The current wet weather is likely to continue for the rest of December 2025. Thundery showers are expected in the afternoon on most days, extending into the evening on some days.

The above outlook was released by the Meteorological Service Singapore on Dec 16.

Yet, in the past week, that forecast has not quite materialised. I’m sure you’ll agree with me that on some days, it felt like we were right back in the middle of summer.

As difficult as it is to predict the weather, forecasting a market outlook is even more elusive.

So why do I even bother with this 2026 outlook? Why am I predicting a bear market?

Look, I’m not saying it will happen.

However, by preparing for the worse, I’m protecting myself from getting carried away by the success of recent years.

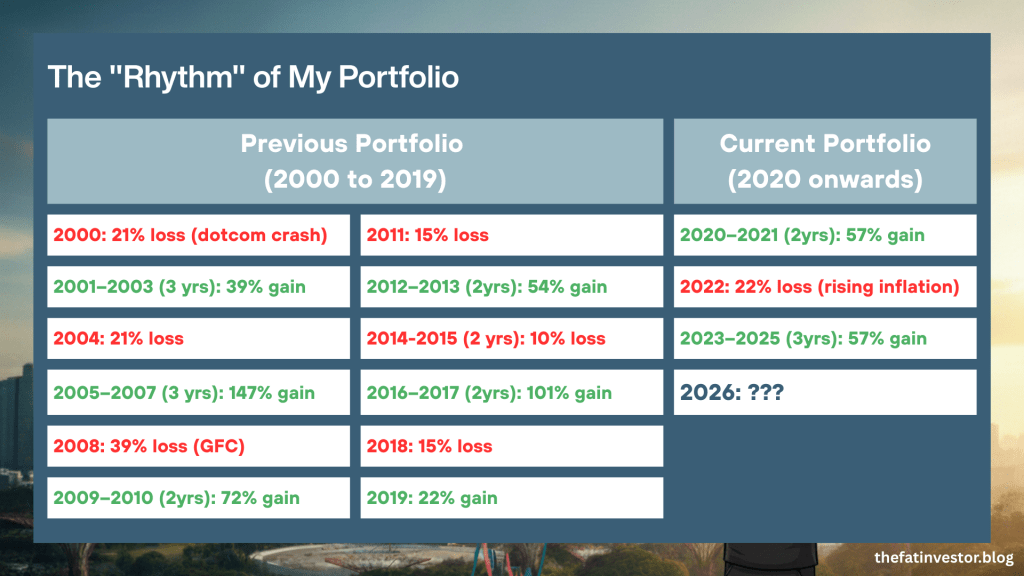

The “Rhythm” of My Portfolio

Experience is a great teacher, and after more than two decades in the markets, I’ve learnt to respect the “rhythm” of my portfolio.

As seen in the above image, there’s a clear pattern: a down year inevitably follows every two to four years of gains.

This is especially true for my strategy. Since I don’t short the market or use options to hedge, my portfolio is “long-only”, which essentially follows the ebb and flow of the broader markets.

Imagine my portfolio as a small boat in the open sea. It rises and falls with the waves.

As the captain, I can’t control the weather, but I must ensure the boat doesn’t break or capsize in the rougher sea.

My portfolio is currently coming off three successive years of double-digit returns.

While I rejoice in that robust performance, the mathematician in me knows that the statistical likelihood of a “down year” is now significantly higher.

Why the 2026 Outlook is Getting Cloudy

I’m not a “macro” expert, but it’s clear the world is still in a state of flux.

The “Delayed” Reality Check

For one reason or another, we avoided the “hard landing” many feared in 2025. Economies remained resilient despite the volatility, and a recession was averted with GDP growing at a healthy clip.

However, part of that growth was fuelled by a “rush” to beat new global trade tariffs. That momentum might fade in the coming months.

Fragile Valuations

It’s too early to celebrate.

While the surface looks calm, the global environment remains unpredictable. With many countries looking inwards, a sudden shift in policy can change the market mood overnight.

Even if quality businesses manage to navigate these uncertainties and continue to perform well, their stock prices appear over-optimistic.

In such a fragile market, any drizzling of “bad news”, such as slowing growth, could trigger a massive, knee-jerk sell-off.

The market is currently priced for fair weather in 2026, but as any Singaporean knows, those dark clouds can appear on the horizon very, very fast.

My Game Plan: Caution Over Overhaul

Despite a possible downturn, I am not overhauling my strategy.

Since I left my regular job three years ago, my plan is already designed for survival rather than optimisation.

I am writing this to remind myself to keep my feet on the ground.

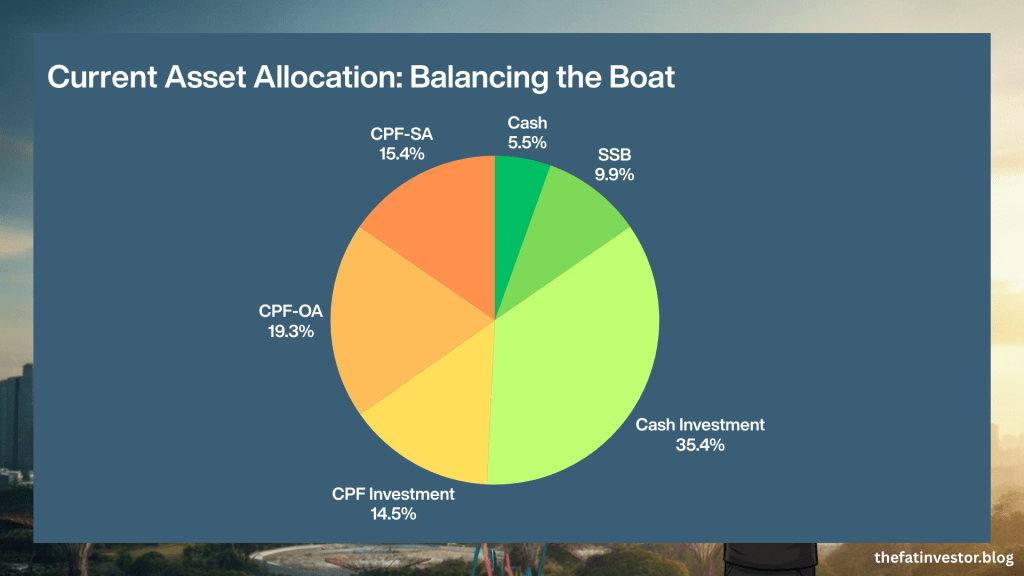

Balancing the Boat

I will continue to keep my exposure to equities at around 50%, which is sufficient to grow my net worth over the long term.

My cash and Singapore Savings Bonds (SSB) provide me with enough liquidity for at least the next three years. I hope to avoid cashing out my SSB, as I’ve successfully locked in tranches with yields above 3%.

While my CPF is out of reach for now, it’s heartening to see it grow in the background. It will serve as another reliable income stream just a few years down the road.

Trimming the Sails

I will continue to trim my portfolio if markets stay exuberant in 2026.

While I could afford to sit tight, I am sticking to my rules to respect the portfolio’s “rhythm” and protect my cash reserves.

My rule is simple: Sell if the total return (including dividends) hits 10% at any point during the year, or if it reaches 6% by year-end.

The amount sold will be the gap between my projected 2027–2029 spending and my current cash holdings.

Waiting for the Perfect Storm

My total transactions dropped to 77 this year — one of the lowest on record for this portfolio.

I expect that number to be even lower next year, as I’ll likely be doing much less buying. I am happy to wait for genuine opportunities to arise, like what happened this April, rather than forcing trades in an expensive market.

Rhythm Changes, New Patterns Emerge

Just as changing the arrangement of a familiar rhythm creates an entirely new piece of music, old market patterns can shift when new information appears.

Here is why 2026 might actually turn out to be brighter than expected.

The Shortened Cycle

We live in a faster world.

Information flows at a velocity that was unthinkable even a decade ago, and that fundamentally changes market dynamics.

While my portfolio may face a downturn soon, modern markets often recover much faster than they did in the ’90s or 2000s.

There is a likelihood that the “annual pattern” of my portfolio will compress. This means sharper drops followed by quicker rebounds, and my portfolio could still end 2026 in the green.

The “Brighter” Surprise

Uncertainty doesn’t always lead to the worst; it can also lead to unexpectedly bright outcomes.

A resolution of major global conflicts or a second, more powerful wave of AI productivity could easily prolong this up-cycle far beyond what the “math” currently suggests.

So, which stocks in my portfolio are best positioned to ride this “brighter surprise”?

Stay tuned for my next post, where I’ll be revealing the six stocks I believe could turn out to be my portfolio’s potential winners for 2026.

Related Posts

Can I Survive The Next Bear Market?

My Emerging Strategy: Investing CPF in World/US Equity Funds During Downturns

My Investment Plan Amidst Tariff Uncertainty

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.