You may recall that I re-invested in these three stocks in the recent months: VICOM Ltd (SGX: WJP), ComfortDelGro Corporation (SGX: C52), or CDG, and Food Empire Holdings (SGX: F03), or FEH.

I’m pleased that the positive business momentum experienced by all three companies continued in the latest quarter.

Here’s what caught my attention for each company.

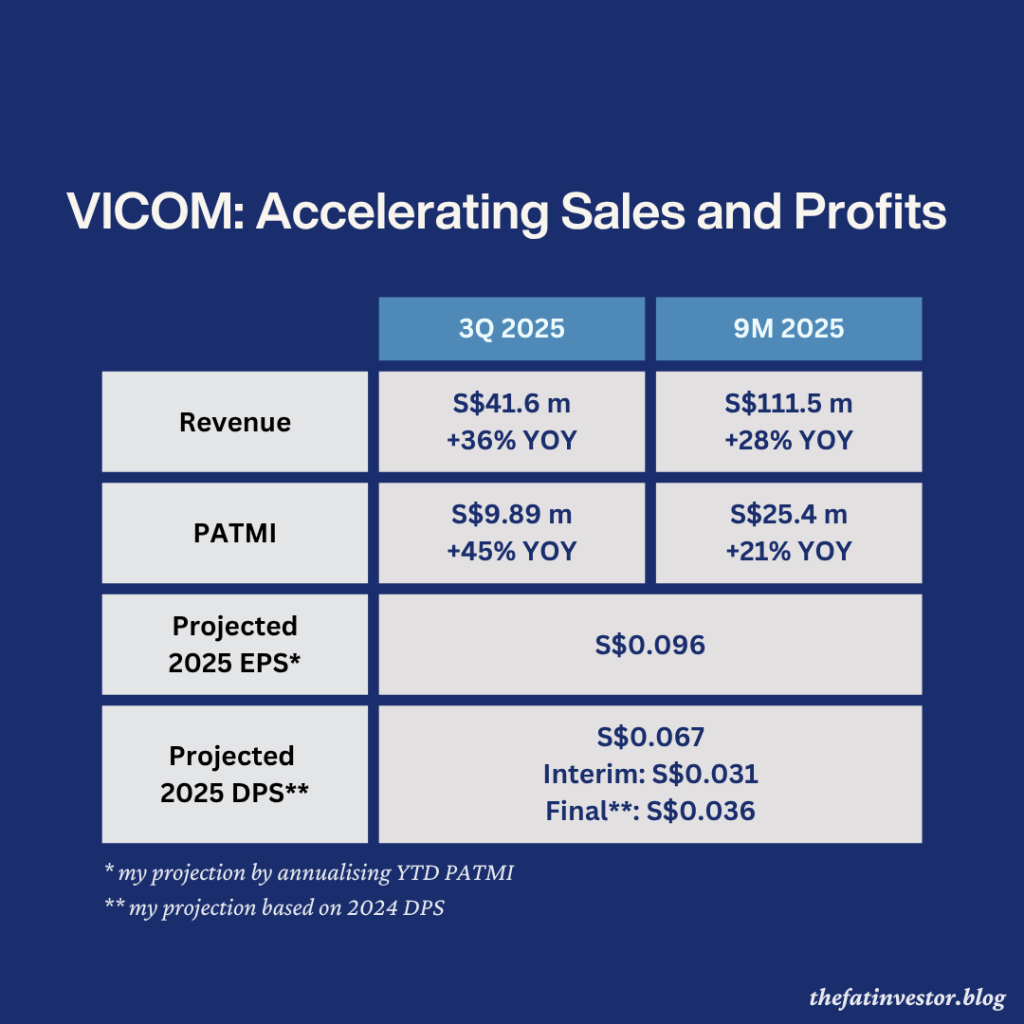

VICOM: Accelerating Sales and Earnings

I’m impressed by the significant jump in both top- and bottom-line figures for the quarter, indicating a strengthening business momentum throughout the year.

| Quarter | Revenue (million) | PATMI (million) | QOQ Growth in PATMI |

| 1Q 2025 | S$33.3 | S$7.5 | — |

| 2Q 2025 | S$36.5 | S$8.1 | 8.0% |

| 3Q 2025 | S$41.6 | S$9.9 | 22.2% |

The S$9.9 million PATMI for 3Q 2025 represents a robust 45% year-on-year (YOY) increase, a much greater growth rate than the 10.2% YOY growth rate achieved in the first half.

While the accelerated installation of On-Board Units significantly boosted revenue, the disproportionately higher YOY PATMI growth for the quarter provides strong evidence of robust underlying demand in the non-vehicle testing segment.

This bodes well for the company’s plan in expanding this segment with new test capabilities when its Jalan Papan Integrated Testing Centre comes online by 1H 2026.

Capital Expenditure and Dividend Outlook

The expansion comes with a significant capital expenditure (CapEx). So far, VICOM has incurred S$25.6 million year-to-date (YTD).

With the previous guidance of an estimated S$50 million in total CapEx for FY 2025, a remaining outlay of about S$24.4 million is expected in 4Q 2025.

More importantly, the strong performance allows VICOM to manage this investment without compromising shareholder returns.

The company’s cash balance of S$42 million, and with another S$10 million of operating cash flow expected in the final quarter, this is more than sufficient to fund the CapEx.

With the 70% dividend payout ratio maintained for the interim dividend, I’m projecting the final dividend to jump 20% YOY to S$0.036.

Together with the interim dividend of S$0.031, the recent price of S$1.64 provides a decent yield of around 4%.

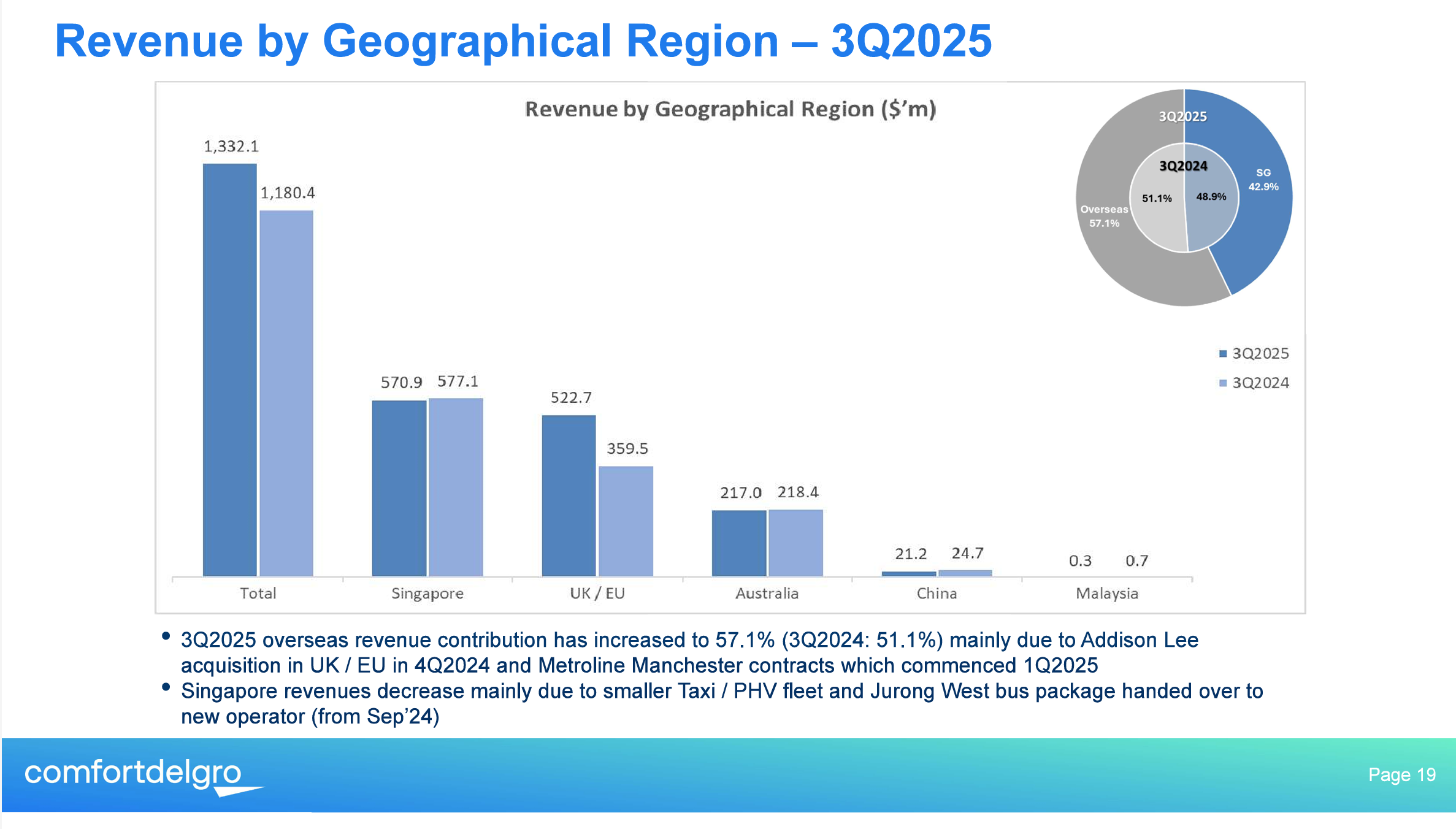

ComfortDelgro: Steady Growth

CDG, VICOM’s parent company, also reported a strong set of earnings.

As mentioned in my earlier post, compared to VICOM, CDG has a lot more moving parts that can cut both ways. For this quarter, however, its diverse business model, including overseas businesses, truly worked to its benefit.

Despite the drop in revenue (2.4% YOY) and net profit (20.6% YOY) for the quarter by its significant subsidiary SBS Transit (SGX: S58), CDG still managed to post a robust growth in its revenue and profits over the previous year.

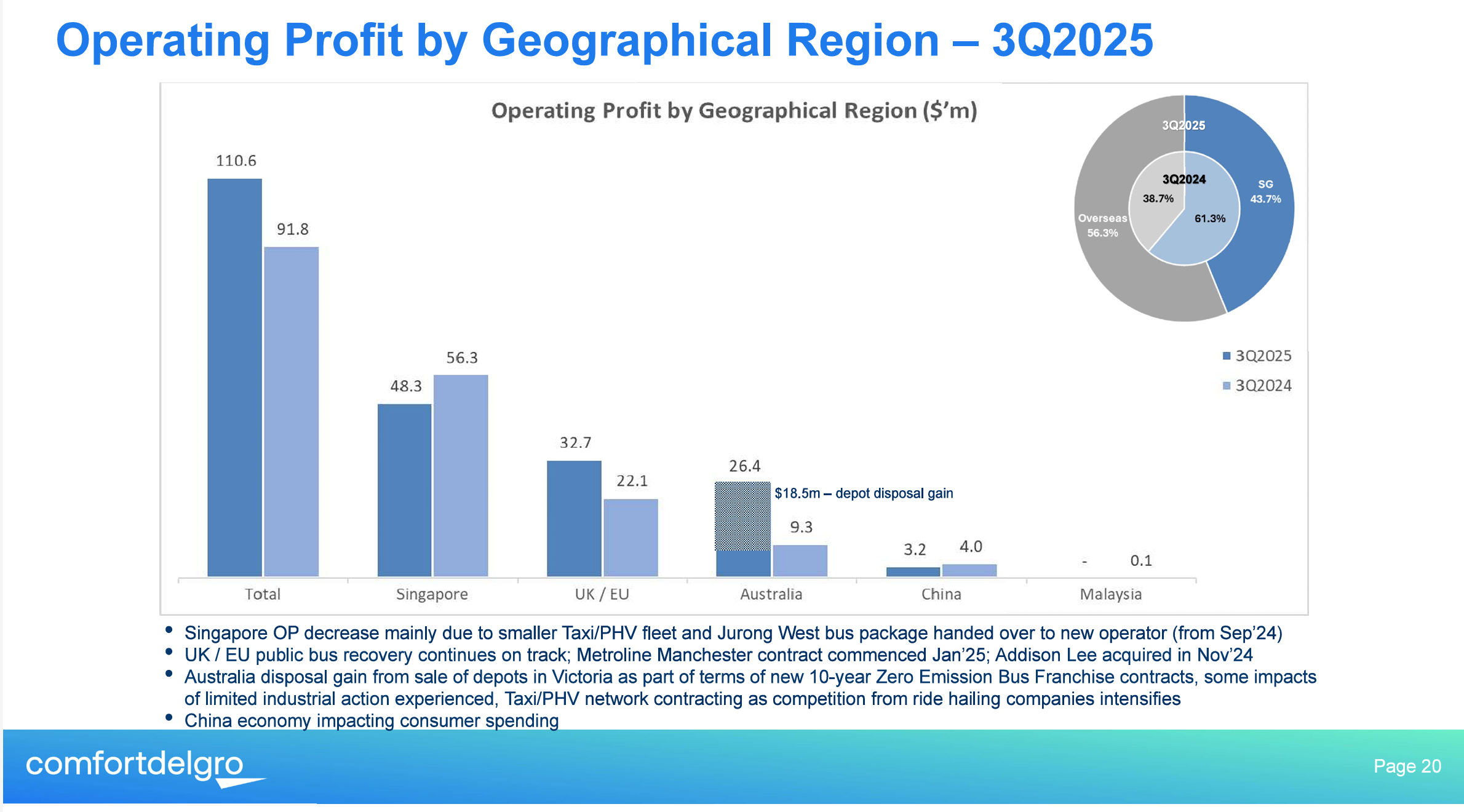

Overseas Operations Cushioned Domestic Headwinds

As shown in the above images, the growth in CDG’s overseas operations due to favourable contract terms, stronger overseas operating margins, and accretive acquisitions (like Addison Lee) was able to cushion and significantly overcome the impact of domestic headwinds in Singapore.

Even if the one-off depot disposal gain in Australia is stripped off, CDG will still see a slight increase in 3Q 2025 operating profit.

More importantly, the impact of this disposal gain is a lot less significant when viewing the YTD operating profit.

Stripping out the one-off gain from both years, CDG’s YTD operating profit would have increased by a healthy 12.9% YOY, showcasing the strength of its core global operations.

Annualising its YTD PATMI and using its recent 80% dividend payout ratio as a guide, I’m projecting a final dividend of S$0.0473.

Together with the interim dividend of S$0.0391, the recent price of S$1.46 provides an attractive yield of nearly 6%!

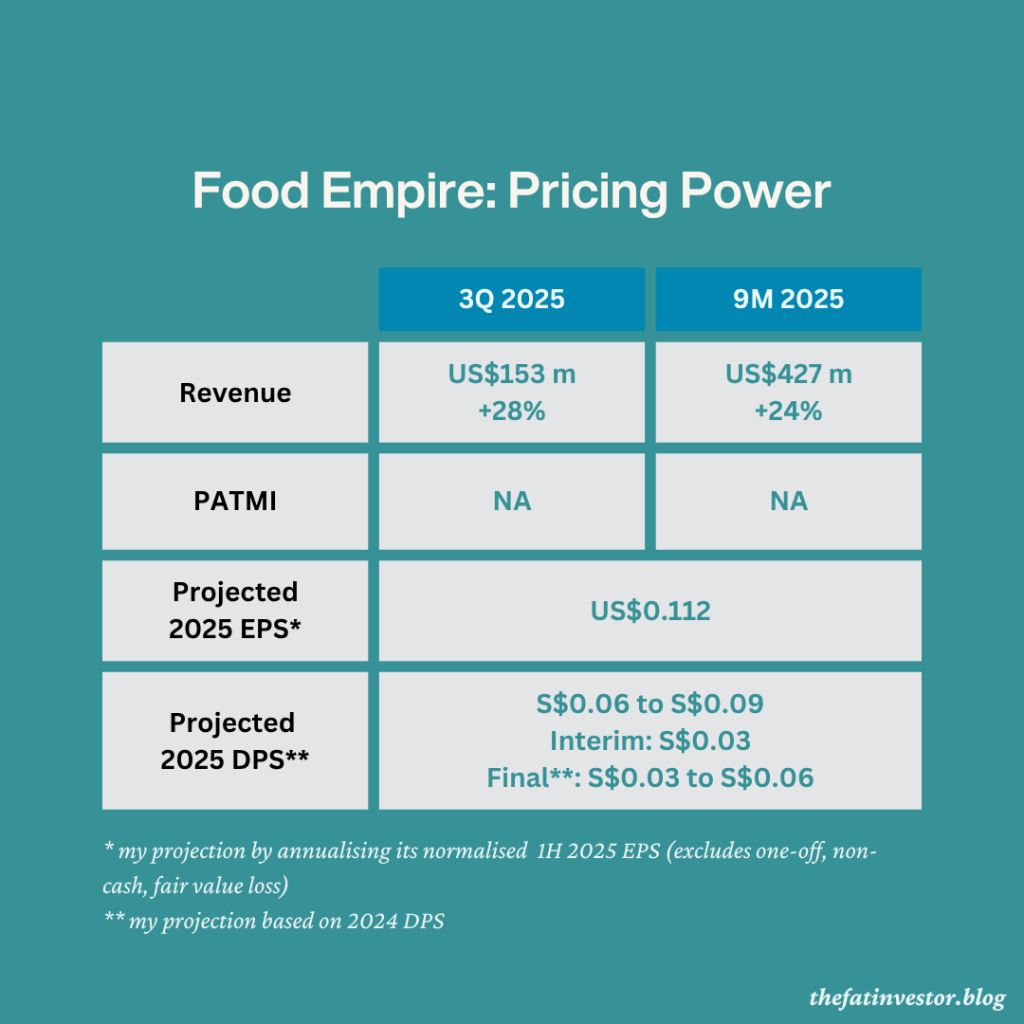

Food Empire: Pricing Power

FEH reported exceptionally strong Year-over-Year (YOY) sales growth of 28% for 3Q 2025, surpassing the already robust 1H 2025 YOY growth of 22%.

This acceleration was primarily driven by the surge in quarterly revenue from the critical CIS region:

- Russia: 48.8% YOY increase

- Ukraine, Kazakhstan, and CIS: 39.2% YOY increase

Management attributed this growth to both an increase in volume and sustained price gains. This is a clear indication of the pricing power and strong brand loyalty commanded by FEH’s flagship MacCoffee instant coffee brand in these regions.

Despite the competitive landscape for instant beverages, years of branding effort and tailored consumer taste development provide a strong moat for the company’s products.

Talking about consumer taste, I can use myself as an example here.

With the increase in Nescafe’s instant coffee price in recent years, I’ve attempted to switch to other brands, including house brands which are at least 25% cheaper.

However, they just don’t satisfy my palate.

In the end, I’m resigned to paying a higher price for my daily cup of Nescafe. It’s that taste consistency that locks me in.

While my personal experience is anecdotal, I believe this is a key reason for MacCoffee’s dominance in Russia and CIS regions.

This same brand power gives me optimism for its effort with CaféPHỐ in Vietnam.

The success there is visible, generating a 29.3% increase in sales to US$73.5 million for 9M 2025, which means the company has established a footing in a huge and growing market.

I could be wrong, but I think the slower quarterly growth in the overall Southeast Asia (SEA) segment (12.5% YOY vs 1H 2025 25.3% YOY), which is also seen in its South Asia’s market, is likely related to its ingredients business.

I don’t think that there’s a lack of demand.

More likely, it’s just about reaching optimal capacity in its India plants and the phasing in of the utilisation of its expanded NDC facilities in Malaysia.

This temporary capacity constraint is precisely why future growth looks visible:

- A new coffee-mix manufacturing facility in Kazakhstan (Central Asia) by end 2025.

- A new freeze-dried soluble coffee manufacturing facility in Vietnam by 2028.

Dividend Outlook

With the strong performance exhibited this year, FEH should have no issue maintaining or increasing its final ordinary dividend.

However, given that it already distributed its first-ever interim ordinary dividend of S$0.03, and faces hefty CapEx for the following few years (though largely funded by recent placements and notes), I’m unsure how management and the board will factor these in.

Putting myself in their shoes, I see three possible scenarios for the final ordinary dividend per share:

- S$0.03: Maintains the total ordinary dividend at S$0.06 per share (S$0.03 interim + S$0.03 final), signalling extreme conservatism despite record profit.

- S$0.05: The total ordinary dividend increases to S$0.08 (S$0.03 interim + S$0.05 final), effectively maintaining the total payout seen in FY2024 (S$0.08) but substituting the special dividend for a higher ordinary payout.

- S$0.06: The total ordinary dividend increases to S$0.09 (S$0.03 interim + S$0.06 final), showing high confidence by matching last year’s ordinary final amount.

This translates to a decent yield of 2.3% to 3.4% for a company with a visible, multi-year growth path.

A Good Start with Potential Upside

I’m definitely pleased with the performance exhibited by these “new” stocks in my portfolio. My perception is that in near-term, all three will continue to grow at respectable rates, and hence I’ve just increased my stake in them.

I will share more detail of my purchases in an upcoming post.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.