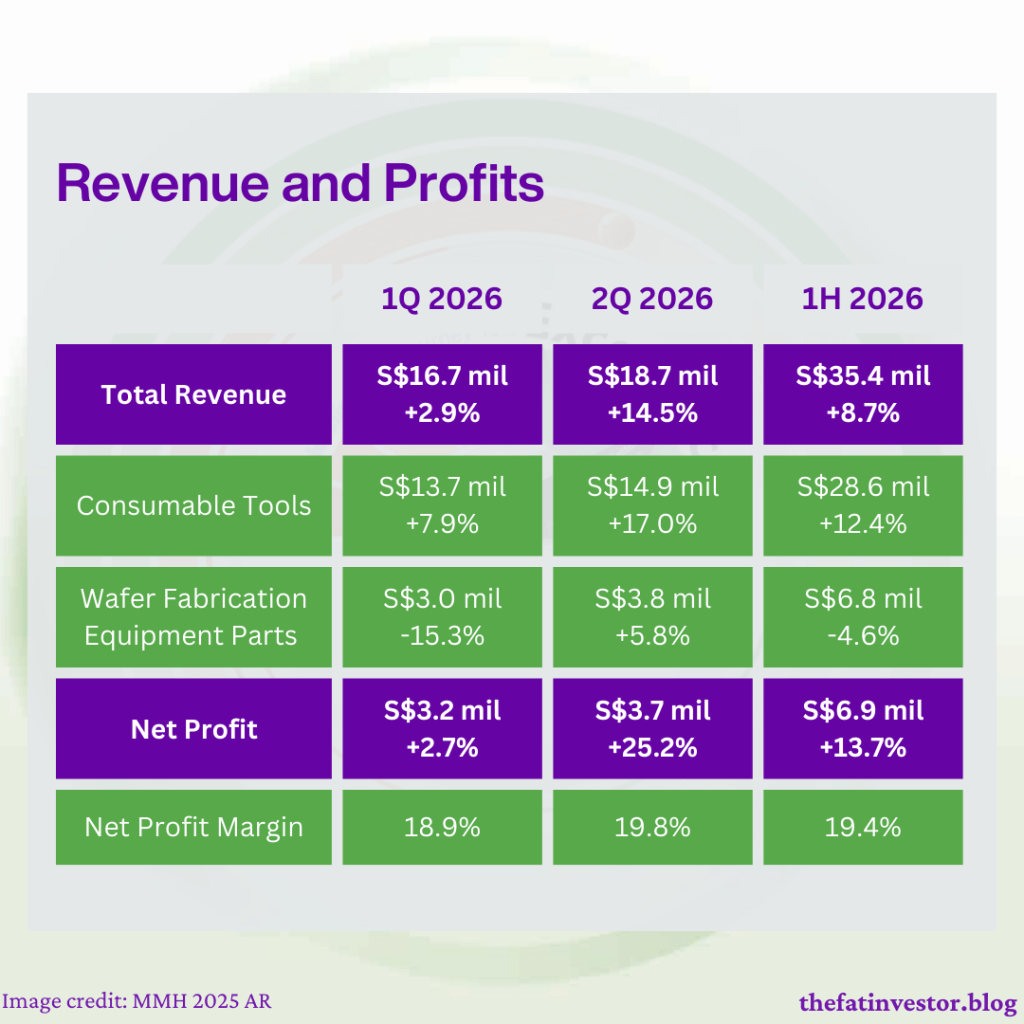

The headline is certainly head-turning: a 25.2% surge in net profit for 2Q 2026.

However, knowing that material delays and shortages hampered fulfilment in 1Q 2026, the first question that popped into my mind was:

Is this 25% jump just a one-off “clearing of the backlog,” or does it mark the start of a sustainable upcycle for Micro-Mechanics (5DD)?

Not Just a “Catch-Up” Quarter

The data shows that this isn’t just a rebound from supply chain snags.

While the Wafer Fabrication Equipment (WFE) segment did recover as materials became available, the real engine was the consumable tools segment, where sales accelerated 17% year-on-year to S$14.9 million.

Because consumables typically have lead times of just 2 to 4 weeks (sometimes as little as 7 days), they serve as a real-time pulse of the industry.

The acceleration in tool sales suggests that the recovery in upstream wafer fabrication has finally reached the downstream back-end production phase, clearing the path for a full industry upcycle.

During the results briefing, CEO Kyle Borch highlighted that WSTS now forecasts semiconductor sales to hit US$975 billion in 2026, putting the industry ahead of the original “US$1 trillion by 2030” trajectory.

With equipment makers actively checking supply chain capacities, the convergence of strong sales and optimistic forecasts suggests renewed operational momentum.

Why the Dividend Stayed the Same

Wondering why the interim dividend stayed the same at S$0.03 despite the profit surge?

While MMH is still paying out well above its 40% dividend policy floor (the current payout is 60.8%), the management made a strategic shift in cash management last year.

Maintaining the dividend allows MMH to build a cash “war chest,” currently at S$27.2 million.

This provides the flexibility to capture emerging opportunities or ensure dividend consistency even if the cycle turns. Key growth seeds highlighted in the report include:

- Localised support in Taiwan and expansion plans for the Arizona market.

- Product development for Advanced Packaging and equipment for WFE manufacturing.

Going forward, I am expecting a S$0.06 annual dividend, which translates to a decent yield of 3.6% at the recent closing price of S$1.68.

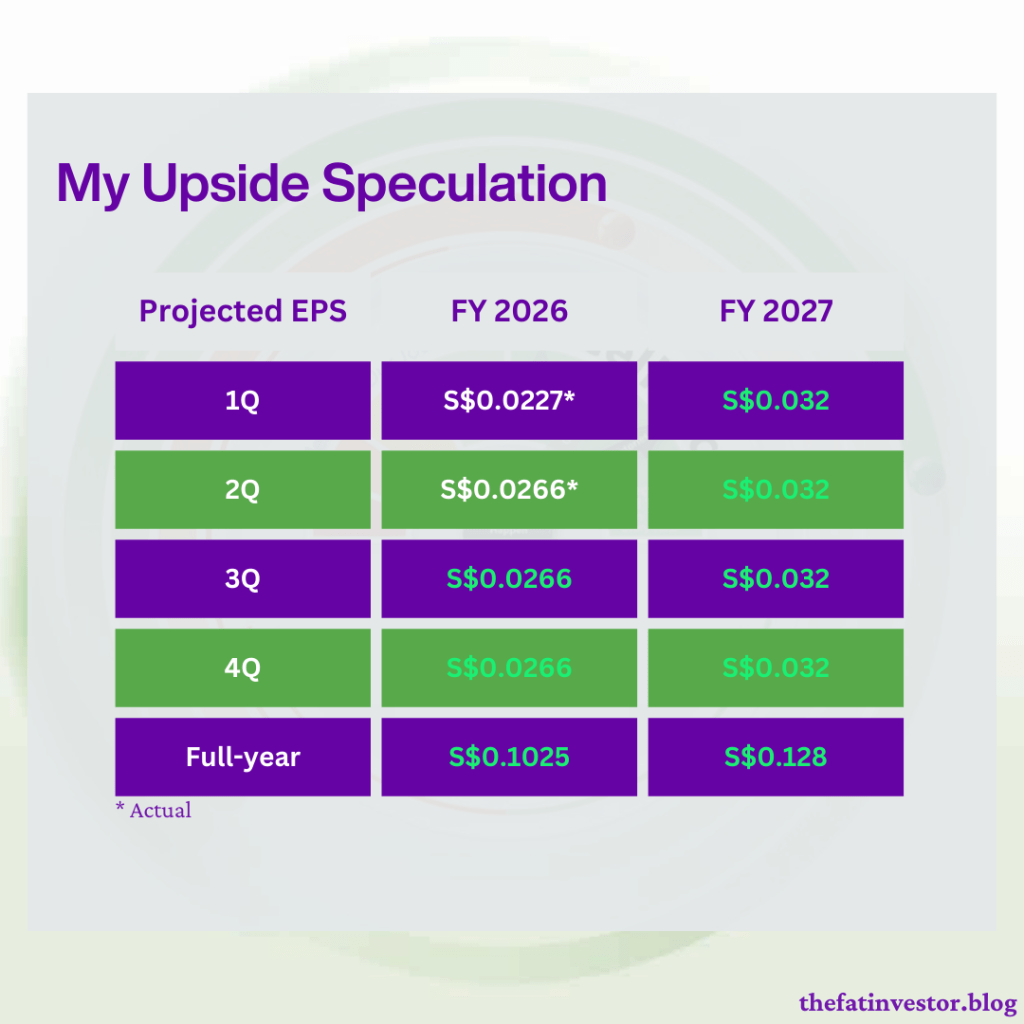

Speculating on the Upside

The semiconductor industry is notoriously cyclical; demand can dry up as fast as the weather changes.

However, let’s lean into a bit of optimism and speculate on the upside with the following assumptions:

- FY 2026: Positive momentum continues for the remaining two quarters.

- FY 2027: Remain in the upcycle and new growth bears fruit.

Under these conditions, you’ll be looking at an EPS of nearly S$0.13 for FY 2027, just shy of its record high of S$0.1425 in FY 2022 at the previous cycle peak.

This represents an average growth of around 20% for these two years from last year’s EPS of S$0.089.

At last Friday’s closing price of S$1.68, the forward PEG ratio is only around 0.8. In the world of value investing, a PEG ratio below 1.0 often indicates an attractive entry price relative to future growth.

Furthermore, since MMH’s free cash flow often outpaces its net profit, any surplus cash might eventually be returned as a special dividend.

The Math behind PEG:

To understand why the valuation is compelling, here is the breakdown using my projections:

- Last Friday’s Price: S$1.68

- Projected FY2026 EPS: S$0.1025 (Estimated based on current momentum)

- Forward P/E Ratio: 16.4x (S$1.68 / S$0.1025)

- Estimated Growth Rate for next two years: 20%

- PEG Ratio: 0.82 (16.4 / 20)

Portfolio Reality Check: Holding the Line

The scenarios above are my own “wishful thinking”. While they could come true, the short term is always unpredictable.

MMH has a proven track record of resilience and shareholder returns, but for now, I am choosing to hold rather than add to my position.

Primarily, I funded my MMH investment via CPFIS, and had reached my stock limit last year.

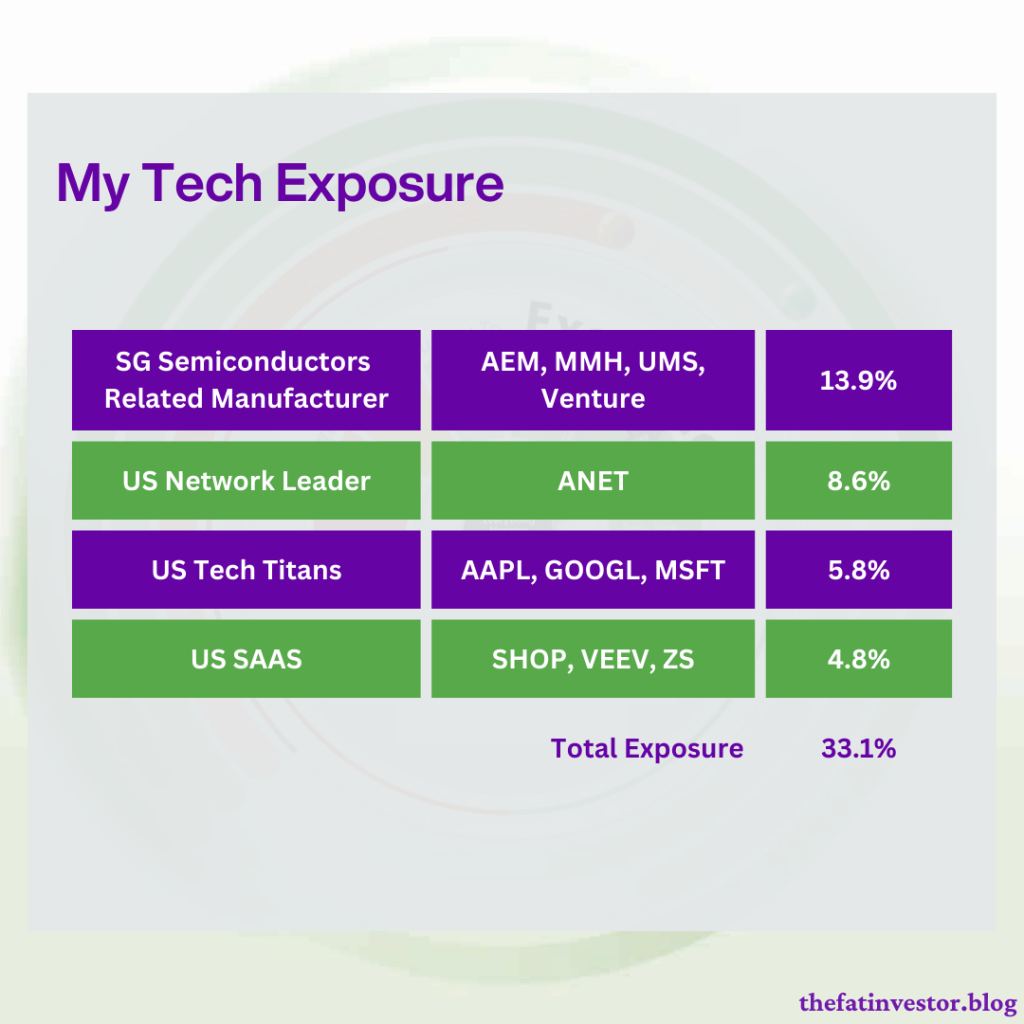

Moreover, my exposure to the manufacturing and tech sector is sitting at a heavy 33%! (see image below)

While I remain confident in secular tech growth, I can’t ignore the impact of a possible downside risk.

Looking from another perspective — if the upcycle indeed comes true, my portfolio is already well-positioned to enjoy the ride.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.