Following my attendance at the AGM, here is a follow-up on Frasers Centrepoint Trust (J69U).

To give you the full picture, I’ve produced a video that blends my pre-AGM homework with the new perspectives shared by CEO Richard Ng and the latest 1Q 2026 Business Update.

It’s the best way to get up to speed on where FCT stands right now.

Here are my four key takeaways.

1. Resilience in Distribution Per Unit (DPU)

The question on every shareholder’s mind is DPU.

In response to queries regarding slow growth, Richard acknowledged the observation but pointed out that the macro environment over the last five years has been challenging — particularly due to high interest rates.

Crucially, he noted that while many S-REITs saw significant payout drops, FCT maintained a consistent DPU.

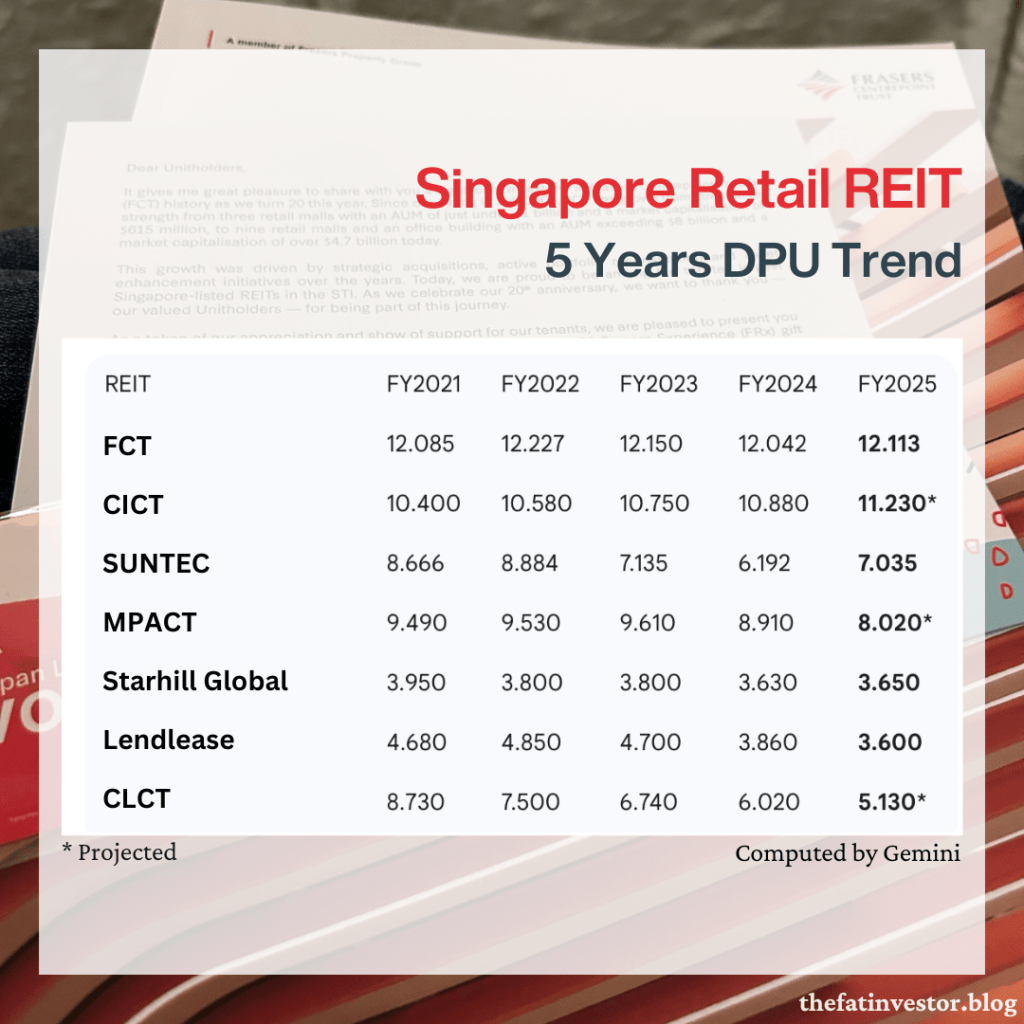

I compared the five-year DPU trends of Singapore retail REITs to verify this.

While not a perfect “apples-to-apples” comparison due to differing geographical exposures and property mixes, it is clear that aside from CapitaLand Integrated Commercial Trust (C38U), FCT has provided the most stable dividends over the past five years.

In fact, were it not for the dilution from the Equity Fund Raising (EFR) for the Northpoint City South Wing acquisition and rental arrears from Cathay Cineplexes, FCT would have seen a notable DPU increase last year.

2. Strategic Response to Competition (RTS Link)

Competition is a constant in any market.

It was reassuring to hear that management is proactively evaluating the risks associated with the RTS Link completion this December.

While I’ve previously noted that “JB is not Shenzhen,” Richard’s insights provided the data to back that gut feeling:

Scale and Connectivity: Shenzhen is a megacity of 18 million with a high-efficiency transit network. JB is ten times smaller, and transit remains difficult outside the Bukit Chagar city center. Moreover, HK-SZ are more “densely” connected than SG-JB.

Demographics: The HK-SZ border was originally built to attract mainland shoppers; consequently, SZ rapid development hit them hard. Conversely, Causeway Point was designed to serve a local catchment, making it more resilient to cross-border shifts.

Price Parity: There is little arbitrage for international brands like Uniqlo. Interestingly, Richard shared an anecdote from a Singapore brand that it’s cheaper to buy their shoes in SG than JB.

Reverse Expansion: There is a trend of increasing Malaysian brands (e.g. Oriental Kopi, ZUS Coffee) expanding into Singapore, further strengthening local mall offerings.

Causeway Point and Beyond

Driven by these observations and the upcoming massive development in Northern Singapore, FCT is planning to transform Causeway Point into a “regional mall.”

The goal isn’t just size; it’s about refining the trade mix to pull shoppers from a wider catchment, including Sembawang and Kranji.

Regarding the cinema space: SAS Cineplex (a relatively new player) has taken over the spot vacated by Cathay.

While I am naturally cautious about how a newer operator will perform, it’s helpful to know that this is a temporary arrangement until the major rejuvenation work at Causeway Point begins.

This makes the transition acceptable, as it keeps the space vibrant without locking FCT into a long-term commitment before the mall’s transformation.

For context: This strategy contrasts with Century Square, where FCT has already secured a stable, long-term backfill with Golden Village taking over the former cinema space.

3. Beyond Location: Active Management

FCT’s real “moat” is its location, but that vibrancy requires active management.

They constantly monitor sales figures to curate the right tenant mix. For instance, at Waterway Point, they broke up the large H&M space into smaller accessory shops.

Since anchor tenants typically enjoy lower rents, subdividing the space has allowed FCT to significantly improve overall yield.

Of course, this only works if the vacancies can be filled!

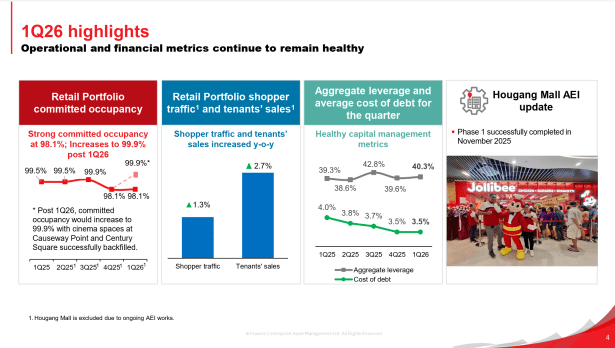

That shouldn’t be an issue for FCT as its fully occupied malls are still seeing increases in both shopper traffic and tenant sales as of 1Q 2026.

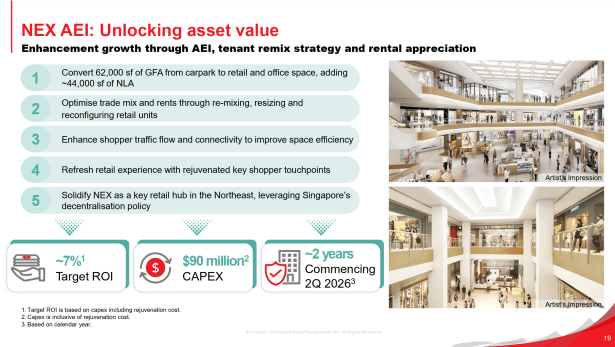

Upcoming NEX AEI

FCT’s strong positioning allows them to stagger their Asset Enhancement Initiatives (AEI).

Following the successful AEI at Tampines 1 and Hougang Mall, NEX is next in line for April 2026, perfectly aligning with the expiry of the Isetan lease.

By carving up the large Isetan space for multiple tenants, FCT expects to boost average yields and traffic flow.

Most excitingly, they plan to convert part of the car park into retail and office space, increasing the Net Lettable Area (NLA) by nearly 7%.

4. Capital Management: On Borrowing and Perpetual Securities

Finally, let’s look at FCT’s financial health.

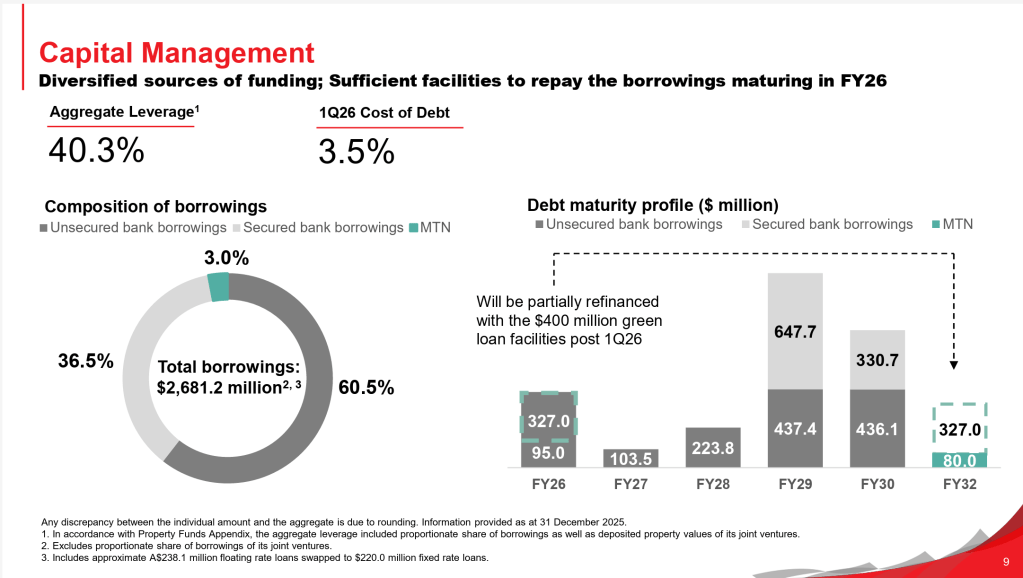

- The Good: The cost of borrowing sat at 3.5% for 1Q 2026, which is lower than the FY2025 average of 3.8%.

- The Caution: Gearing has risen to 40.3%, likely due to funding the final phase of the Hougang AEI and initial NEX costs.

While the lower cost of borrowing is a positive, I’ll be watching closely to see if those interest savings are enough to offset the impact of higher leverage.

During the AGM, Richard clarified that FCT does not “bet” on interest rates; they aim to keep fixed-rate hedges between 50–70%.

He also assured shareholders that Perpetual Securities are used only when necessary (like the Northpoint acquisition) and are not a regular capital management tool.

Concluding Thoughts

While I would love to see more growth in its DPU, context is vital.

Being able to maintain payouts while strengthening the portfolio during a period of macro turbulence speaks volumes about management’s capabilities.

Ultimately, what has kept me vested with FCT for a decade is the alignment with their logic and proactive execution.

Among my holdings, FCT may not offer the most alluring returns, but it offers a sustainable, high-quality yield that fits its defensive role in my portfolio perfectly.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.