A fortnight till the end of the year.

With all major expenses accounted for, it’s time to review this year’s spending.

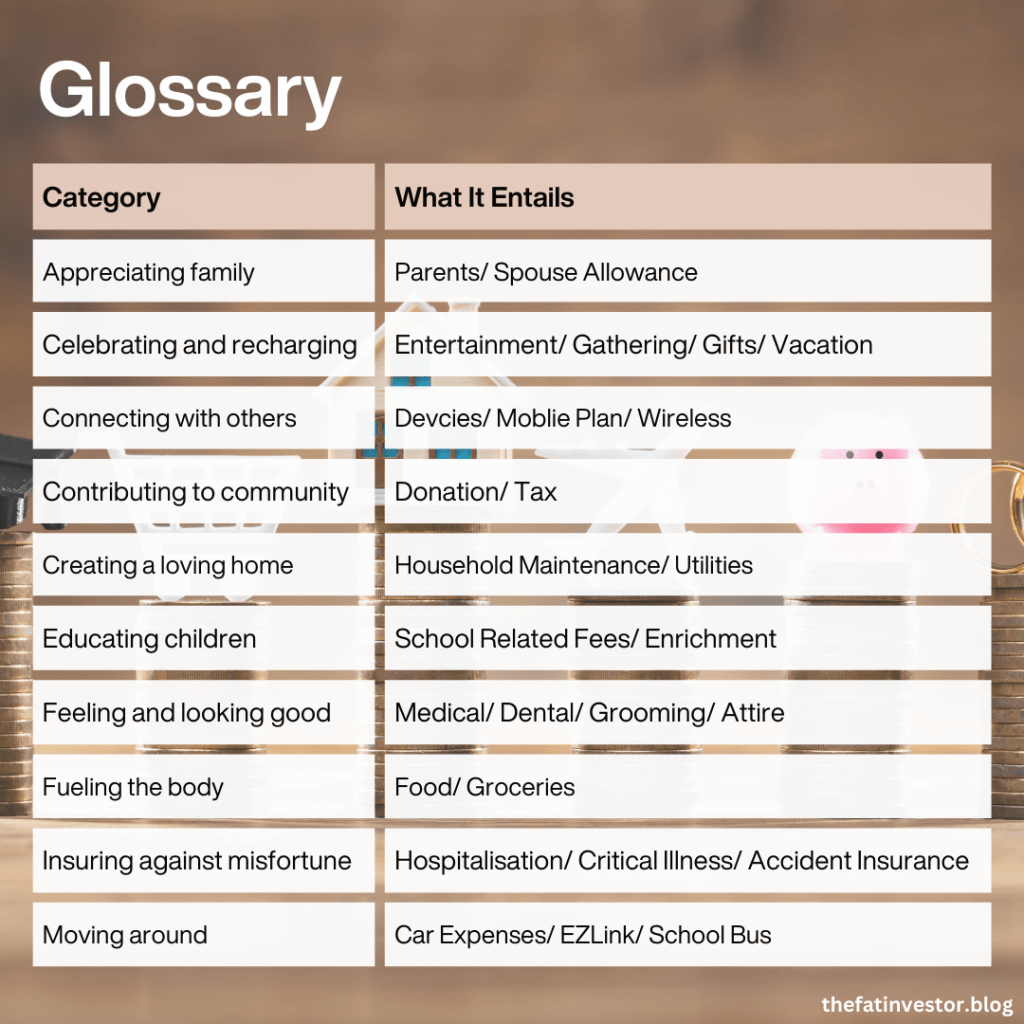

As a reminder, I categorise my expenses using action words to focus on the why rather than just the what.

Way Below $7,500 Per Month Budget

With home improvements in mind, I originally budgeted S$90,000 for the year. However, those plans are deferred.

It wasn’t a lack of funds; rather, the physics of inertia applies to daily life. The reluctance to invite the inconvenience of renovations dampened the process.

On the bright side, this suggests our current fixtures are still serving us well.

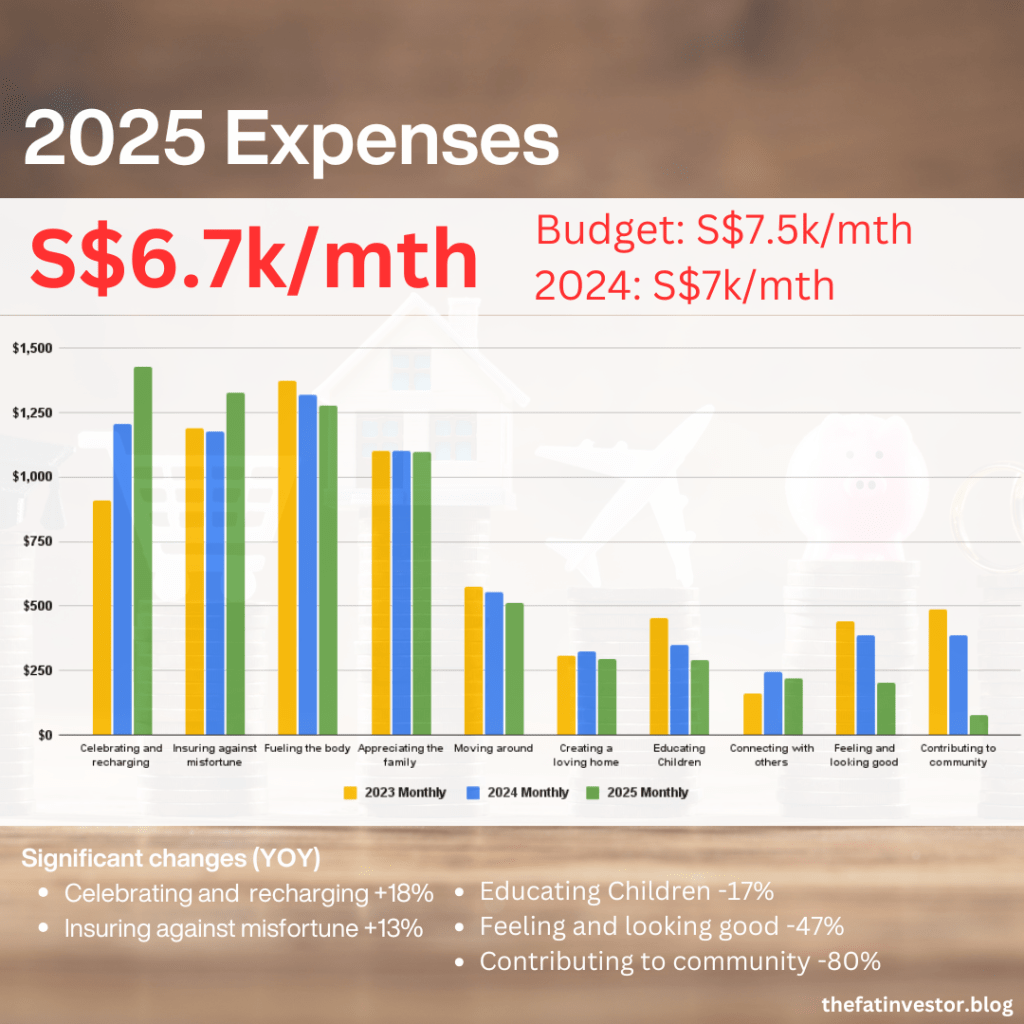

As a result, my average monthly expenditure dropped to just above S$6,700! A solid S$300 below my spending in the previous two years.

How did I do it?

Let’s zoom into the individual categories for further details.

Reduction in Medical, Tax and Children’s Expenses

The charts provide a clear visual of where money was spent this year. And with three years of data, the trend is a good indication of my spending habits.

I will briefly highlight the categories that saw significant changes from the previous year.

Celebrating and recharging: It’s another jump this year as we travelled further (Taipei and Hong Kong). This is likely to inch up for a few more years as we continue to expose the younger boy to longer flights and holidays.

Insuring against misfortune: As shared in an earlier post, crossing the age band almost doubled my cash outlay for the premium. I’m watching for next year’s “rider” changes to see if costs ease.

Educating children: Grateful for the significant decrease in Pathlight’s school fees since July. There were also no textbook and overseas trip costs for my eldest daughter this year.

Feeling and looking good: Completed payment for daughter’s braces, and resolved her acne problem.

Contributing to the community: This was the first year of zero income tax. Instead, my son and I raised over S$2,500 for the Autism Resource Centre (ARC). If you’d like to support them, their Giving.sg campaign remains open till end of the year.

My Declining (Safe?) Withdrawal Rate?

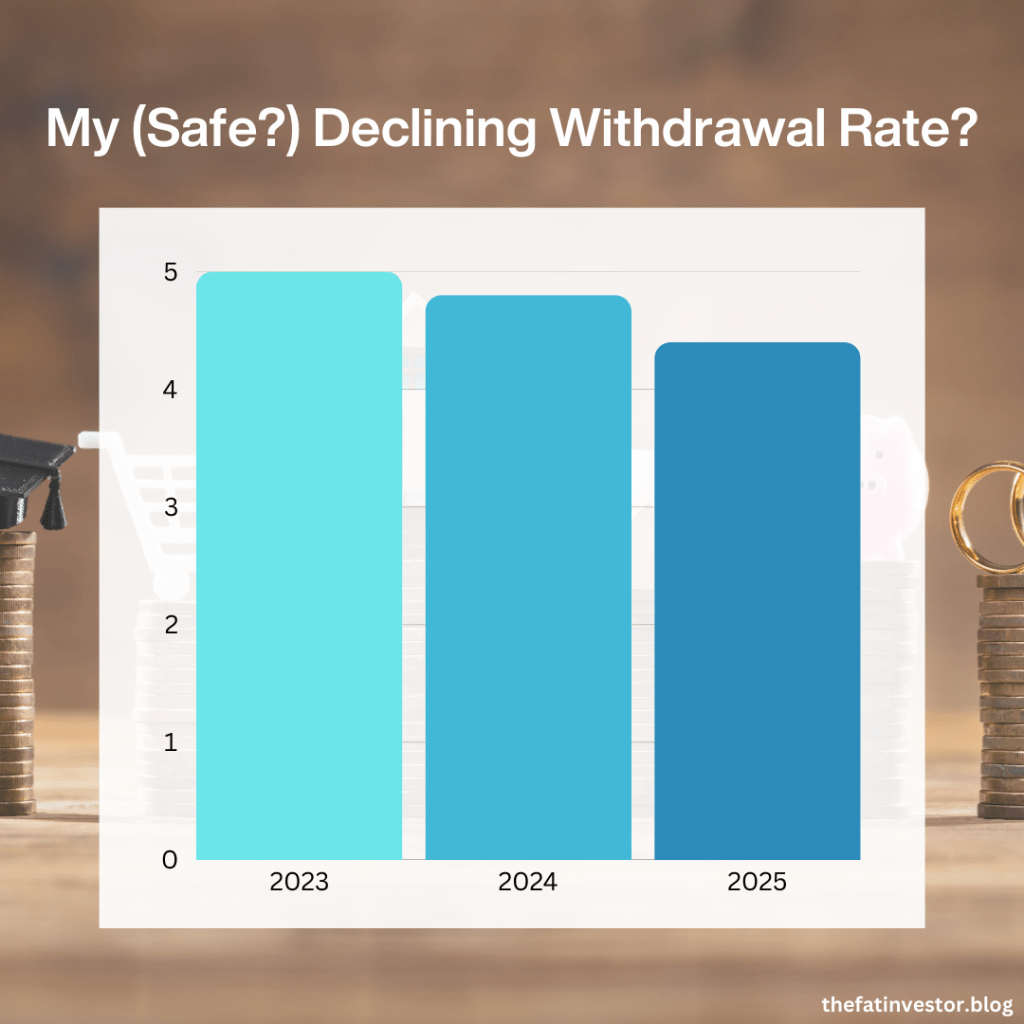

I’ve never been a follower of the “4% Rule,” but curiosity finally led me to calculate my own withdrawal rate for 2023 — the year I left service and traded my regular income for independence.

The result? 5.0%.

According to the original Trinity Study (1998), jumping from a 4% to a 5% withdrawal rate for a balanced portfolio (50/50) causes the success probability to plummet from 95% to 68%.

On paper, a 30% chance of failure is startling! But while the 4% rule is a useful compass, it is a poor GPS.

It provides a general heading but ignores the shifting conditions of an individual life; it relies on a generic average for inflation when, in reality, inflation is personal.

In hindsight, ignorance was a blessing. I didn’t base my retirement on a generic rule of thumb, but on a granular annual projection.

The Illusion of Safety

As shown above, my withdrawal rate has steadily declined over the last three years.

This trend highlights the flaw in the “4% Rule”: you cannot rely on a single “magic number” when both annual spending and net worth are in constant flux.

You might argue that a lower withdrawal rate makes retiring this year “safer” than it was in 2023.

However, that safety is an illusion.

My expenses are set to spike: home improvements can’t be delayed forever, and a staggering COE renewal awaits in 2027. My withdrawal rate will inevitably surge past 5% in the coming years.

So, should you base your “safe” rate on maximum peak spending instead?

While that is a valid conservative approach against running out of money, it ignores the biggest variable of all: life expectancy. This non-measurable parameter is the ultimate wild card.

Math can tell you if your money will last; it can’t tell you if your time will.

Before you fixate on the percentages, remember that time is the only truly finite resource.

Read my earlier article Retiring Early: Beyond Your Money for my thoughts on that.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.