In my previous post, I shared the big-picture view of 2025: a third consecutive year of 15%+ returns and a fascinating psychological battle between beating the S&P 500 and lagging the STI.

Thanks to “Santa Rally,” the portfolio edged up by another percent to hit a total 18% XIRR for the year.

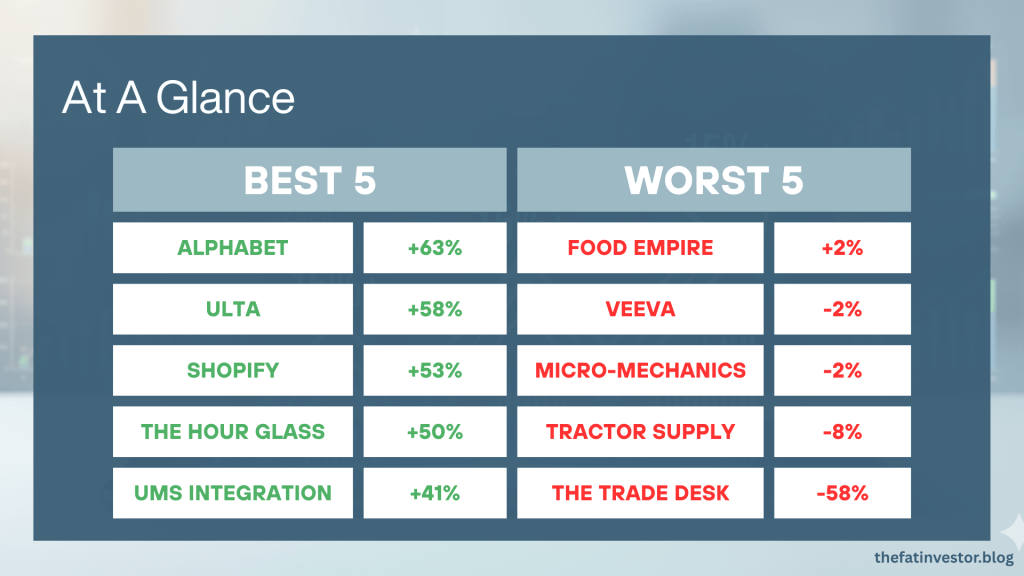

However, an 18% return doesn’t happen in a vacuum; it is the collective result of individual wins and losses. Today, I’m lifting the hood to reveal my 5 best and worst stocks that defined my 2025.

The 2025 Leaderboard: Percentages vs Strategy

While the chart above shows the “score,” the video below explains the “play.”

In this video, I dive into the “why” behind these moves. I shared why I invested in these businesses, what caused their specific performance, and exactly what I’m doing with them now.

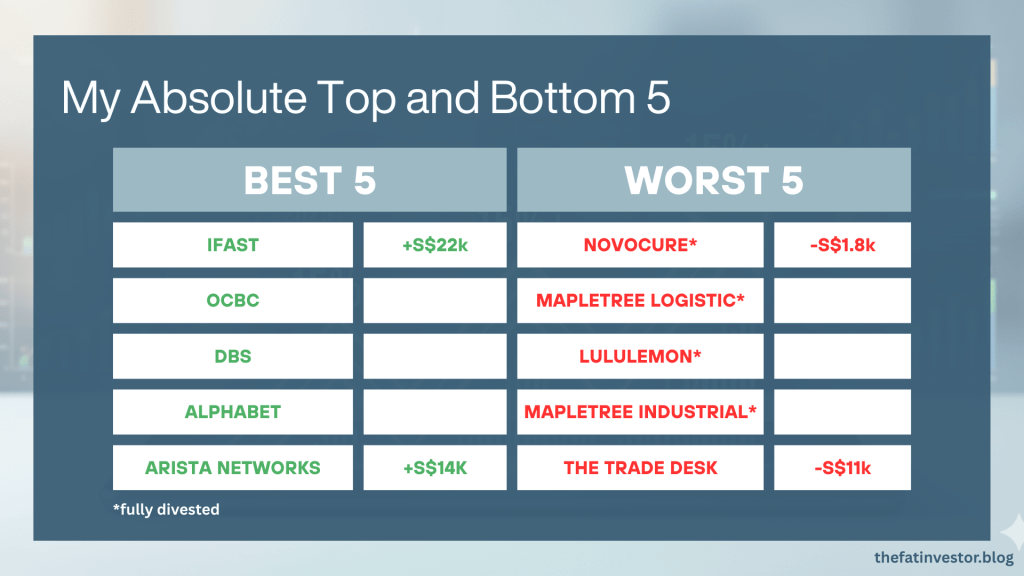

But Weight Matters: My Absolute Top & Bottom 5

Percentage gains make for great headlines, but as any seasoned investor knows, portfolio contribution is where the real battle is won or lost.

A 50% gain on a tiny “speculative” position is fun, but a 15% gain on a “cornerstone” position is what actually pays the bills.

The image below shows the top and bottom 5 stocks based on absolute value, and it looks very different from the one shared in the video. Besides Alphabet (GOOGL) and The Trade Desk (TTD), none of the other stocks appears on this list.

This contrast highlights two key takeaways for my investing strategy.

The Quiet Strength of Cornerstones

Stocks like iFAST (AIY), OCBC (O39), and Arista Networks (ANET) are among my top five largest positions. Their returns were solid (12% to 30%) but not “explosive” like Ulta’s 58%.

However, because I had high conviction and high weighting in these established businesses, their “modest” gains resulted in the most significant dollar contributions to my portfolio return.

It’s like having the star players on a team delivering consistent results. Their performance lifts the entire team to achieve the win (in this case, an 18% portfolio return).

The lesson?

While hunting for “multi-baggers” can get you good return, it’s not the only way. You can achieve the same portfolio-level impact by having sizeable positions in established, high-conviction businesses.

Survival Through Sizing (Limiting the Downside)

Losing S$11,000 on The Trade Desk this year was painful. However, because of disciplined position sizing, that loss was entirely offset by the gains of just one of my top-five winners.

By accumulating new positions in tranches over months and years, I managed to limit the “damage” from most underperformers. For example, the lost on Novocure (NVCR) and Lululemon (LULU) this year is only low four-digit.

When you couple loss-limitation on low-conviction plays with fair returns on high-conviction plays, you increase the likelihood of long-term success significantly.

Deep Dives & Detailed Write-ups

In the video, I gave a brief summary of these stocks. If you want to read a more detailed write-ups, you can refer to my original thesis or latest analysis below.

The Trade Desk

David vs Goliath: The Trade Desk’s Rise to Power against Ad Giants Google and Facebook

Ouch! Trade Desk Suffers Brutal 33% Stock Plunge

Tractor Supply

Forget the S&P 500 ETF: These 3 US Stocks Gave Better Returns

Micro-Mechanics

Micro-Mechanics Profits Surged 54%: Balancing Growth Potential and Dividends

Micro-Mechanics AGM and 1Q 2026: Flat Quarter Masks Resilient Turnaround and Future Growth

Veeva Systems

From LUVZ to UVZ: Veeva and ZScaler

Food Empire

Food Empire: Lim Kopi Again for its New Growth Story

My Three “Newcomers” VICOM, ComfortDelgro, Food Empire Nailed 3Q 2025

UMS Integration

Investing Opportunities in Singapore Semiconductor Companies: A Return to UMS Holdings

2Q 2025 Revenue Jump: UMS Starting to Bear Fruit

The Hour Glass

Beyond Singapore Banks and S-REITs: 2 Unlikely Dividend Gems in Singapore

Are Dividend Cuts a Death Knell for Your Singapore Stock?

The Hour Glass AGM 2025: Resilience from Key Partners Relationship

Shopify

Long growth runway for Arista Networks and Shopify

Shopifying Good FY 2024: The Flywheel Effect in Action

Shopify Sparkles. Venture Hopeful?

Ulta Beauty

Beautifying My Portfolio: A Deep Dive into Ulta and e.l.f.

Do I still luvz them? Lululmeon and Ulta Beauty

Alphabet

Initiated position in Alphabet and bought back The Trade Desk

Alphabet (Google) Stock Price Dropped by 10%: Should You Buy?

GOOGL 3Q 2025 vs MSFT 1Q 2026 Earnings: Is Vertical AI the Better Buy?

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.