To diversify my portfolio beyond Singapore and US markets, I decided to buy some Asian, Europe and Japan unit trusts in April with my CPF-OA. The impetus was the market carnage during February and March which I saw as an opportunity to plant the seeds.

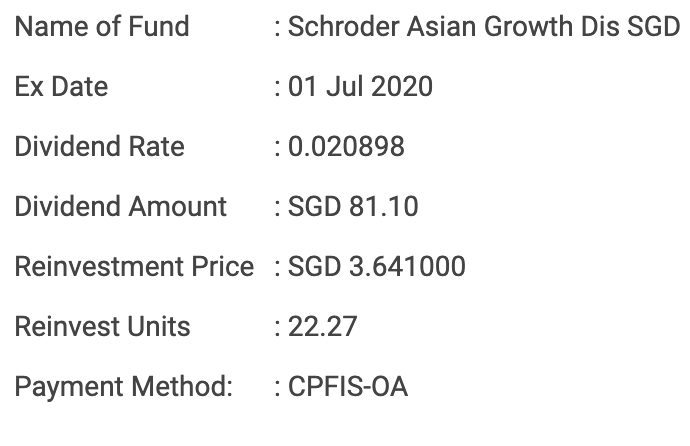

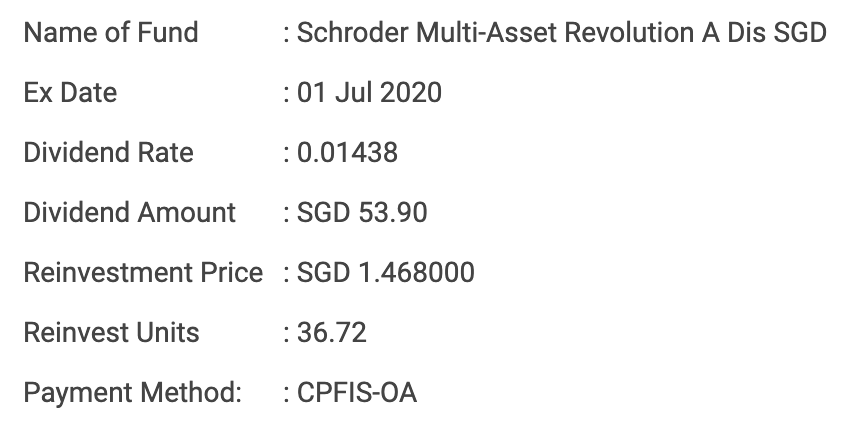

Due to the recovery of the markets since May, the funds have done well and I am up by about 19% at the time of writing. I received a pleasant surprise this week when I realized that two of the funds I bought actually give out dividend and re-invested them to the funds.

The amount is minute. For the Asian Growth fund, the yield is only 0.675% and for the Multi-Asset fund provides a yield of 1.08%. Nonetheless, I still the icing on the cake. Will wait patiently to see if the remaining four funds give dividend.

Cheers.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

Nice way to diversify, congrats on the dividend

I never thought I would ever buy unit trusts again. now I think it’s good to have a mixture.

Same here, I switched to ETF a while ago but I realised in SG, I cannot get ETFs for the exposure I want. I have to go to US market to find, Unit Trust is a much easier way to do the same – but it cost more … no free lunch I supposed.

I would love to get ETF but CPF does not allow that. I think FSMOne has quite a good offering of ETFs but not sure if its charges.

I go to POEMS to buy unit trust – no platform fees and usually no sales charge too