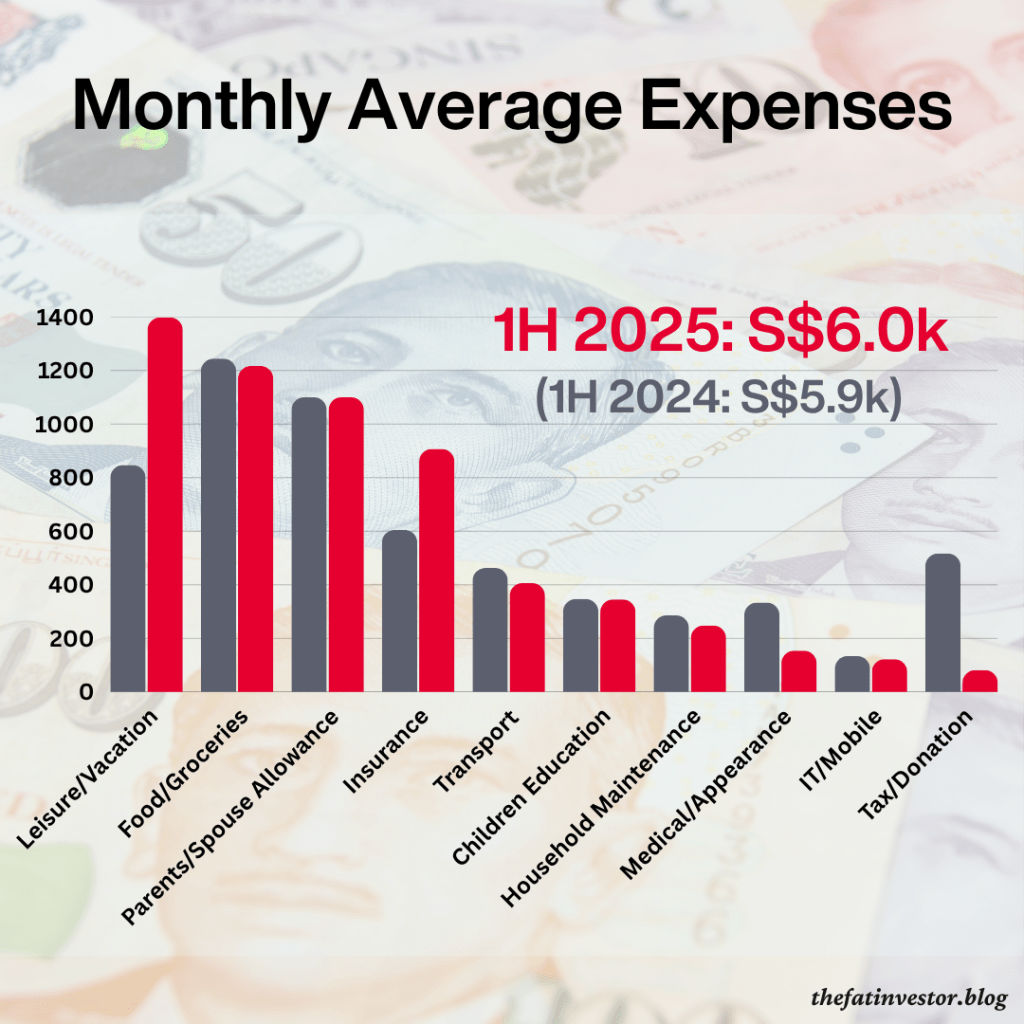

A quick comparison of our spending data for the first half of the year, as illustrated in the above chart, reveals something interesting.

While our overall monthly expenses have edged up by about S$100, or roughly 1.4%, the amount we spend on food and groceries has actually remained quite stable, even dipping slightly by about 2%.

This figure doesn’t include savings from CDC Vouchers, which I’m anticipating will be phased out eventually.

Perhaps, without even realising it, we’ve unconsciously reduced our frequency of dining at restaurants, which seems to have helped offset the increasing cost of eating out.

While this overall spending shows a slight increase, a deeper dive into specific categories reveals some significant shifts that contribute to the bigger picture. Let’s take a closer look at where our money is really going.

Leisure/Vacation: The 65% jump is mainly due to the recent Taipei vacation.

Compared to a year ago, when we just had a short getaway to Bintan, the further destination and longer duration naturally cost more. It’s money well spent as we had a wonderful time together.

Insurance: Amount paid for insurance ballooned by 50% this year!

Both my spouse and I crossed the age band, resulting in the significant increase in premium for private hospitalisation plan. This is an expense that I am monitoring closely, and I am likely to downgrade our plans eventually, as it no longer make sense to pay for the excessive premium.

Tax/Donation: For the first half of last year, I was still paying my 2023 income tax due to the GIRO arrangement. Without it, expenses for this category plummeted by 85%!

Medical/Appearance: It feels good to see a near to 60% drop in medical expenses.

I needed to bring my daughter to see a skin specialist last year for her acne situation. With the issue resolved last year, there isn’t a need for further follow-up, resulting in the much reduced expenses.

Besides the above four categories, the spending has remained fairly stable.

As per usual, I am anticipating higher expenditure for the second half of the year due to premium for critical illness insurance and a longer year-end school holidays.

Besides, there is likely to be more home improvement work, to repair and replace the older interior finishes, furniture and appliances. Consequently, this will drive up the spending further.

At the beginning of the year, I have budgeted S$96,000 spending for this year. Based on current situations, I should be able to keep within that and maybe I can bring it down further to S$90,000.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

That’s really impressive result. Is your projection factoring in the downturn? As during the downturn, you won’t get at least 6% for that year depending on how long the downturn is. Understand you will prepare 3 years of expense to weather through the downturn, which is a very good risk management.

Yeah, I understand where are you coming from that our time is finite. Great that you manage to accept it mentally. I’m still trying to adjust the mindset.

It’s average annual return. So during a downturn, it will swing to negative, but when market recovers I am likely to get a much higher return. That has been the nature of stock market.

So yes, the 3-year buffer is to give time for the market to recover. Once I have access to my CPF, I will increase the buffer to around 5 years.

Hi, interesting to find your FIRE journey from reddit. You mentioned in the reddit that your liquid assets which is about 1mil, however, your yearly expenses is about 90k. Thinking from safe withdrawal perspective, this turns out to be almost 9%, which is extremely high. I am sure you know you know what you are doing, hence, checking with you. Maybe there is something I can learn? Looking forward for more sharing.

I don’t follow SWR as my spending vary. Also, I believe that it will drop when I am older – children become independent, stopped driving, less travelling etc. So I project my future expenses and investment return till 90, which lead me to believe that I stand a good chance of not running out of money. Here’s my thought process then when I took the leap: https://thefatinvestor.blog/2022/04/02/can-i-ditch-my-regular-pay/

Hi KC, thanks for sharing the link about the thought process.

The running 3-year, 5-year and 10-year compounded return over the period from 2009 to 2019 showing in the link share, is that your portfolio return? If yes, it’s really impressive that the 10 year CAGR is above 10%. That’s amazing.

Yeah, I totally get you that that the expenses will drop when your children become independent, stopped driving etc. That’s I’m experiencing too, which I created a bucket expenses fund to fund those expenses. The FI amount I am working is for the core retirement amount that needed. I learnt it from the provident retirement framework.

How do you project how’s your asset at 90 years old with different rates of return? As you mentioned the stock market is so dynamic and there is different sequence of risk (can be good or bad) scenarios.

Still looking for your other articles!

Yup, that’s unaudited return, which sort of give me some confident that I can get at least a 6% return from my stock portfolio.

The projection is based on individual asset class. So equities 6%, CPFOA 2.5% and so on.

Of course, it won’t be 100%, and I could really still run out of money, with the exception of CPFLife payout.

But knowing that our time is finite, I choose to take the risk.