With one month still on the clock, I’m officially closing my investment shop for the year.

Barring a drastic, 10%-plus market shock, my buying and selling are done, and all that’s left are receiving a few dividend payouts.

This pause makes it the perfect time to look back, reflect, and celebrate a successful year of execution.

Without further ado, here are my Top Five Investment Moves of 2025.

#1 Capitalising on the “Tariff-ied” Markets in April

Markets were indeed “tariff-ied” in April, sending stocks on a rapid sale.

I am pleased that I had a clear plan, quickly adjusted it as the decline accelerated, and most importantly, executed it.

The results were significant: My investment in the Amundi Index MSCI World Fund (using CPF) generated the equivalent of five years of compounded interest in just three months.

Separately, a quick trade when DBS Group Holdings (SGX: D05) went on a flash deal fully covered my Taipei accommodation in June.

Could I have made more by holding? Yes.

But given the macro situation remained shrouded in uncertainties, I was right to take profits on these opportunistic plays and secure the gains.

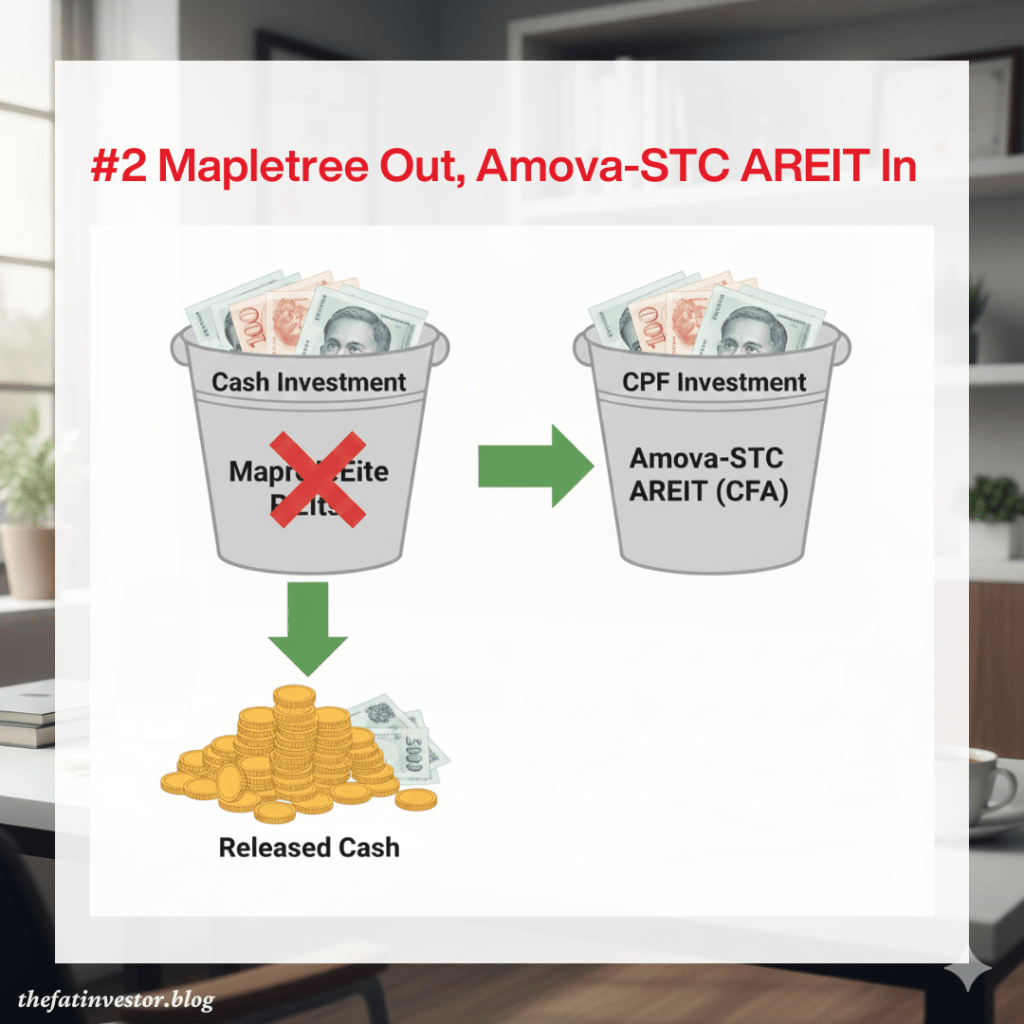

#2 Cash Released: Mapletree Out, Amova-STC AREIT In (CPFIS)

Continuing on the topic of CPF Investment, here’s a tactical allocation switch that released locked up cash.

While the Amova-StraitsTrading Asia ex Japan REIT Index ETF (SGX: CFA), or Amova-STC AREIT, has been under the CPF Investment Scheme (CPFIS) since November 2021, I only made my first purchase in late 2023.

However, it took a sudden realisation this May to see the true potential: by consolidating most of my REIT exposure into the ETF within my CPF, I was able to free up cash for other opportunities!

Why didn’t I think of it earlier?

Hmm, perhaps in the past, I thought investing in individual S-REITs was similar to investing in other stocks, but now it doesn’t feel the same

Or perhaps, when I had an active income, I wasn’t searching for ways to increase my available cash flow.

Regardless of the underlying reason, I am pleased that this simple move significantly increased the amount of funds available for investment.

Enough of the higher level moves, now let’s zoom in to the best moves for individual stocks.

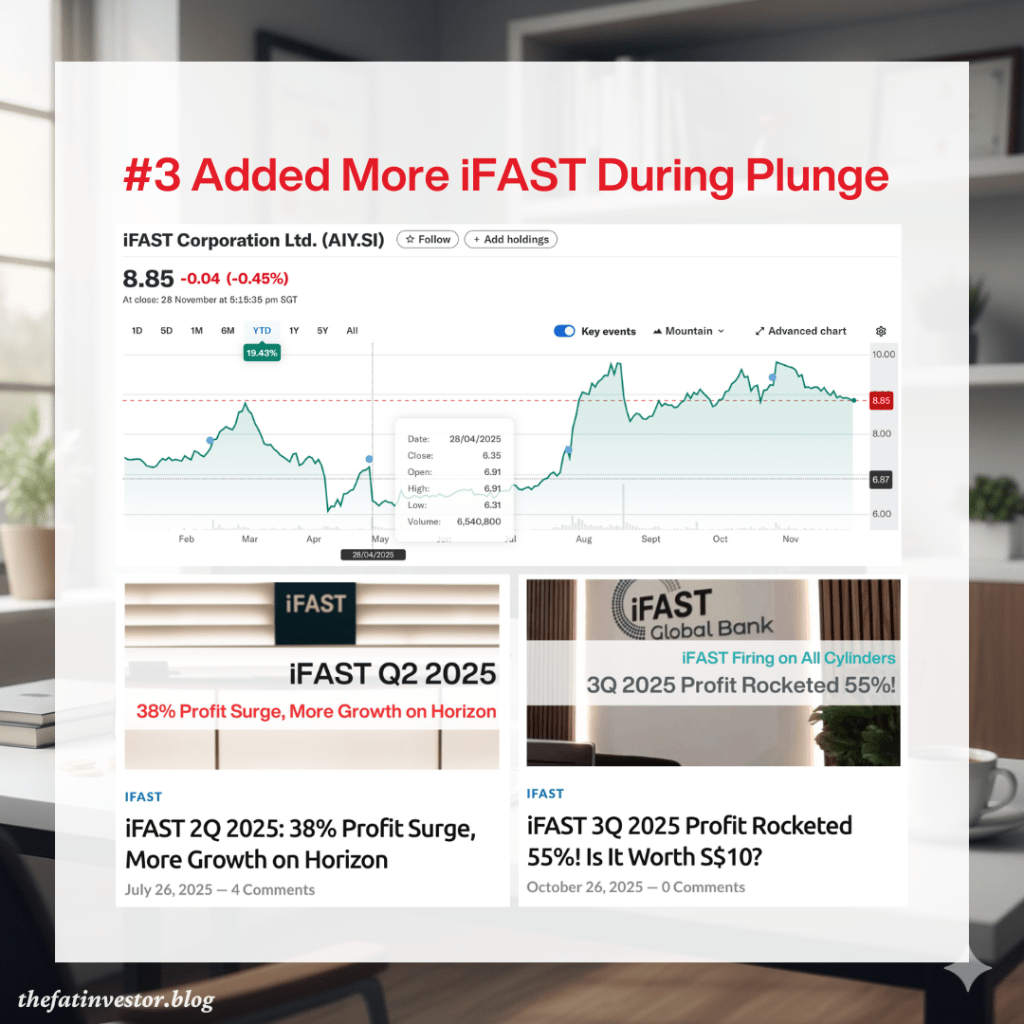

#3 Held On and Added More iFAST During the March Plunge

Unless you are a shareholder of iFAST Corporation (SGX: AIY), you probably won’t recall its 12% single-day share price plunge following the release of its 1Q 2025 results in March.

While common in US markets, such a sharp, immediate drop is rare in Singapore.

What makes this event truly notable is that iFAST had actually reported an all-round strong set of results, with record performance already expected for the year.

The culprit was not poor performance, but a surprising announcement: a reduction in its 2025 profit before tax (PBT) target for the Hong Kong segment.

Management stated this was due to allocating more resources and incurring additional costs for the massive eMPF (Mandatory Provident Fund) platform onboarding.

For many, this was a cause for panic.

For me, having been invested in iFAST for eight years and witnessed how it successfully navigated various adversaries, I saw this simply as another blip in its long-term growth journey.

I’m glad my conviction paid off.

My decision to hold on and decisively add additional shares on that fateful day turned out right.

iFAST has since gone on to report two explosive quarters, and its share price has gained about 40% since the plunge.

#4 Conviction Paid Off: Doubling Alphabet (Google) Stakes

Alphabet (NASDAQ: GOOG) was another stock whose share price, for a good part of the year, was punished by the market’s misguided expectations, rather than reflecting its robust underlying performance and massive growth potential.

Of course, the ongoing antitrust lawsuit regarding its Google Search business was the second major shackle on its share performance.

To be clear, these were (and remain) valid concerns.

However, I took the position that these issues were temporary distractions.

I strongly believe the market will eventually recognise the immense potential of Alphabet’s vertical AI integration approach, which I see as the primary driver of its growth for the next decade.

Therefore, doubling my stake when the market was most doubtful paid off sooner than I expected.

The recent gains have nearly doubled my average purchase prices, proving that conviction in a quality business often trumps short-term fears.

#5 Overcoming Bias: Bought Back Ulta Beauty and Food Empire

Buying back stocks you previously sold is never easy.

It forces you to confront the original reason for divestment, and the reality is, you probably weren’t monitoring them closely after closing the position.

It was the same for me, and the chance to re-invest in them are typically opportunistic rather than pre-planned.

This year, I bought back a few of them, but Ulta Beauty (NASDAQ: ULTA) and Food Empire Holdings (SGX: F03), or FEH, proved to be the better moves.

For Ulta, the sharp drop in its prices in early 2025 and the subsequent change in CEO was the trigger for my purchase.

Kecia Steelman’s emphasis on the customer experience, rather than solely focusing on immediate results, resonated with me and gave me cautious optimism that she could turn the business around.

It’s still early days, but there are indications of a return to growth in the coming year. Market sentiment has clearly reversed, reacting positively to Ulta’s results in the past few quarters, rewarding me a return of over 40% thus far.

As for FEH, I suffered from anchoring bias, remembering its lower valuation and concentration risks from years ago.

This prevented me from seeing its current high-growth trajectory, until I finally took some time to analyse its recent years’ performance in October.

The company’s successful pivot towards the higher-margin ingredient segment and expanding market shares in Vietnam means the FEH business is now significantly more resilient than it was.

While it’s too early to conclude the long-term success of the FEH investment (though I’m already sitting on a 10% gain), I’m proud that I wasn’t held back by its explosive share price gain this year.

Re-entering this Singapore gem was a move that acknowledges new data over old sentiment — the final, and perhaps most important, lesson of the year.

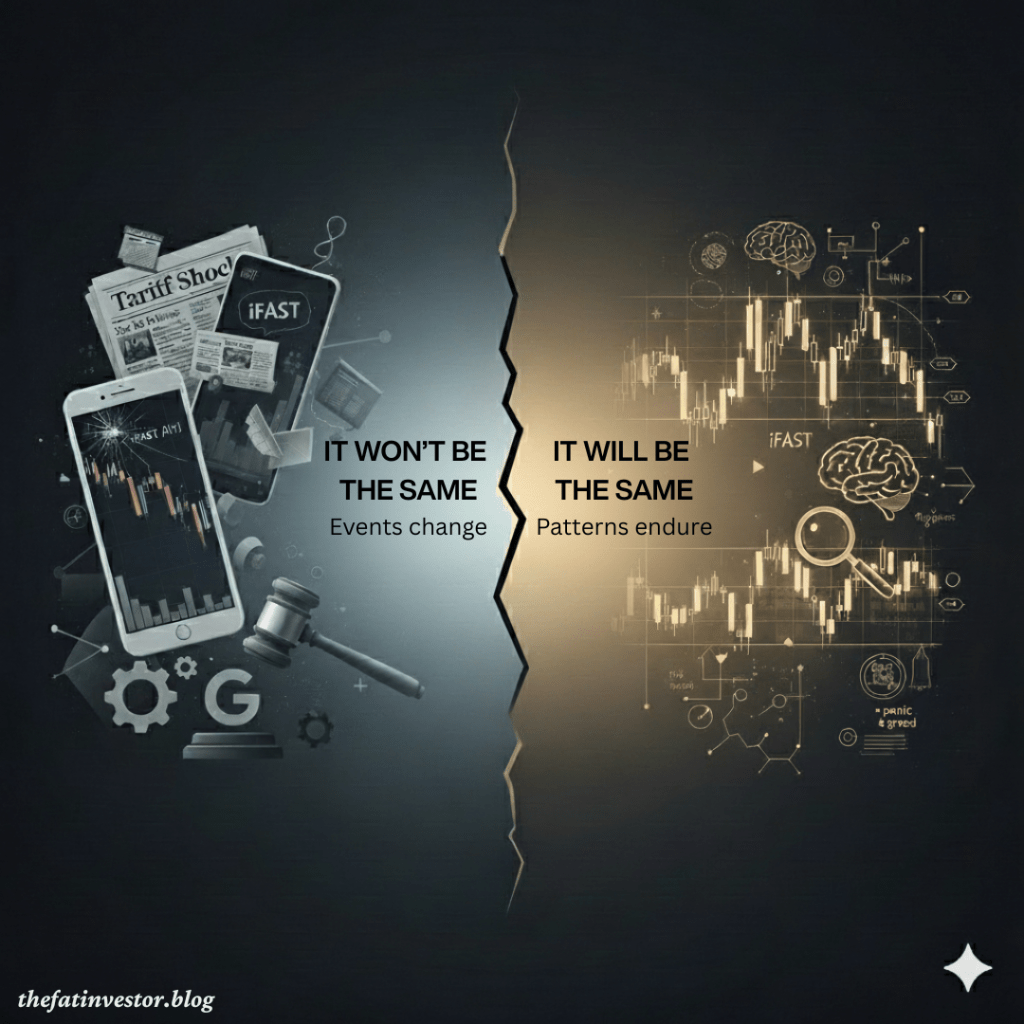

It Won’t Be The Same. It Will Be The Same.

Reflecting on these five successful moves which span from macro-timing to strategic allocation to individual stock conviction, serves a far greater purpose than just celebrating gains.

The specific crises, headlines, and catalysts of 2025 won’t repeat.

It Won’t Be The Same.

However, the underlying drivers of market behaviour: psychological bias, overreaction to news, and the human tendency to panic or ignore data, will always persist.

Future years will inevitably bring similar situations where conviction is tested.

It Will Be The Same.

You can train yourself to act correctly in the future by understanding why you executed decisively in the past.

Success isn’t about predicting the next event; it’s about having the conviction and discipline to execute when those timeless patterns of opportunity appear.

Related Posts

GOOGL 3Q 2025 vs MSFT 1Q 2026 Earnings: Is Vertical AI the Better Buy?

iFAST 3Q 2025 Profit Rocketed 55%! Is It Worth S$10?

Food Empire: Lim Kopi Again for its New Growth Story

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.