The final quarter of the year is typically when I adjust my portfolio in anticipation of companies’ performances for the coming few years.

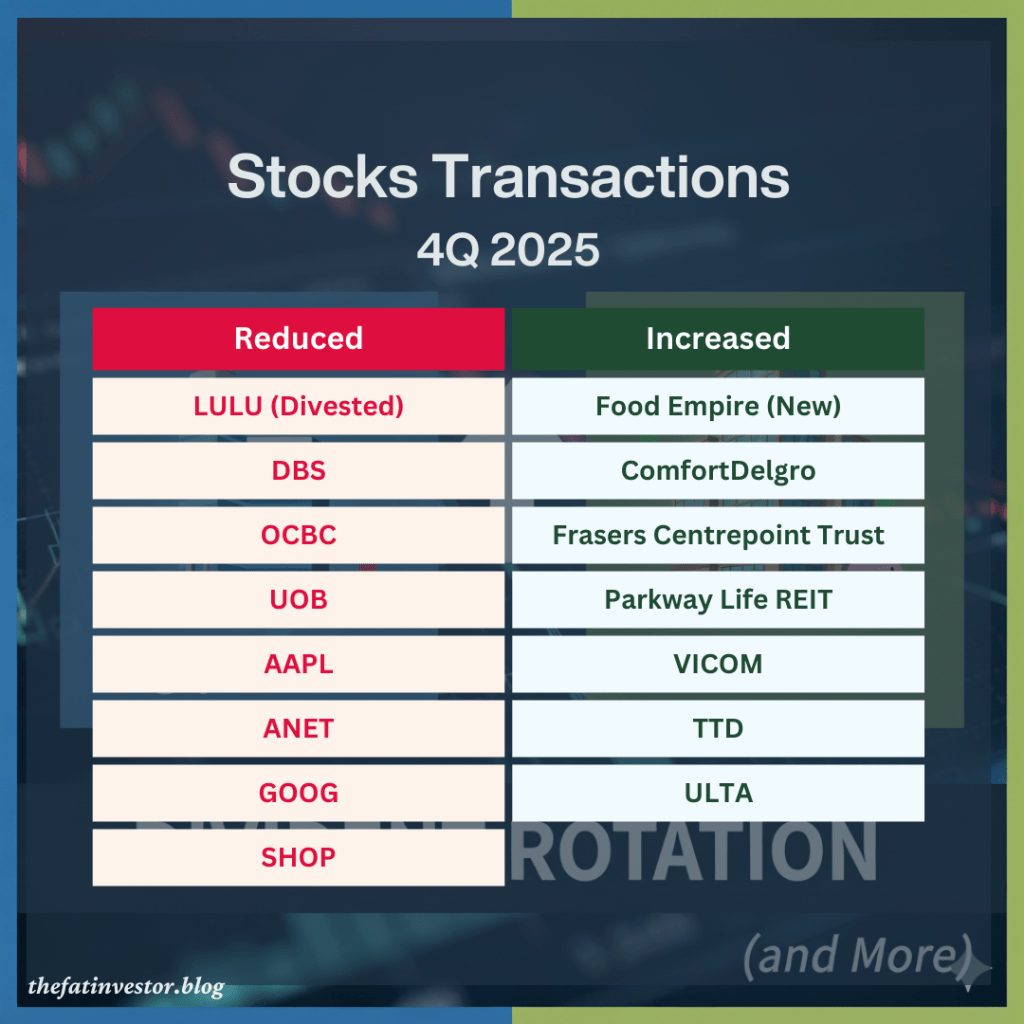

While it wasn’t intended, the transactions made over the quarter can be summarised into the following themes:

- Singapore Banks to S-REITs

- A Different Growth Bet

- Trimming US Portfolio

Shifting Dividend Play: Singapore Banks to S-REITs

I trimmed about 20% of my stakes in the three Singapore’s leading banks: DBS Group (SGX: D05), OCBC Ltd (SGX: O39), and United Overseas Bank Ltd (SGX: U11) in September.

Since then, with the exception of UOB, the other two banks reported a resilient set of performance for 3Q 2025.

Their capabilities to manage dropping interest rates mean the banks, especially DBS, are likely to continue to do well in the coming year, sustaining their incomes and profits at current or probably slightly lower levels.

However, this also mean that the upside is likely to be muted.

Conversely, I’m anticipating higher growth potential in dividends per unit (DPU) from both Parkway Life REIT (SGX: C2PU) and Frasers Centrepoint Trust (SGX: J69U) in the coming years, which led to my increased stakes in them.

Importantly, this is a strategic adjustment, not an overhaul.

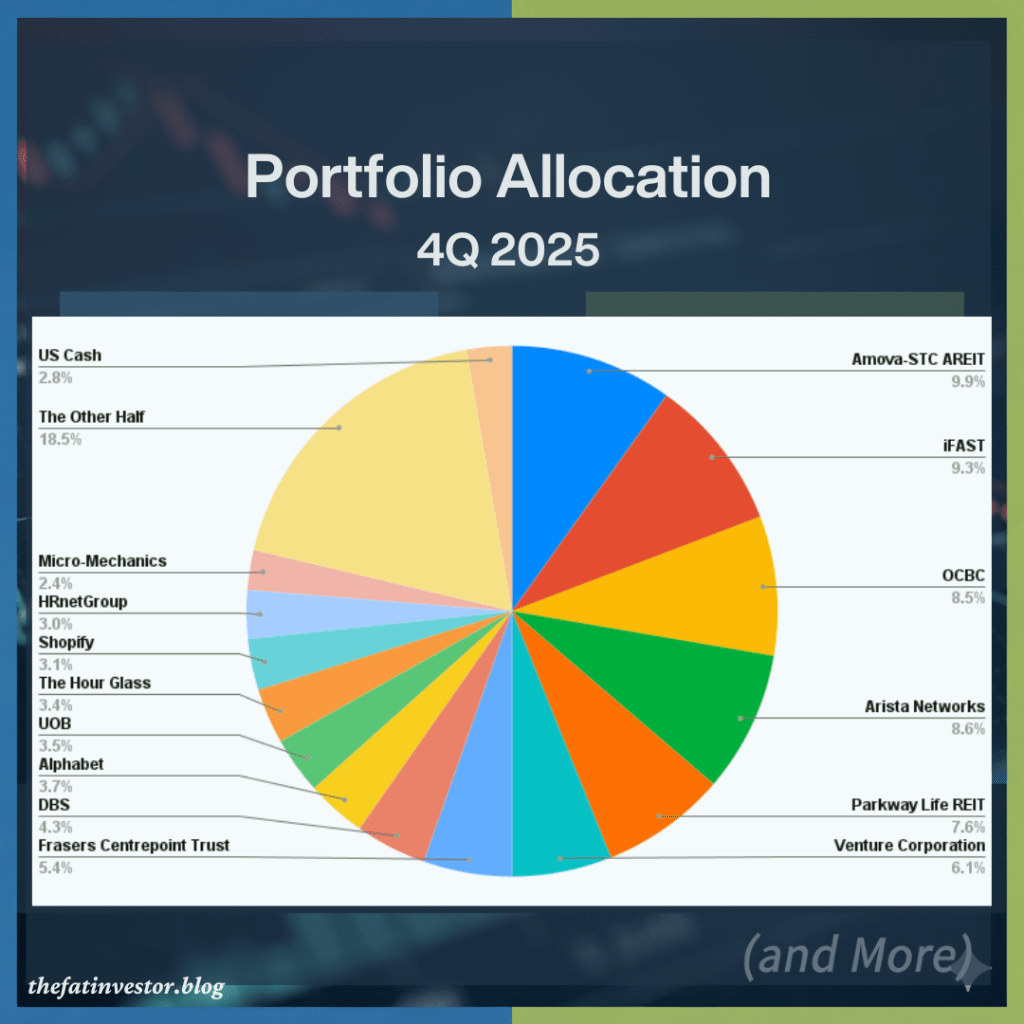

Even after these adjustments, the three Singapore banks still take up about 16% of my portfolio. The two S-REITs, together with Amova-STC AREIT (SGX: CFA), now occupy 23%.

Clearer Growth Visibility and Turnaround Play

Since my divestment at US$166, share price of Lululemon Athletica (NASDAQ: LULU) has increased by more than 14% to US$190. A strong set of Q3 2025 numbers this Thursday could potentially propel its price further up by another 10%.

Regardless of how it turns out, I’ve no regret with my divestment as I was uncertain about whether Lululemon could turn around its current business momentum.

On the other hand, the growth trajectory of Food Empire Holdings (SGX:F03) is a lot clearer. Hence, despite its price sliding more than 9% since my last purchase, I remain confident in its long-term business performance.

Similarly, a third consecutive robust quarter indicates a clearer growth recovery for Ulta Beauty (NASDAQ: ULTA).

In 3Q 2025, sales grew by 12.9% year-on-year (YOY) to US$2.9 billion, a rate not seen since more than two years ago. Crucially, this marks the third consecutive quarter of strong Comparable Store Sales:

- Q1 2025: +2.9%

- Q2 2025: +6.7%

- Q3 2025: +6.3%

This sustained performance above 6% in the last two quarters strongly validates the new growth path.

While the quarter profit was flat at US$231 million, the slight decline in operating margin to 10.8% is expected, given the massive acceleration of expansion (like the recent Space NK acquisition and international moves into Mexico and the Middle East).

With this clear domestic recovery, combined with new initiatives such as the UB Marketplace online platform, Ulta’s overall trajectory appears firmly re-established on a strong growth path.

Trimming US Portfolio: Awaiting Opportunity

A decision made by both logic and feelings, and I continue to stand by it.

This move increased my cash position, which provides flexibility: I can use it to partly fund my drawdown next year or reinvest it in selected positions if markets experience a severe correction.

To be clear, I remain largely in the market, as this cash still accounts for less than 3% of my equities portfolio.

Furthermore, the funds are not idle, earning a good interest of more than 3.3% in the FSMOne Auto-Sweep Account.

Stock Allocation Stays Similar

The adjustments have little impact the overall portfolio allocation; the same stocks still occupy the top half of my portfolio.

However, two notable changes did occur in the ranking:

- Amova-STC AREIT assumed the top position after the sale of OCBC and Arista.

- Alphabet (NASDAQ: GOOG) rose to the ninth position despite the trim, due to its strong share movement over the past month.

I continue to favour the resulting mix of Singapore Banks, S-REITs, other income stocks, and growth stocks among the top half of my portfolio.

I believe this balance should continue to deliver solid returns over the next three to five years.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.