Hitting the next age band, my private hospitalisation insurance premium jumped significantly this year. As a result, the cash outlay for my hospitalisation plan almost doubled!

I’m still considering when I would downgrade my plan, but meanwhile, the increasing distribution per unit (DPU) from Parkway Life REIT (SGX: C2PU), or PLife, helps to mitigate the rising cost.

In the latest 3Q 2025 business update, PLife posted a 8.1% year-on-year (YOY) growth in its year-to-date (YTD) Net Property Income (NPI) to S$111 million.

After the various trust expenses, finance costs and distribution adjustments, YTD Distributable Income (DI) and DPU increased to S$75.4 million (10.4% YOY) and S$0.1156 (2.3% YOY) respectively.

While the YTD numbers are strong, the underlying quarterly performance gives even more reason for optimism.

Higher DPU Growth for 2H 2025?

As you can see from the above table, DPU for 3Q 2025 actually grew by 4%, a higher growth compared to the previous quarter.

While DPU varies slightly quarter from quarter, likely due to forex and mitigated by the net income hedges, I’m quietly confident that DPU for 4Q 2025 should hit at least S$0.038, 5% higher YOY.

Barring any unforeseen circumstances, FY 2025 DPU will be around S$0.154 and about 3% higher than the last year.

A 3% growth is downright boring, but context matters.

Firstly, you have to remember that this is a S-REIT, and not a growth stock. Therefore, the primary investment purpose is to receive stable and steadily increasing income.

It’s like you don’t buy a defender and expect it to be your team’s top goal scorer. Occasionally, he might contribute a goal or two, but his main role in the team is to defend against onslaught from the opposition.

And in that sense, PLife has demonstrated that it is a top-notch defender.

Although its DPU only grew at a compounded annual rate of 2% in the last five years (FY 2020 to FY 2024), this is achieved during a period of heightened geopolitical uncertainties.

Like other S-REITs, it is negatively impacted by the rising interest rates and strengthening of Singapore Dollars (SGD) against other currencies.

And while other S-REITs with foreign properties falter, PLife still grew its DPU.

The performance is even more amazing if you consider that JPY has depreciated by more than 40% during this period!

That’s why PLife has always traded at a premium.

At yesterday’s closing price of S$4.05, the expected DPU of S$0.154 for this year only translates to a dividend yield of 3.8%.

However, that still compares favourably to the average 10-year interest rate of 1.85% for the latest issue of Singapore Savings Bonds (SSB). It’s even more compelling as SSB’s first year interest will be a mere 1.35%.

Of course, it’s crucial to remember that both the invested principal and DPU are not guaranteed.

But given its track record, it is an investment worth considering, especially with the anticipated jump in DPU next year.

The FY2026 Catalyst: Will DPU Hit S$0.18?

Started in 2023, Project Renaissance — the S$350 million renewal project for Mount Elizabeth Hospital, will come to a completion this year.

Based on the Pro Forma illustration, DPU would hit S$0.1826 at the end of Year 4 of the renewal term, 27.6% higher than FY 2020 DPU of S$0.1379.

However, the illustration was done four years ago.

Since then, cost of debt has ballooned from 0.52% in FY 2021 to the current 1.57%. As a result, year to date’s finance cost (S$10.3 million) is already nearly double that of FY 2021 (S$5.2 million).

Not forgetting, the share count has increased by about 8% to the current 652 million, after the equity fund raising exercise last year.

So will the Pro Forma figure still hold?

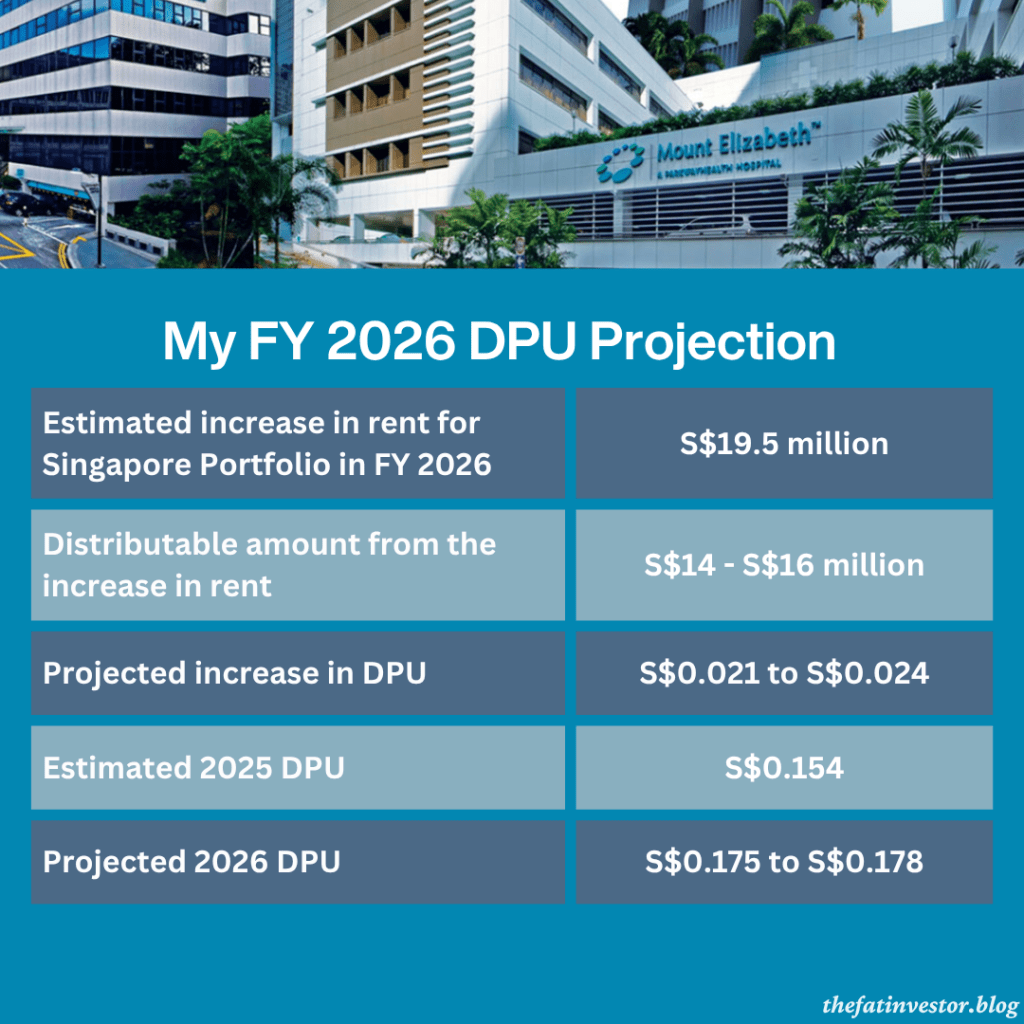

I decided to do a rough projection based on the latest information available.

Among the data given in Pro Forma, the rent payable should be fairly accurate. So I take it that the increase in rent for Singapore hospitals will S$19.5 million in FY 2026.

What is harder to determine is how much would this flow through to the DI.

From this year’s figures, DI is around 64% of total revenue.

But the new S$19.5 million rent jump from the Singapore hospitals is a pure revenue gain.

Since the expenses, such as the higher finance costs and any currency impact (forex) on the Japanese properties, are already accounted for, a much larger proportion of this specific rent increase will flow straight to DI.

Moreover, given the hospital leases are structured so that many of the property costs are borne by the tenant, I estimate a higher flow-through rate of about 70% to 80% on the new Singapore rent.

My back-of-the-envelope projection, after factoring in the enlarged share count, says that FY 2026 DPU will be north of S$0.175, which translates to a yield of at least 4.3%.

That’s a good spread for me, not only over the SSB but also the CPF-OA interest of 2.5%.

Buy, Hold or Sell?

I’ve invested in PLife for more than a decade.

Its steady performance and my familiarity with its management’s approach means I’m unlikely to sell. However, given that it’s already among my top five holdings, I’m in no hurry to add either.

In the meantime, I think it’s more meaningful for me to deliberate on my decision to downgrade my private hospitalisation plan, or maybe just drop the rider.

Alternatively, I’ll keep an eye out for news on Minister Ong’s suggested lower-tier rider, a topic he discussed in a recent interview.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.