There were no surprises when Parkway Life REIT (C2PU) announced its FY 2025 results on Monday.

Net Property Income (NPI) rose a steady 8% year-on-year (YOY) to S$147.5 million, while DPU grew by 2.5% to S$0.1529.

This marks a phenomenal 18th year of uninterrupted dividend growth. However, for the forward-looking investor, the 2025 results are just the preamble.

The real story isn’t the 2.5% DPU growth you just saw; it’s the 15% total return potentially waiting in 2026.

While PLife is often dismissed as a slow and steady dividend stock, a massive contractual rent reset is about to shift this REIT into a higher gear.

Beyond the DPU Jump: A Structural Growth Shift

The excitement centers on the completion of Project Renaissance at Mount Elizabeth Hospital (MEH).

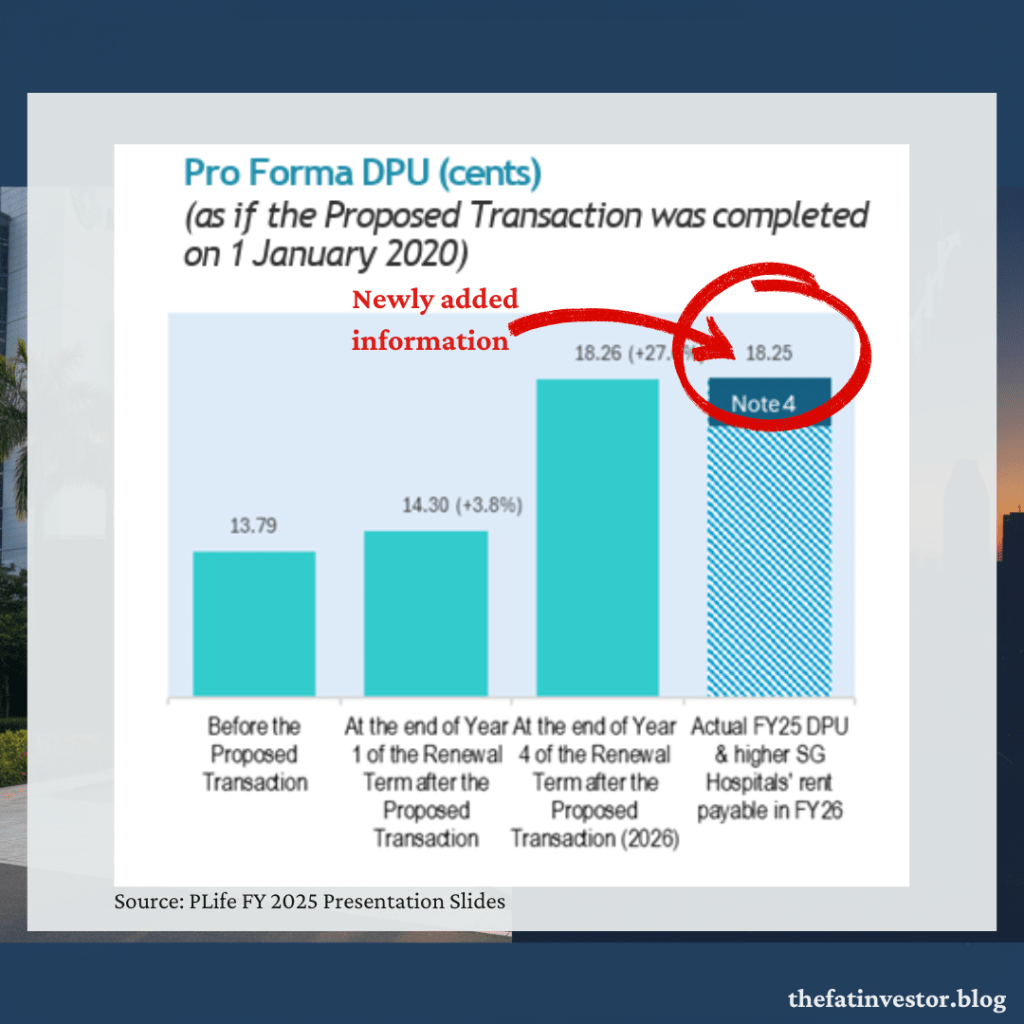

Under the renewed master lease, Singapore hospital rent is slated to jump by at least S$19.3 million this year.

After accounting for management performance fees, this adds roughly 2.9 cents to the annual DPU. Even with a buffer for rising interest costs and trust expenses, investors are looking at a projected FY 2026 DPU of at least S$0.18.

At Tuesday’s closing price of S$4.10, this translates to a attractive forward yield of 4.4% for an asset of this caliber.

You might scoff at a 4.4% yield but PLife has earned its premium through sheer resilience.

Its performance during two major recent crises—the COVID-19 pandemic and the 2022–2023 rate hike cycle—solidifies its reputation as the ultimate “bond-proxy.”

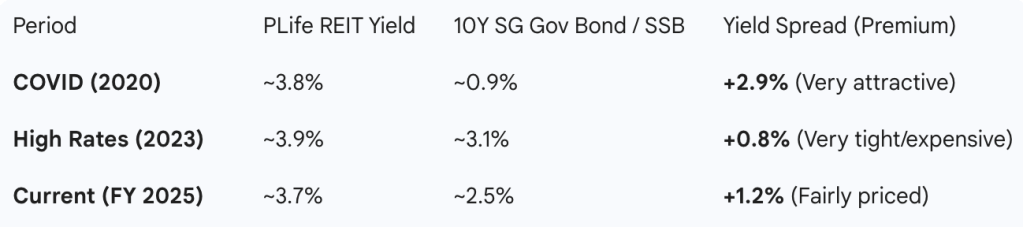

Consider this: during the height of interest rate volatility in 2023, PLife traded at a mere 3.9% yield, maintaining a spread of less than 1% from the risk-free rate.

This demonstrates that the market views its income stream as nearly as certain as government debt, but with one major advantage: contractual growth.

The Case for a 15% Total Return

What this means is you aren’t looking just at a DPU jump this coming year, but a likely re-rating of its stock price.

Historically, PLife trades at a spread of 1.5% to 2.0% above the 10-year Singapore Savings Bond (SSB). Therefore, with the latest SSB average return at 2.25%, a fair market yield for PLife is roughly 4%.

To reach a 4% yield on a S$0.18 dividend, the stock would need to re-rate to S$4.50.

Between the capital gain and the 4.4% yield, you are looking at a potential 15% total return within a single year.

Long-Term Upside: The CPI Compounder and the “Gleneagles Relay”

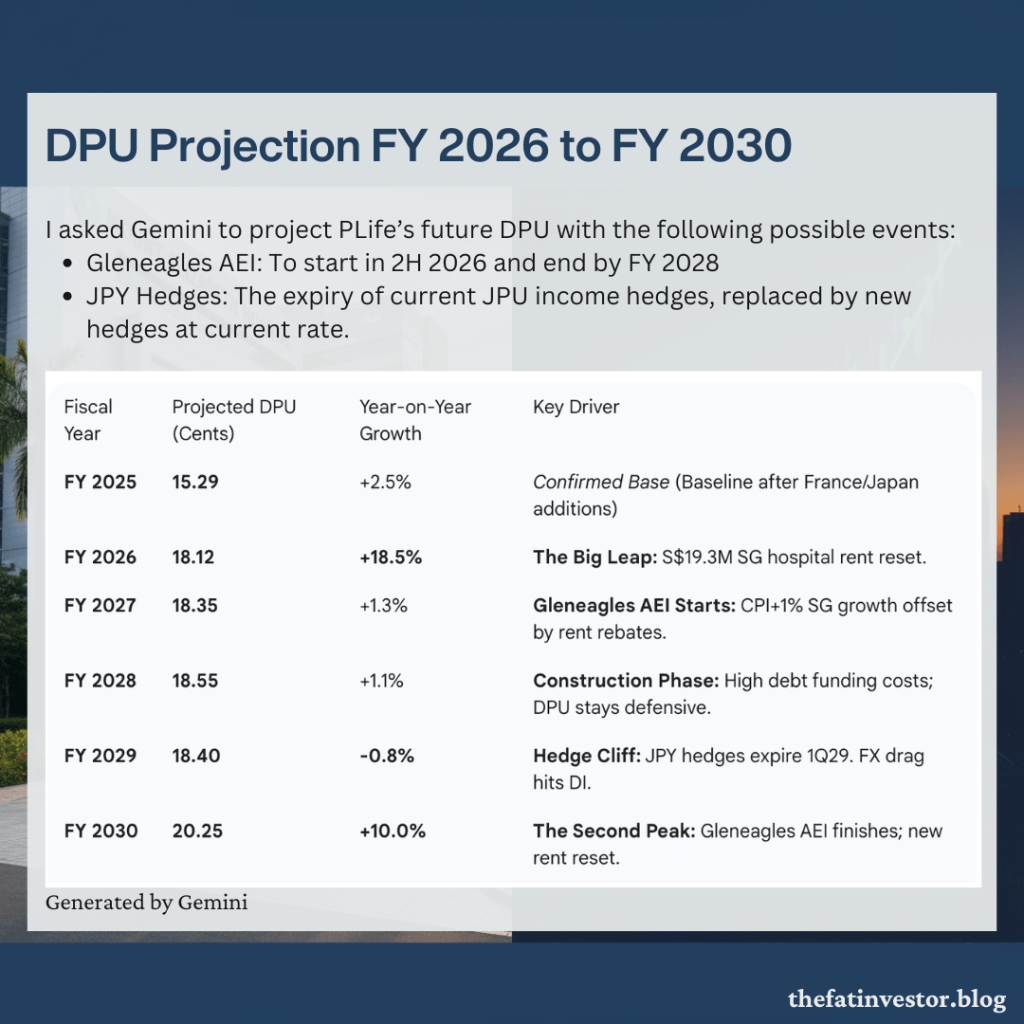

Beyond the immediate 2026 rent jump, PLife REIT is entering a structural growth phase.

From FY 2026 to 2042, the new lease includes an annual rent review formula that acts as a powerful inflation hedge. Specifically, the rent will grow based on the higher of {CPI + 1%} or a {Base + Variable Rent} formula.

This meant the REIT has a guaranteed 1% minimum growth floor every year. In a world of sticky inflation, this compounding effect will steadily push the DPU higher, regardless of broader market volatility.

But the growth story doesn’t end with inflation.

The successful rejuvenation of Mount Elizabeth through Project Renaissance has set a clear playbook for the rest of the portfolio. Gleneagles Hospital is the next natural candidate for an Asset Enhancement Initiative (AEI).

Discussions are already underway to potentially increase the Gross Floor Area (GFA) and modernise facilities at Gleneagles.

If history repeats itself, we could see another major “step-up” in rent once those works complete, providing a fresh growth runway well into the 2030s.

In other words, investing in PLife now is not just about the forward 4.4% yield, but an increasing DPU that comes with built-in inflation protection and a secondary growth engine from future AEIs.

What’s the Catch?

Despite the high visibility of this growth, a few factors could slow the momentum:

- Interest Rate Volatility: If 10-year SSB or T-bill rates spike back above 3%, the yield spread will compress, and the price re-rating to S$4.50 might be delayed.

- Market Sentiment: You can never predict the short-term market movement. Numerous factors can negatively impact the overall market sentiment.

- The “Hedge Cliff”: While current income is shielded, the JPY hedges expire in 1Q 2029 and EUR in 1Q 2030. If renewed at significantly weaker rates, you could see a temporary drag on growth in those years.

Holding My Fire

While the probability of this story playing out is high, I’m not rushing to increase my stake.

Primarily, PLife is already a top-five position in my portfolio. Moreover, I might uncover other compelling offers during the current earnings season.

Therefore, I’m holding my fire and will likely decide only at the end of this month.

Unless… the price drops below S$4.00, a level I would find very hard to resist.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.