I don’t remember every holding, but it’s impossible to forget the carnage suffered by my US portfolio in 2022 — a plunge of more than 40%, wiping out two years of massive gains in just a few months.

Today, it feels like history is trying to repeat itself.

SaaS companies are suffering a crisis of confidence as investors fear that AI disruption will slow down or even replace traditional software models.

Yet, I don’t feel as “gutted” this time around. Here is why:

- Reduced Exposure: Coming out of the pandemic, I didn’t temper my excitement for SaaS and held a very heavy position. Today, while my portfolio is still tech-focused, it is more diversified, with SaaS accounting for less than 20% of my US portfolio.

- Spare Bullets: I’ve been disciplined about taking profits when my portfolio hit an annual return of 10%. In fact, my latest trim was just last October, meaning I have “spare bullets” to fire while others are retreating.

- Irrational Fear: Sentiment often swings from over-optimistic to over-pessimistic. In my view, AI will enhance rather than replace the right SaaS companies.

Think of it this way: If you are a CIO, does it make sense to build an expensive, high-maintenance internal AI team to replicate software, or simply use a trusted platform that has already integrated AI into your existing workflow?

Most will choose the latter. The risk of troubleshooting an “in-house” failure far outweighs the subscription cost of a proven leader.

Taking Advantage of the “Sales”

It’s the Chinese New Year period here, and retailers are everywhere with promotions. My spouse and I were happy to grab some drinks on sale over the past few days.

On the same note, I am glad I have spare cash in my account to take advantage of the current “SaaS-pocalypse.”

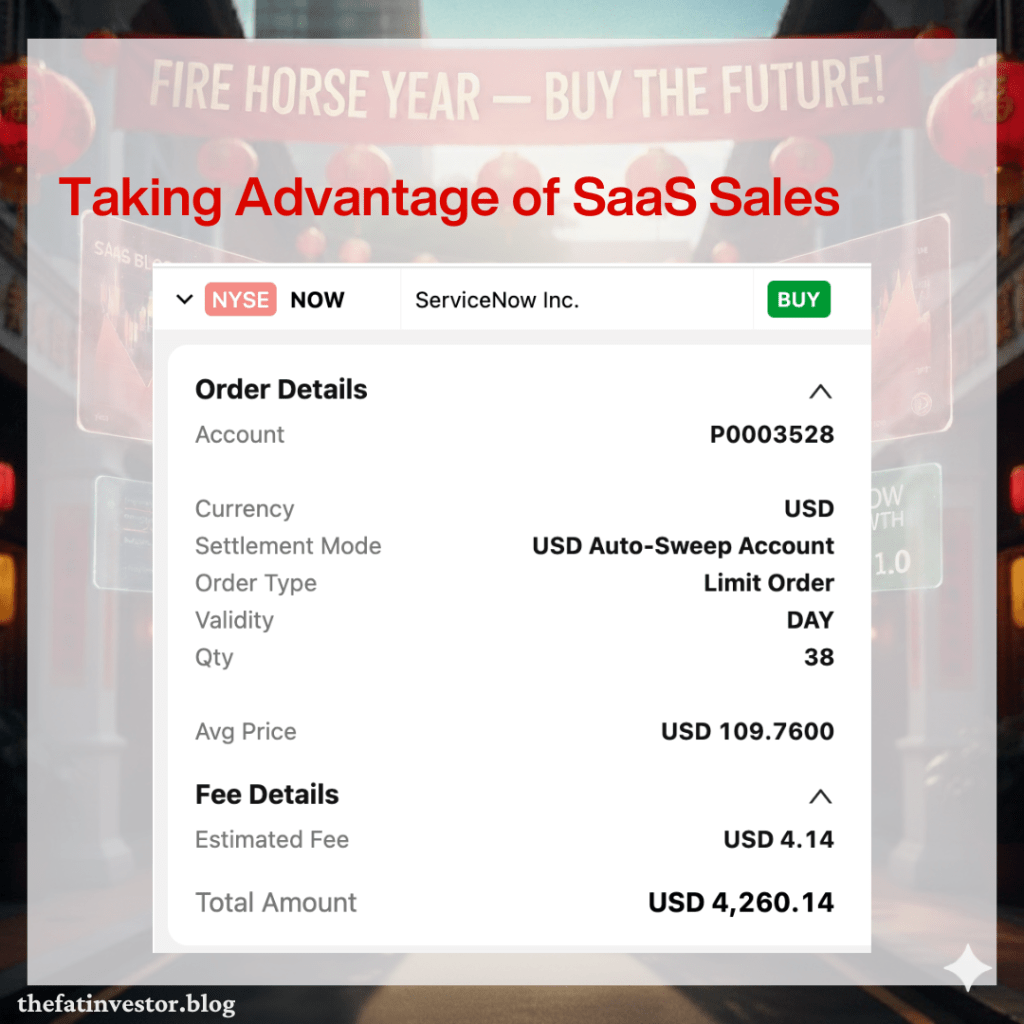

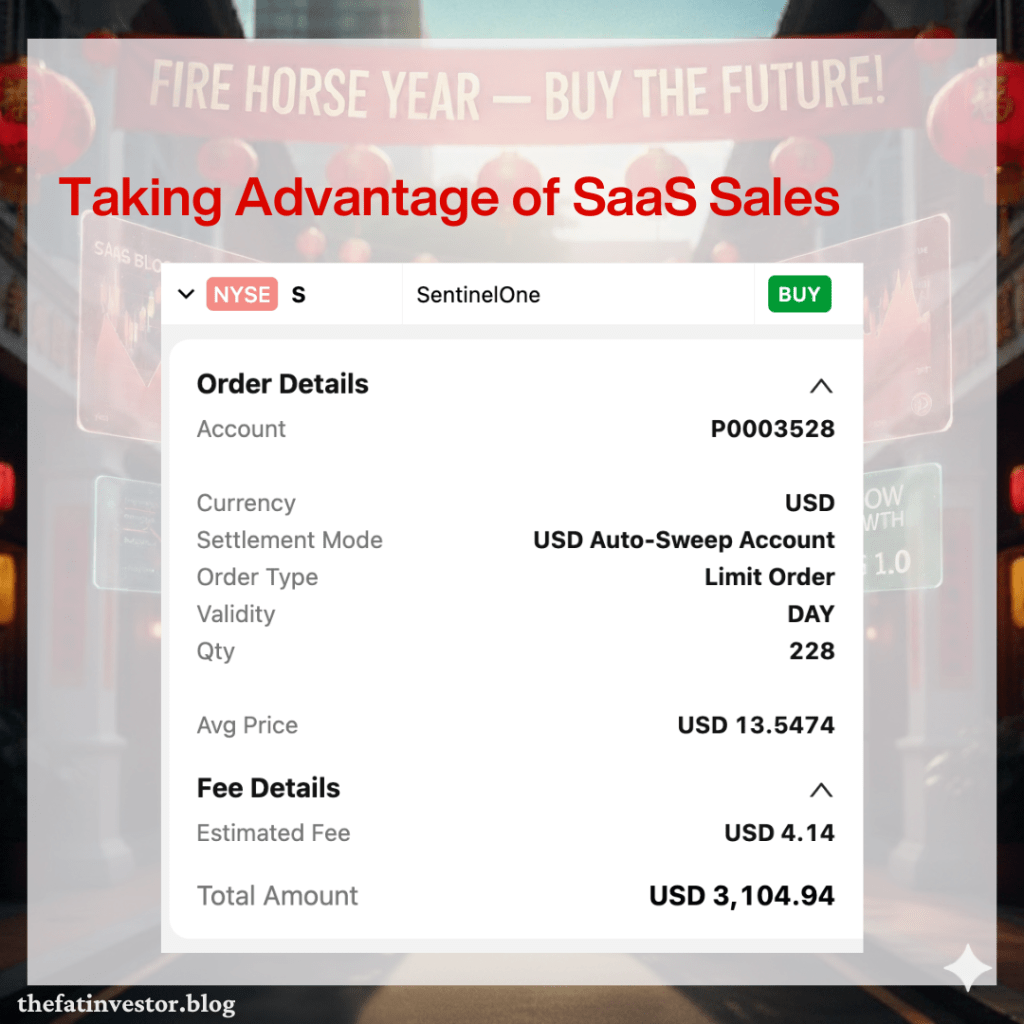

While I originally had my eyes on Salesforce (CRM) and was considering increasing my stake in Zscaler (ZS), I ultimately chose to re-invest in ServiceNow (NOW) and SentinelOne (S) instead.

Here’s why.

ServiceNow: The Unshakeable Backbone

Salesforce has been on my radar since late last year.

As its price dropped to an increasingly attractive valuation (PEG hovering just around 1.0), it looked like a perfect addition.

It would also act as a strategic insurance policy for my Veeva (VEEV) investment, as Salesforce expands its footprint in the Life Science domain.

On the contrary, ServiceNow stayed relatively expensive throughout 2025 despite its share price weakness too.

It was getting cheaper, but was still at a premium.

However, the continued plunge in early 2026 changed everything.

With a staggering 33% drop at the time of writing, ServiceNow’s forward PEG has finally compressed toward 1.0.

Moreover, ServiceNow has already started monetising its AI agents to supplement its traditional revenue.

Its hybrid business model, which combines traditional seat-based licensing with usage-based “assist packs”, is a brilliant hedge against the “seat-count” fear.

Think of it like the self-service stations at Fairprice or Sheng Siong (OV8).

Years ago, we feared these machines would kill the cashier’s job. In reality, supermarkets didn’t install them solely to fire people; there simply weren’t enough people willing to take up cashier roles to meet demand.

ServiceNow is doing the same for the “soul-crushing” manual tasks in IT and HR. Their AI Agents aren’t just replacing employees; they are filling the massive global gap in skilled labor.

By automating the “plumbing” of a company, they allow the remaining human staff to focus on high-value strategy while ServiceNow captures the value of every “assist” performed.

It’s a win-win for both the companies and the software providers.

With both Salesforce and ServiceNow now trading at similarly attractive valuations, I found myself pulled toward ServiceNow.

Given its resilient role as the enterprise backbone, I’d rather bet on the “plumbing” that is effectively becoming the automated checkout for the modern enterprise.

SentinelOne: The Cybersecurity Dark Horse

Cybersecurity is another sector which I believe would be foolish to simply let in-house AI to take over.

Preventing a breach, especially one led by AI-driven attackers, requires global data points and decades of expertise. Who would have the nerve to fire the experts and leave the keys to a DIY internal model?

I was originally looking to add to my Zscaler position, as it’s down 20% this year.

However, as I was doing my research and comparison, SentinelOne appeared to be the ultimate “value buy” in the sector.

While its smaller size compared to CrowdStrike (CRWD) leads to a valuation discount, the market seems to be ignoring several major 2025-2026 milestones:

- The $1 Billion Bar: Growth has naturally cooled from the triple-digit days, but SentinelOne continued to grow at a respectable 20% rate and has officially crossed $1.05 Billion in ARR. They are no longer the “small player”.

- Profitability Achieved: With a 7% non-GAAP operating margin and positive free cash flow, the business is finally sustainable. It’s no longer a “cash-burn” story.

- Purple AI Traction: This isn’t just a marketing buzzword. Purple AI has reached a 40% attach rate on new licenses. Customers aren’t just curious; they are opening their wallets for AI-native security.

The factor that finally tipped the scales for me was their $200 million share buyback program.

Share-based compensation has been a persistent thorn in my Zscaler investment, so seeing SentinelOne uses its healthy balance sheet ($1.1B in cash) to offset dilution is a huge plus.

I divested SentinelOne last May at US$17, taking a 25% loss. Now, I could buy it back a much stronger and profitable business at US$13 – a sale that I couldn’t miss.

What If It’s a Repeat of 2022?

With many SaaS stocks dropping by 30-40% over the past year, it already looks like the 2022 playbook, but for a different reason.

While 2022 was a valuation reset triggered by rising interest rates, 2026 is a crisis of confidence triggered by AI disruption.

Crucially, my US portfolio isn’t experiencing the same 40% drop like in 2022.

Compared to a year ago, it’s still up by 1%; and year-to-date, it has retreated by just 5.4%. It’s still painful, but I’m not rattled by it.

In 2022, I felt like a victim of the carnage because I was overexposed and unprepared. This time, I’m the one with the shopping basket.

So it’s not a repeat for me.

The market is right to fear that AI is replacing traditional software models.

However, this “SaaS-pocalypse” is a Darwinian sifting process.

Like the various crises you witnessed in the past, it will crush the weaker players, but the leaders will adapt and emerge stronger.

By using AI to fill labor gaps, these companies aren’t just cutting costs; they are fuelling a new wave of growth that will eventually create higher-value jobs we haven’t even named yet.

Market sentiment may be fearful, but I’m confident that when I look back three years later, the “future me” will applaud this move.

Meanwhile, it’s time to take a break from the markets and enjoy the upcoming Chinese New Year festive period.

May you also enjoy the sales, find your dark horse, and “huat” in the Fire Horse Year.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.