You might think I’m crazy, but I love CPF LIFE. It’s the ultimate safety net that protects against longevity risk.

And guess what? As I did my research for this post and video, I realised that for homeowners, the deal is even sweeter!

While many know you can pledge a property to stick with the Basic Retirement Sum (BRS), I always had the impression that I had to make that “final” decision right at age 55.

What I discovered is that between age 55 and 65, I can actually draw down from my Full Retirement Sum (FRS) in my Retirement Account (RA) back to the BRS level.

This is the “Homeowner’s Hack”: The RA effectively acts like the “old” Special Account (SA) after 55!

That means you enjoy 4% risk-free interest with the flexibility of drawing down (up to the FRS amount) if you need the cash.

Did you already know this, or am I the only “mountain tortoise” here?

Given that the vast majority of Singaporeans are homeowners, I wonder why this point wasn’t highlighted when the SA closure was announced.

It likely would have pacified quite a number of members, except for those specifically aiming for the Enhanced Retirement Sum (ERS).

[After Note]

Thanks to a reader for pointing this out: The interest earned in the RA cannot be withdrawn; only the principal amount can be drawn down to the BRS level. This might be why the finance community didn’t talk much about it. It’s a principal-only hack!

Personally, this is perfectly fine with me. My goal isn’t to squeeze every last cent of interest out of the system; it’s to ensure my principal remains accessible from 55 to 65.

Why I’m Choosing Liquidity Over ERS

On paper, the ERS looks like the gold standard: higher payouts and a guaranteed 4% return. But I’ve realised that for my strategy, choosing liquidity is the real winner.

There is a fundamental difference between having your money in the RA as a “flexible reserve” versus committing it permanently to the ERS.

In the video below, I break down the math, the “10-Year Option” strategy, and the reason why ERS doesn’t fit into my current plan.

Watch the video below for the full breakdown.

Retirement Planning is Not a Silo

It is easy to get blinded by that 4% figure or the promise of a larger monthly payout. However, financial planning isn’t just about chasing the highest yield; it’s about optionality.

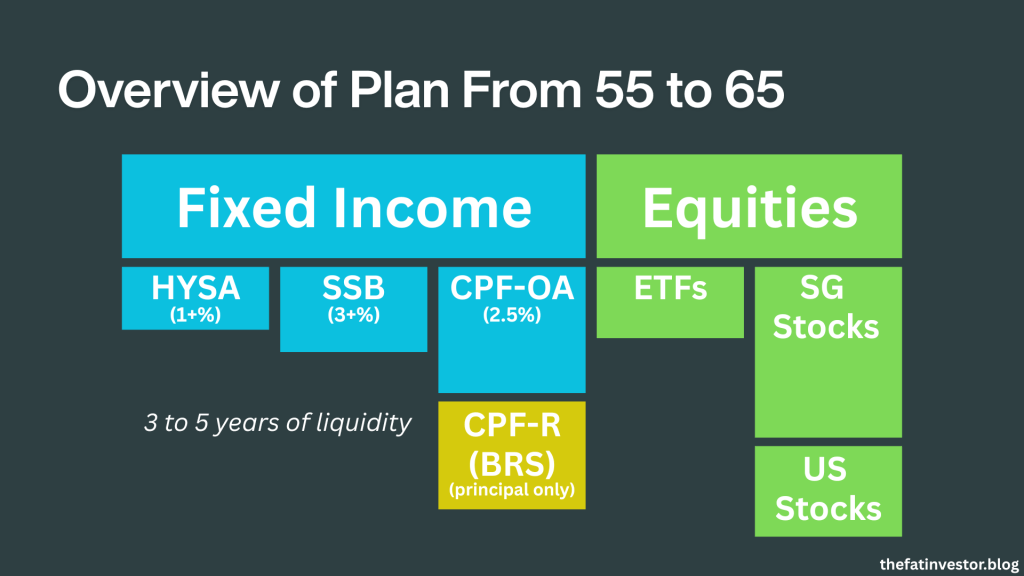

This is why CPF should never be viewed in a silo. It is just one piece of a much larger puzzle. My decision to stay at FRS and keep my principal liquid is based on my overall plan.

You need to consider all the moving parts (your cash, other investments, and insurance) before deciding which CPF scheme is suitable for you.

I hope my sharing provides you with a useful reference and sparks some ideas on how you want to plan your retirement.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

I think the reason why no one talks about this hack is because it doesn’t really exist. You cannot withdraw interest earned in the RA, so if you have FRS, you can only withdraw up to your BRS amount with property pledge, and there is no way to leave only BRS in RA.

The amount of Retirement Account (RA) savings you can withdraw excludes, generally, interest earned, government grants received and top-ups to your retirement savings. It also depends on your RA balance at the point of withdrawal. For example, if you are on CPF LIFE and have started your monthly payouts, any new inflows received in your RA will be used to increase your CPF LIFE premium and you will not be allowed to withdraw them.

https://www.cpf.gov.sg/member/retirement-income/retirement-withdrawals/withdrawing-for-immediate-retirement-needs/withdrawal-of-cpf-savings-for-property-owners

You are right about the interest. Thanks for pointing that out. I did highlight it in the video and should make it clear in the post too. Will add to the post later. For me, not locking up the principal is good enough.