Last year delivered record dividends, but 2025 saw a dip in my total collected dividend income.

I’m not panicking though, as this was expected.

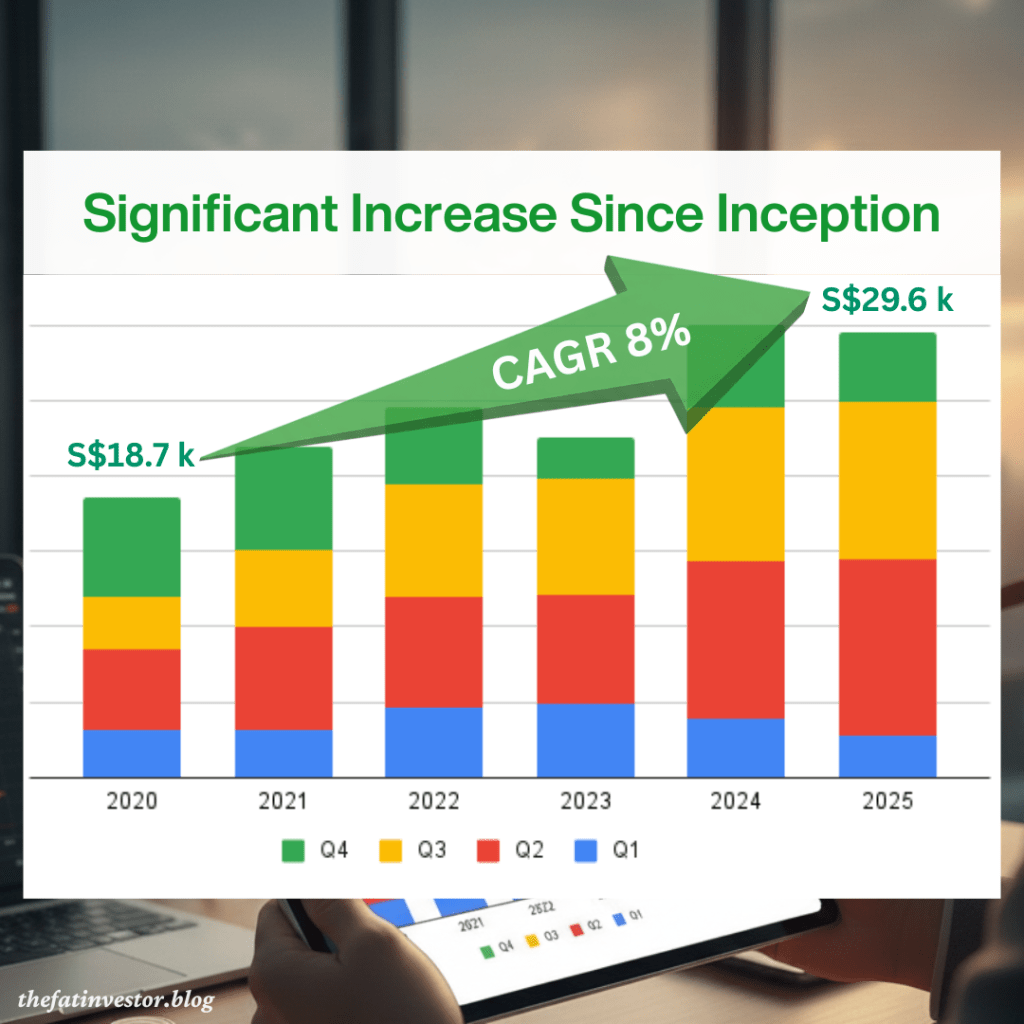

In fact, the portfolio fared better than my projected 5% drop last November, with dividends dipping by just 1.8% from the previous year, totalling approximately S$29,600.

That’s still a significant increase from the S$18,700 dividends when this portfolio incepted in 2020.

Another way to look at this is that I’ve received nearly a total of S$150,000 of passive income over the six years!

The better-than-expected performance this year was the result of a myriad of factors.

Besides the portfolio drawdown and Parkway Life REIT (SGX: C2PU), or PLife, advanced distribution last year, the full divestment of the three Mapletree REITs in May and a lower final dividend from The Hour Glass (SGX: AGS) also contributed to the reduction.

This dip was mitigated, however, by strategic increases in my existing stakes, especially Amova-STC AREIT (SGX: CFA), and higher declared dividends from key counters like DBS Group (SGX: D05), Frasers Centrepoint Trust (SGX: J69U), or FCT, and PLife.

Recovery In Sight: Record Dividends for 2026?

Now that the results for 2025 are on the books, my attention is fully on 2026, where I’m anticipating a higher and possibly record dividend.

Here’s why.

Boosting Income with Recent Purchases

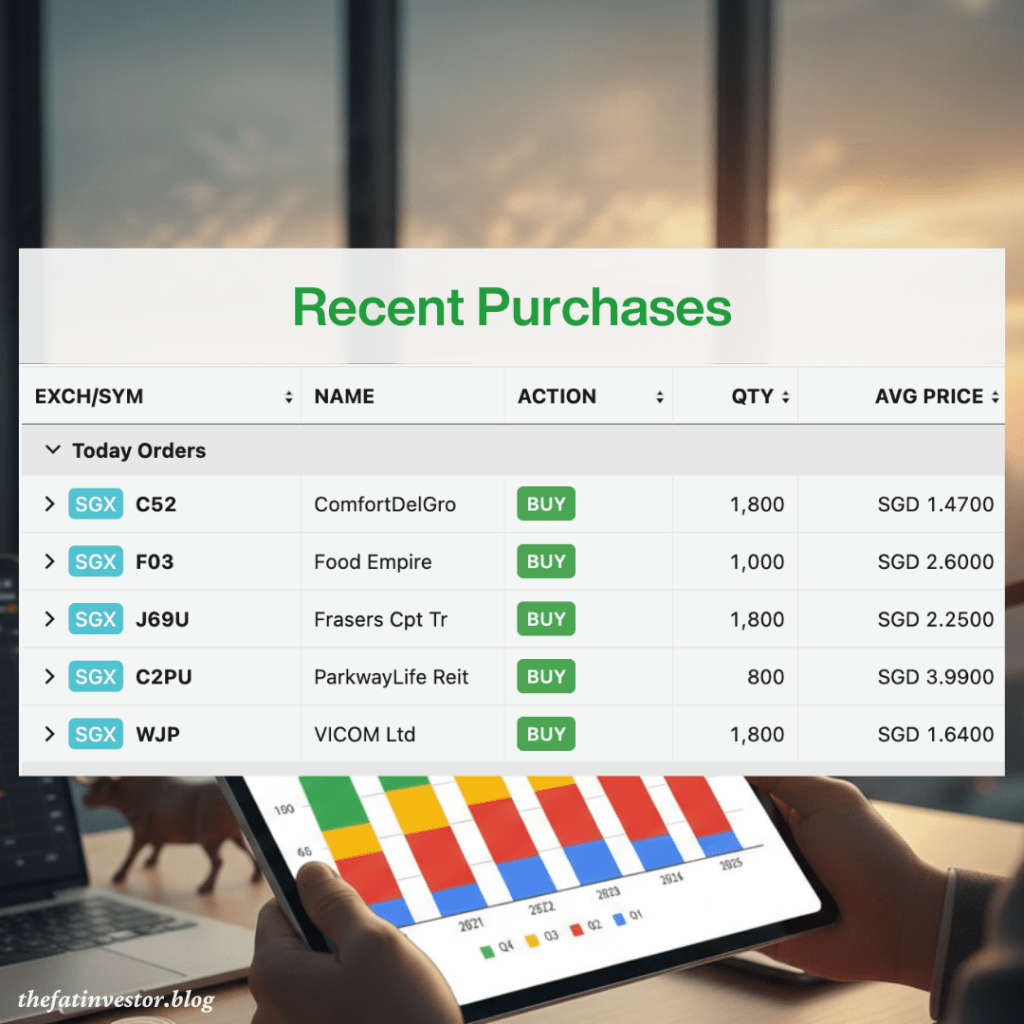

Last month’s US portfolio trim, and this year’s lower-than-expected expenses meant I had spare cash to fund the above purchases on Monday.

Two primary reasons for the stock choices:

- Positive business momentum gave me confidence to beef up the three new and smaller positions of my portfolio: VICOM Ltd (SGX: WJP), ComfortDelGro Corporation (SGX: C52) and Food Empire Holdings (SGX: F03).

- Anticipated increase in Distribution Per Unit (DPU) for the coming years prompted my decision to increase my stakes in two S-REITs: FCT and PLife.

You can read my views on their latest quarterly results in my earlier posts (links at the end of this article).

At this juncture though, I want to share further insights on FCT as I finally heard its 2H 2025 audio cast last week.

Disclaimer: I’m writing these FCT points purely from memory. Please listen to the official audio cast for the most accurate information.

- Full-year Northpoint City South Wing contribution next year, with synergy realisation requiring a longer timeframe.

- Hougang AEI is completing next September, with the upcoming AEI at NEX.

- Seeking alternate tenants for Cathay Cineplexes space. The S$3.3 million in total rental arrears included deposits.

- Average cost of debt could drop to 3.3% to 3.4% level next year.

- Increasing population and Progressive Wage Model would support spending in suburban retail malls.

These positive outlooks provided me the conviction to add on to my stake in FCT.

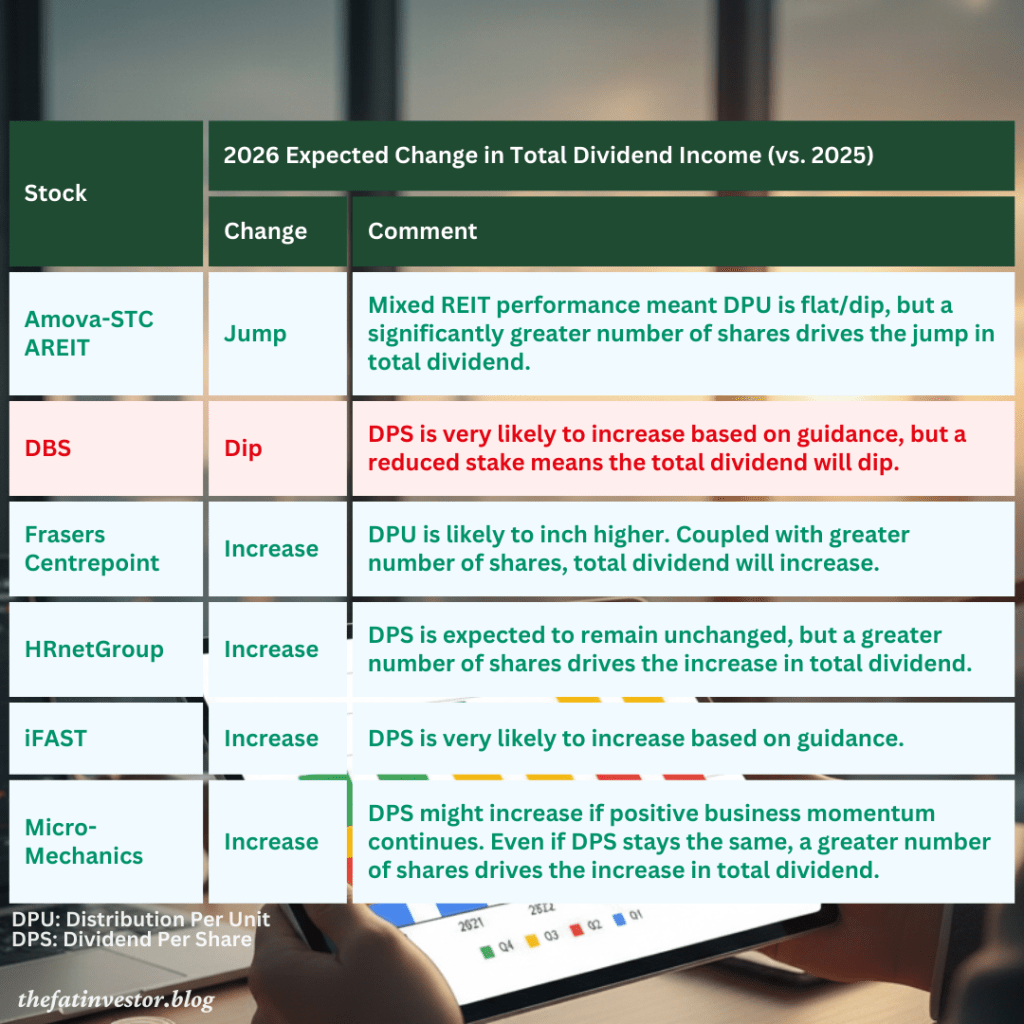

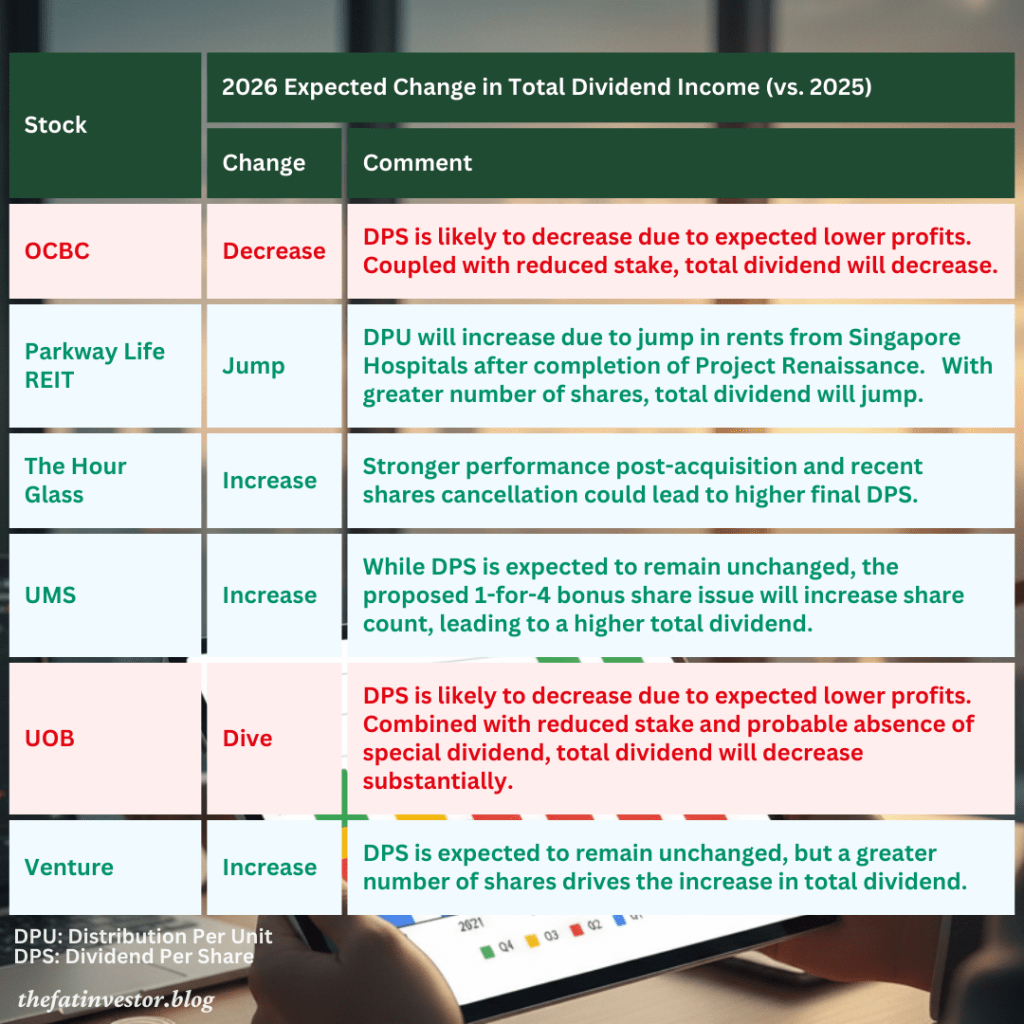

Expected Change in Dividends

Excluding the three new holdings, the following images illustrate my expectation of how the absolute dividends received from the individual stocks next year will change, as compared to 2025.

In essence, I will be collecting less total dividends from the three Singapore banks next year. However, the dividends collected from the remaining stocks will likely exceed this drop.

Obviously, these projections aren’t guaranteed. Barring any drastic events, the companies’ strong track records provide confidence that my estimations won’t be too far off.

Beyond Dividends

As you know, I don’t just invest for dividends, with income counters making up about 60% of my portfolio.

Hence, the yearly variation in dividends doesn’t matter as much to me, especially since I prioritise the strategic allocation of funds between income and growth counters in my portfolio.

This means there is a dynamic transfer of funds between these two segments to take advantage of market volatility.

Ultimately, the portfolio should grow, which would naturally lead to higher dividends over the longer term.

This strategic approach is thus far proving effective for me.

Despite recent market weakness, the portfolio’s year-to-date return still exceeds the 12% return recorded through September.

With just slightly more than a month to the end of the year, it does look like this will be the third consecutive year of double-digit return.

I will share more about my portfolio’s total return towards the end of next month.

Related Posts and Link

My Three “Newcomers” VICOM, ComfortDelgro, Food Empire Nailed 3Q 2025

Parkway Life Record 3Q 2025 DPU Mitigates Rising Insurance Costs?

FCT DPU Only Up by 0.6% in FY2025! Here’s Why

FCT 2H 2025 Presentation Audio Cast

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.