When I last wrote about the three banks DBS Group (SGX: D05), OCBC Ltd (SGX: O39), and United Overseas Bank Ltd (SGX: U11) in March, I questioned if the valuation risks have become too high from the soaring prices.

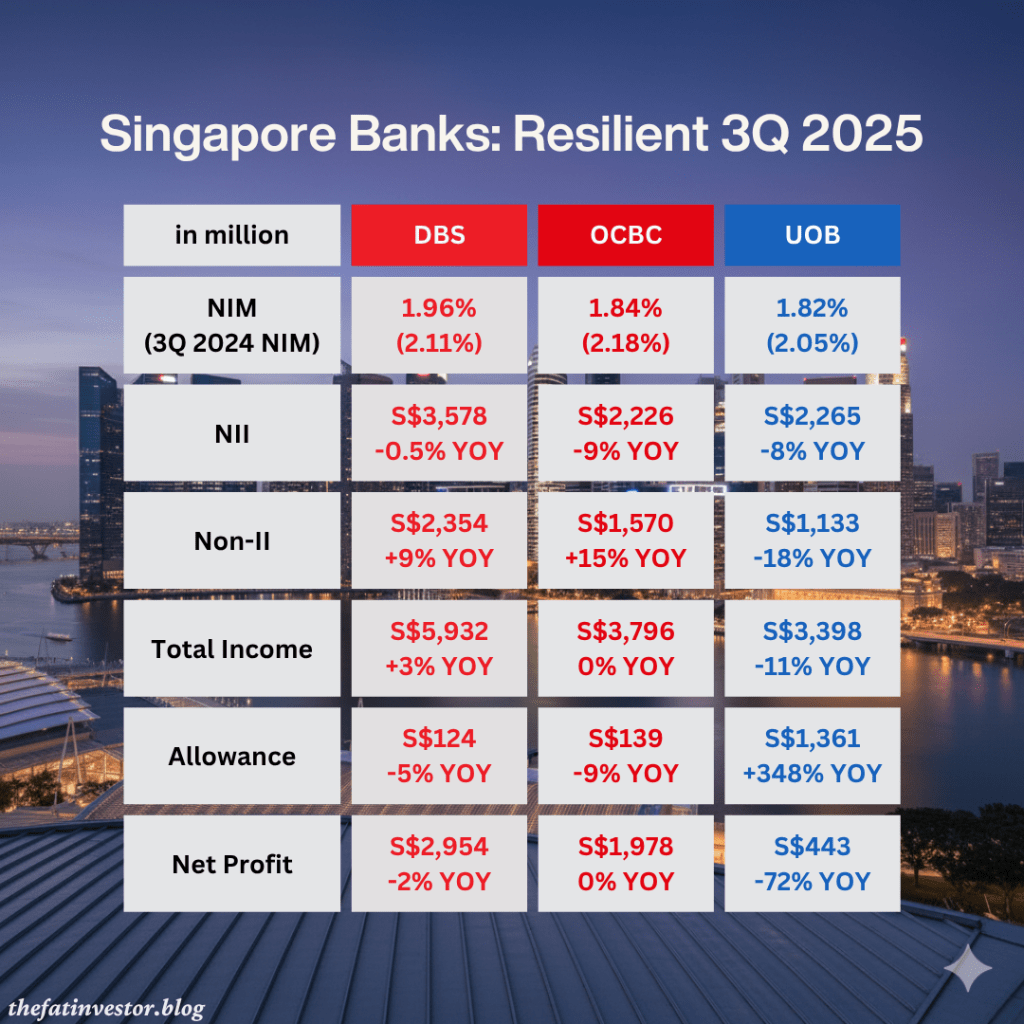

Three quarters of FY2025 have passed, and despite the heightened uncertainties and reduced Net Interest Margin (NIM), the three banks continue to deliver resilient performances.

Instead of rehashing their full performance summaries for 3Q FY2025, I will highlight the most notable differences observed after comparing some of their key metrics.

DBS Outperformance in Net Interest Income (NII)

One must credit the DBS team for achieving a relatively similar NII compared to the previous year, despite the prevailing lower NIM environment.

DBS’s successful strategy in hedging its balance sheet resulted in the smallest drop in its NIM of just 15 basis points YOY.

Coupled with robust deposit volume growth from a larger base, DBS managed to nearly maintain its NII momentum, contrasting sharply with the 8% to 9% NII drop experienced by UOB and OCBC respectively.

OCBC Diversified Non-Interest Income (Non-II) Engine

While DBS showcased resilience in its NII, OCBC Bank’s performance highlights the critical role of diversification in insulating total income.

Despite registering a 9% decline in NII, OCBC successfully cushioned this impact with a 15% surge in overall Non-II YOY, reaching a record S$1.57 billion.

This strength was broad-based, driven by robust fee, trading, and insurance income.

The star performer was the wealth management franchise, where net fee income jumped by a significant 34% as a result of strong customer activities across private banking and premier segments.

This powerful Non-II engine allowed OCBC’s net profit to remain virtually unchanged YOY, underscoring the success of its multi-pillar strategy in navigating the softening interest rate environment.

UOB Non-II Requires Closer Look

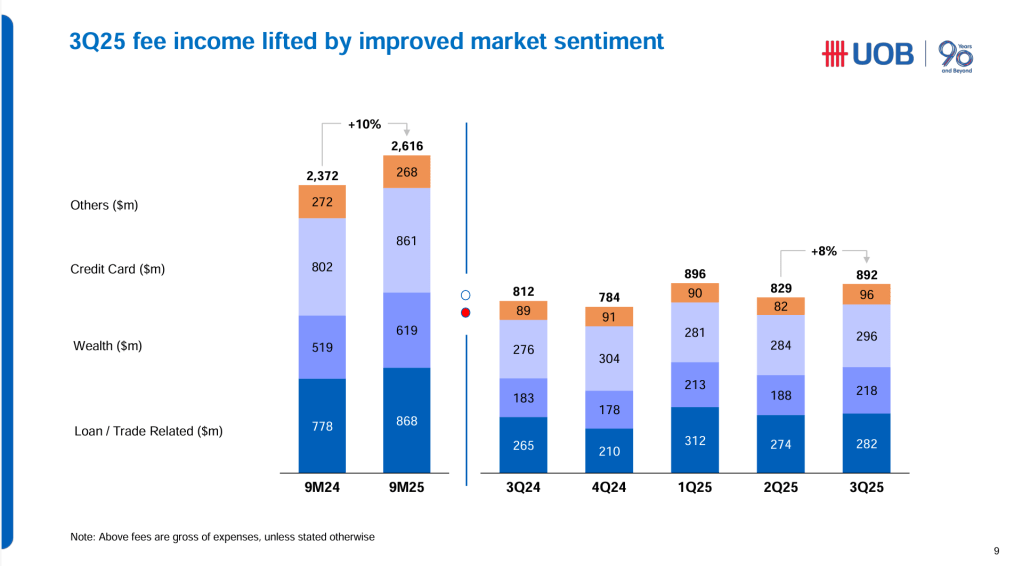

The headline news focused on UOB’s one-off, pre-emptive general allowance for the quarter, but I was more concerned about the substantial decline in its Non-II.

This downturn was unexpected, especially considering that Non-II had increased by more than 6% in 1H FY2025, and both DBS and OCBC reported strong growth in this segment for the quarter.

Specifically, UOB’s Net Fee Income eased by 2% YOY to S$615 million, which seemed contradictory given that the bank reported strong Gross Fee Income of S$892 million (nearly 10% YOY).

Thanks for Jun Yuan (The Singaporean Investor) for sharing the bank’s responses to his queries, the drop in Net Fees Income is due to a surge in rewards redemption, particularly in Thailand.

More importantly, it’s a transitional effect tied to the Citi integration process.

While that explanation is accepted, I was curious about how UOB’s operating income would have fared for the quarter if these anomalies were normalised.

Therefore, I modelled a hypothetical scenario with the following adjustments:

- Decreased 3Q FY2024 trading income by S$222 million (to normalize against last year’s record high).

- Increased Net Fee Income to around S$662 million, assuming a modest 6% YOY growth (similar to 1H 2025).

Based on these parameters, UOB’s operating income would drop by a low single digit YOY.

This scenario suggests a much better underlying performance than the reported 18% drop, but it remains weaker than the other two banks’ overall performances for this quarter.

Citi Integration Requires More Time for Synergy Extraction

It does appear to me that the synergy extraction phase, from the integration of Citi Malaysia, Thailand, Indonesia, and Vietnam, is proving more challenging than initially anticipated.

However, this short-term pressure does not detract from the massive long-term potential for UOB, given its significantly expanded footprint.

While I’m disappointed with this quarter’s results, I remain hopeful that the acquisition will be the catalyst for its growth in the coming years.

Staying Vested

With interest rates continuing to decline, pressure will remain on all three banks’ NIM and NII.

This quarter, however, has already demonstrated their capability to manage these challenges effectively.

Unless the amount and rate of interest rate drops increase significantly, I believe that all three banks can continue to stay resilient.

Having trimmed my holdings in September, I intend to hold on to my current stake.

Related Posts

What’s Up? AEM Surged 18% and Trimmed Stakes in Singapore Banks

Is It Still A Good Time to Buy Singapore Banks? (The Smart Investor)

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.