In my previous post, I broke down iFAST‘s (AIY) impressive growth trajectory and the math behind its potential to double in five years.

Today, I’m turning the spotlight onto Arista Networks (ANET) and Shopify (SHOP).

While these titans are significantly larger than iFAST, they are still galloping with incredible speed.

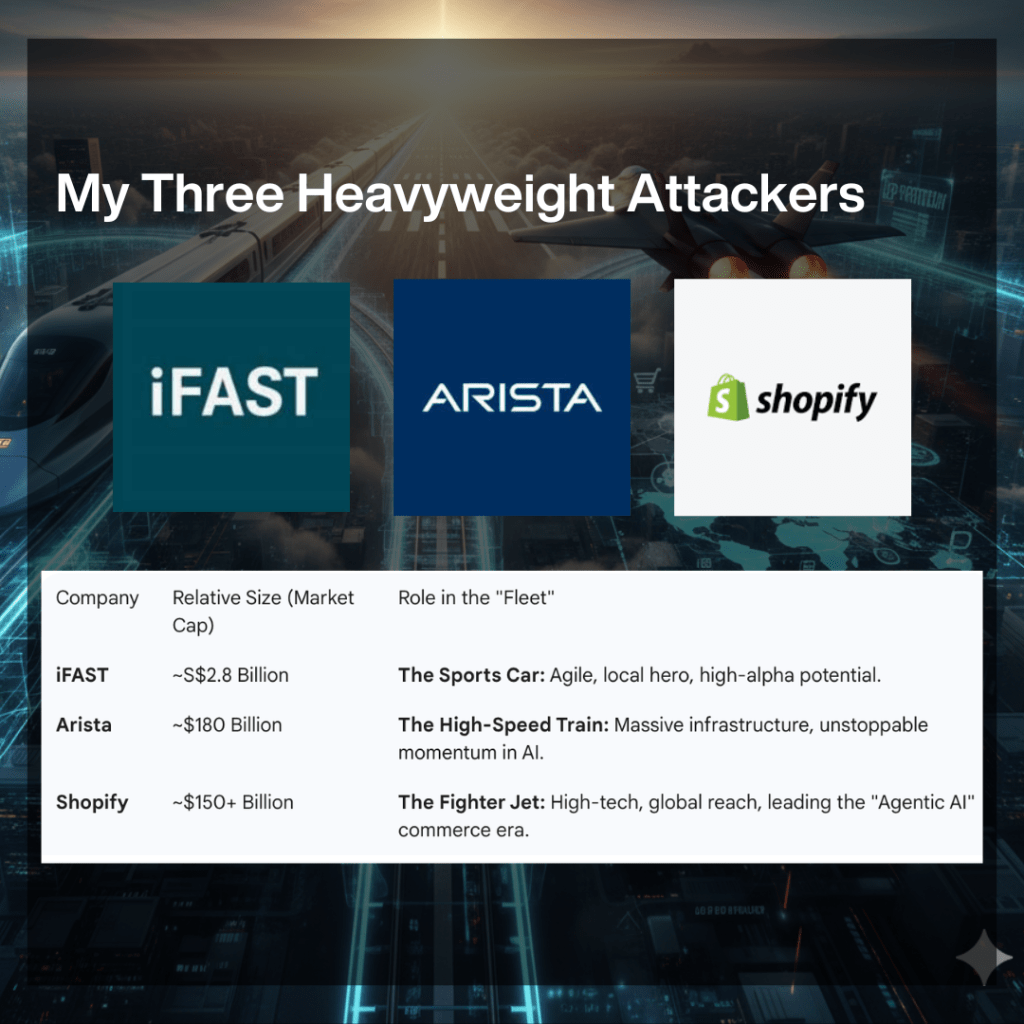

If iFAST is a nimble sports car, Arista and Shopify are the high-speed train and fighter jet of the global tech infrastructure.

Let’s jump into why these two are likely to continue scoring well in the coming year.

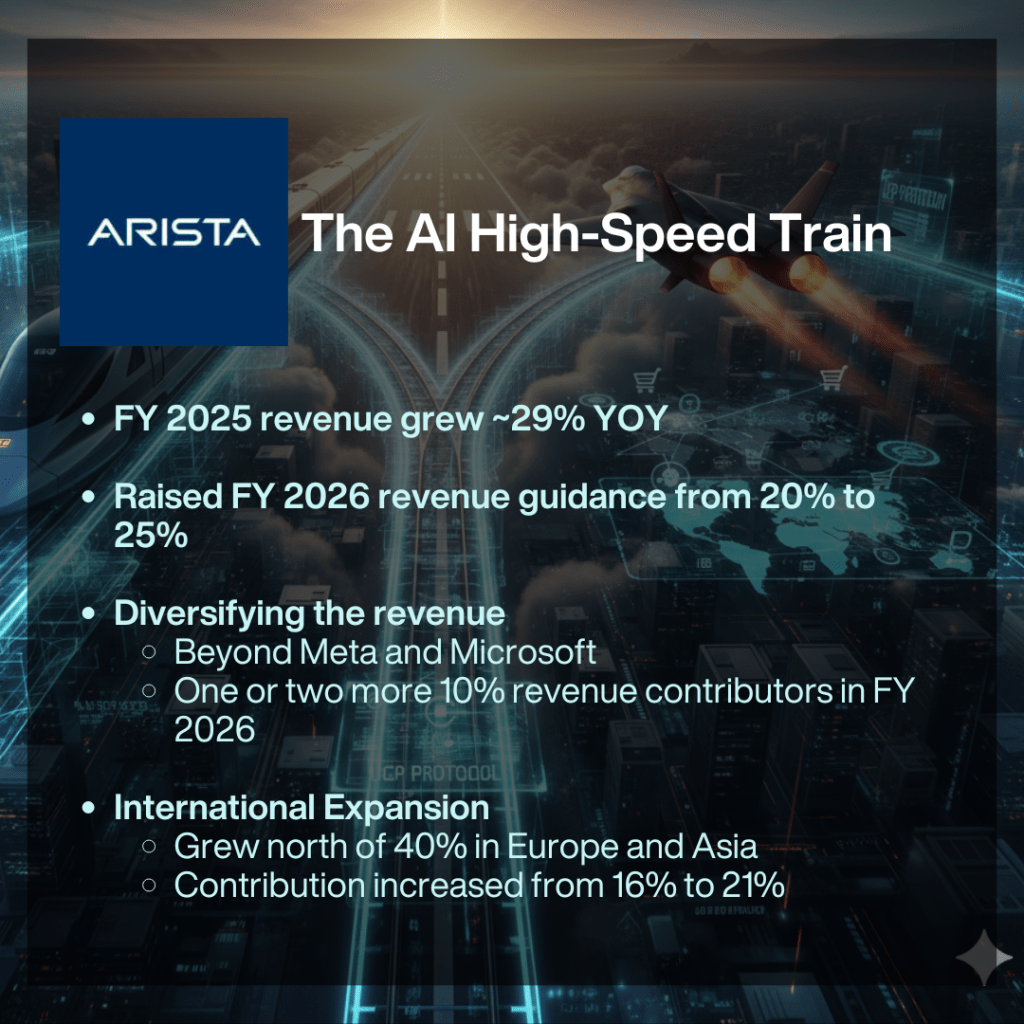

Arista: The AI High-Speed Train

Similar to iFAST, Arista delivered a record-shattering performance in 4Q 2025, surpassing US$1 billion in quarterly net income for the first time.

The numbers tell a story of sheer scale: revenue grew nearly 30% year-over-year to US$2.49 billion, representing a strong 7.8% sequential jump over the previous quarter.

More importantly, riding this massive momentum, management raised their full-year 2026 growth guidance from 20% to 25% (targeting US$11.25 billion).

Having followed Arista for years, I know their guidance typically represents a “conservative floor.” CEO Jayshree Ullal’s words from the call emphasize this visibility:

“I am giving you the greatest visibility I can… on the reality of what we can ship, not what the demand might be. It might be a multi-year demand that ships over multiple years.”

Diversifying the Tracks

What makes this quarter even more satisfying is that Arista is no longer just a “two-customer story.”

While their two largest customers, Microsoft (MSFT) and Meta Platforms (META), continue to drive significant volume at 16-20% each, Arista now anticipates one or two additional customers joining that “10% or greater” club in 2026.

This new demand is coming from “AI and Specialty Providers,” a sector that now makes up 20% of their business. This group includes Apple (AAPL) and Oracle (ORCL), as well as emerging Neo Clouds.

Neo Clouds are specialised cloud providers like CoreWeave, Lambda, and Voltage that are built from the ground up specifically to do one thing: they provide the massive computing power needed to train AI models like ChatGPT or Claude.

These companies are increasingly choosing Arista’s open Ethernet architecture to power their massive GPU clusters because they want an alternative to the “closed” systems of other vendors.

Beyond the AI Hype

It’s not just about GPUs and data centers. Arista is successfully branching out:

- The Cognitive Campus: This segment has surged, hitting its US$800 million target early. Major wins like Warner Bros. Discovery (WBD) prove that Arista’s software (EOS) is winning in corporate offices and industrial sites, not just high-tech hubs.

- Global Reach: International business now contributes 21% of revenue, up from 16% last year. Growth in Asia and Europe is currently clocking in at north of 40% annually.

The “Nervous System” of 2026

With US$6.8 billion in purchase commitments and US$5.4 billion in deferred revenue, Arista has roughly US$12.2 billion in business “pre-booked.” That is more than a full year of total revenue sitting in the wings.

By building the open, “agnostic” Ethernet rails that connect the world’s AI brains, Arista has become bigger, more diversified, and significantly more resilient.

Shopify: The Modern Commerce Fighter Jet

While Arista builds the tracks, Shopify is the fighter jet using AI “afterburners” to propel merchants into the next era of retail.

4Q 2025 was a record-shattering quarter. For the first time in its history, Shopify surpassed US$100 billion in GMV in a single quarter, hitting US$124 billion (up 31% YoY). Revenue followed suit, soaring 31% to reach US$3.7 billion.

At this immense scale, Shopify has achieved the “holy grail” of tech platforms: profitable, durable growth.

In FY 2025, they generated a massive US$2 billion in Free Cash Flow (a 17% margin), proving they can fund their own aggressive AI expansion while still rewarding shareholders.

In fact, management is so confident in this “cash machine” that they just authorized a US$2 billion share buyback.

The “Agentic Commerce” Trailblazer

Shopify was among the earliest believers that AI would be more than just a tool — it would be a change-maker.

This early head start led to the launch of the Universal Commerce Protocol (UCP) in partnership with Google.

By leveraging its massive data on consumer behaviour, Shopify is helping define the “rules” of AI shopping.

The UCP acts as the common language that allows AI agents (like ChatGPT or Gemini) to browse, negotiate, and complete checkouts directly for consumers.

This is exactly parallel to Arista’s role in the Ultra Ethernet Consortium (UEC): both are setting the standards for their respective industries to ensure they own the future “operating system.”

A 15x surge in orders coming from AI-driven search since January 2025, though from a small base, is a clear “smoke signal” of the agentic tailwind.

Furthermore, the fear that AI would “kill” SaaS is proving to be uncalled for, especially for a platform like Shopify.

While low-value “wrapper” apps are being disrupted, Shopify has moved from being a simple application to being the System of Record.

And that’s why heavyweights like Estée Lauder (EL), Coach (TPR), and Starbucks (SBUX) are migrating to Shopify’s AI ecosystem.

These enterprises likely believe that they will reap more benefits from the collective intelligence and discovery patterns of a wider network than by having a custom-built AI agent for a single brand.

The “Circulatory System” of Future Commerce

If Arista is the nervous system (the signals and intelligence), Shopify is becoming the circulatory system — the vital infrastructure that pumps goods, payments, and data through the global economy.

Its future potential lies in its evolution from a destination (a website you visit) to a protocol (an invisible layer that powers every transaction).

By co-developing the UCP, Shopify ensures that whether a human is clicking “Buy” or an AI agent is negotiating a purchase in a chat, the transaction flows through Shopify’s veins.

As giants like Coach and Starbucks integrate into this ecosystem, the switching cost becomes nearly insurmountable. You aren’t just leaving a website builder; you are unplugging your business from the global AI sales force.

Valuation Matters

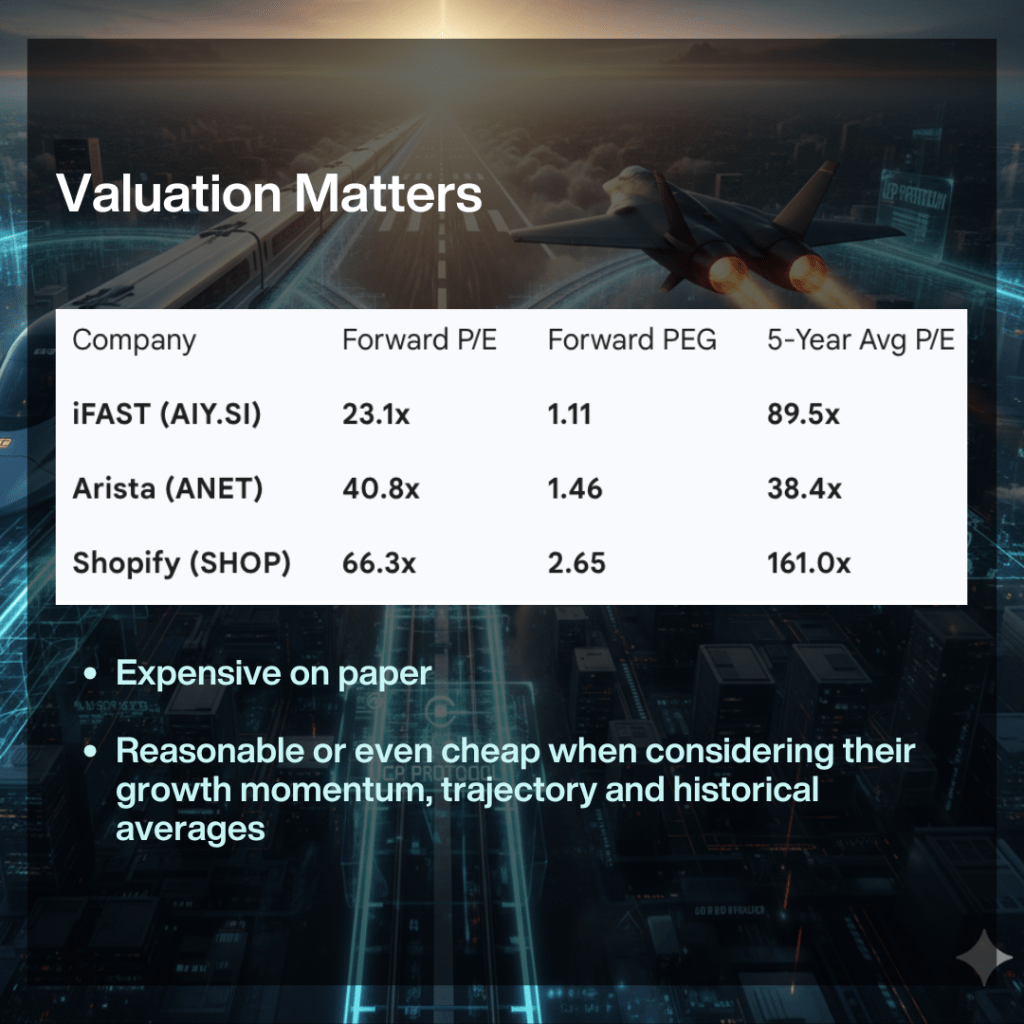

There is no doubt that Arista and Shopify are world-class businesses with proven growth track records. However, as an investor, you have to address the elephant in the room: Price.

Such high-performing businesses seldom come cheap.

Most of the time, the goal isn’t to find them in the “bargain bin,” but to buy them at a reasonable valuation relative to their future earnings.

As we head further into 2026, I believe that is exactly where they sit.

Arista: Paying for Certainty

Arista often looks “expensive” on a surface-level P/E basis (currently trading around 40x forward earnings). However, you aren’t paying for a “hope” but visibility.

- The Growth Floor: With US$12.2 billion in combined backlog and purchase commitments, Arista essentially has over a year of revenue already “pre-booked.” This creates a massive safety net that traditional hardware companies don’t have.

- Guidance Discipline: Management’s recent raise to 25% growth for 2026 (targeting ~$11.25B) is widely considered conservative. When a company has this much visibility into its “tracks,” a premium valuation is the price of admission for that certainty.

Shopify: The Palatable Pullback

Shopify has historically traded at “nosebleed” levels, but the current setup is much more enticing for long-term buyers.

- The Buyback Signal: When management authorises a US$2 billion share buyback (as they just did in February 2026), it is the ultimate signal that they believe their own stock is undervalued relative to the “Agentic AI” future they are building.

- The 25% “Gift”: Despite growing its revenue and GMV by over 30%, the stock has pulled back nearly 25% year-to-date. This correction has brought its valuation down from “euphoric” to “palatable.”

- Free Cash Flow Power: Shopify is now a US$2 billion/year cash machine. Unlike the Shopify of 2021, today’s version is highly profitable with 17–19% FCF margins.

Final Verdict: The Attacking Trio

I’m pleased that my “recruitment” of this attacking trio (iFAST, Arista, and Shopify)into my portfolio six to eight years ago has proven right.

Despite their past successes, the anticipation of them realising their immense future potential still makes my heart palpate.

I’m not just watching these companies as an observer; I’m invested in their evolution into the pillars of the next decade. I continue to look forward to their execution of their vision in the coming years:

- iFAST (The Sports Car): High-alpha growth in the global wealth management space.

- Arista (The High-Speed Train): The unbreakable infrastructure layer of the AI era.

- Shopify (The Fighter Jet): The agile software protocol for the future of global commerce.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.