The three tech titans in my portfolio: Alphabet (NASDAQ: GOOGL), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT) reported their latest quarterly earnings last week.

All three beat consensus on both revenue and profit, with positive momentum into the next quarter.

For this article, however, I’ll focus on the two with significant AI exposure in their core businesses: Alphabet and Microsoft.

Based on current performance and valuation, I’m interested in determining which of the two is a better buy.

Let’s jump straight into the comparison.

Revenue and Earnings: The Consistency vs. Surge Debate

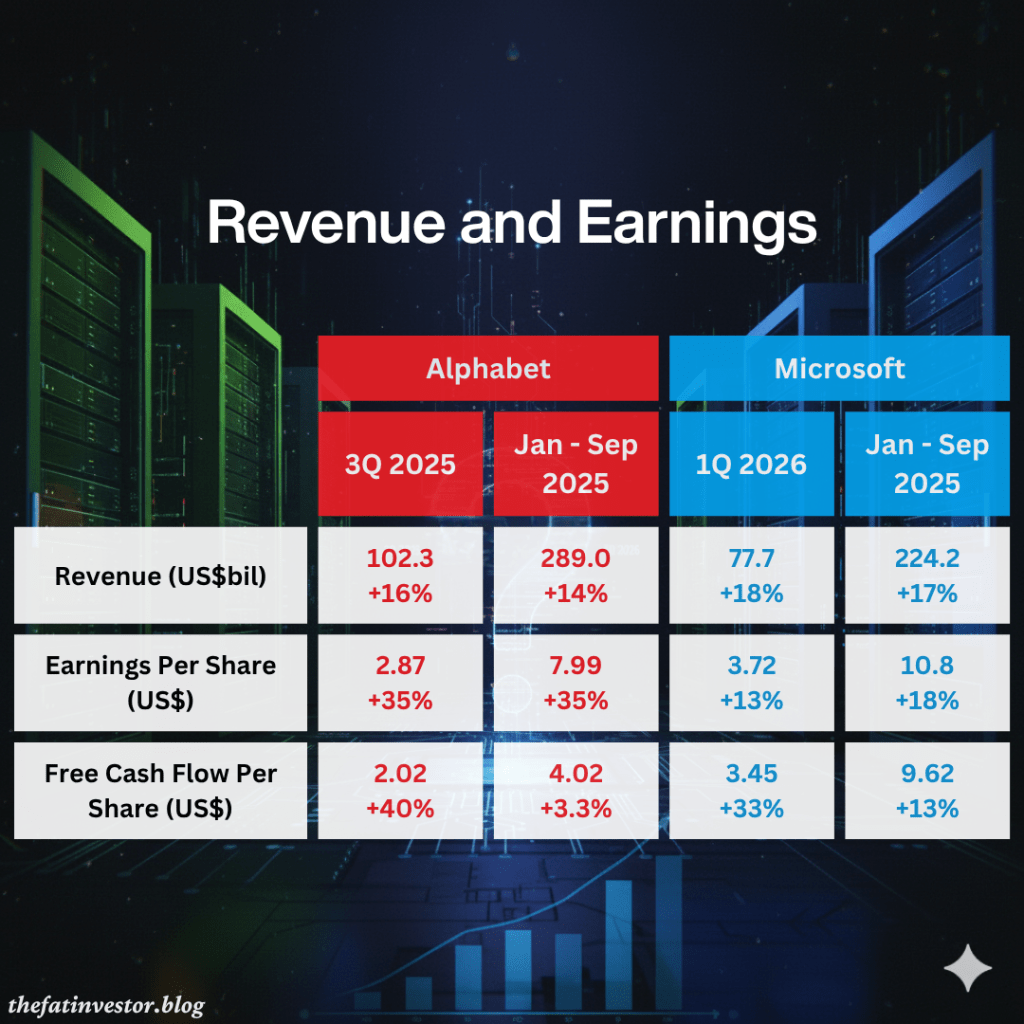

Buoyed by the increased demand for AI infrastructure and services, both Alphabet and Microsoft posted an acceleration in revenue growth for the latest quarter.

Although Alphabet’s revenue growth rate is lower than Microsoft’s, it achieved its first US$100 billion quarter, a result that is significantly higher than Microsoft’s scale.

On first look, it might seem Alphabet beat Microsoft hands down in the earnings per share (EPS) growth rate.

A 35% year-on-year (YOY) increase is amazing, especially when it does not just occur only in this quarter, but for the full nine months this year.

However, the growth wasn’t purely operational. Part of it came from massive market appreciation of Alphabet’s portfolio of private investments.

Microsoft, on the other hand, shows better consistency in managing its capital, with more of its earnings converted to FCF over the past nine months.

What stands out, however, is the surge in Alphabet’s FCF for the latest quarter, which I’ll discuss later in the Capital Expenditure (CapEx) section.

While I’m excited about Alphabet’s performance in the latest quarter, Microsoft wins due to the consistency of its sales and profit growth.

The Cloud Battle: Diverse Moat vs. Dominant Ad Engine

Google Search & Others continues to defy market talk of being disrupted and grew almost 15% year-on-year (YOY) to more than US$56 billion for the quarter.

Together with YouTube ads and Google Network, Google advertising continues to contribute to the bulk (~73%) of the total revenue, but dipped slightly as compared to previous year (~76%).

Growing at 34% YOY to US$15 billion for the quarter, Google Cloud is clearly the key driver of Alphabet’s next phase of growth.

Microsoft though continues to maintain a commanding lead over Alphabet in this segment. With Azure blazing at 40% YOY, Intelligent Cloud grew 28% YOY to US$31 billion in the same period.

Moreover, unlike Alphabet, where its sales still came mainly from Google advertising, Microsoft sees a more diverse contribution from its three main segments.

- Productivity and Business Processes: 42%

- Intelligent Cloud: 40%

- More Personal Computing: 18%

Microsoft wins for its diverse sales contribution and continued robust growth.

AI Infrastructure: Google’s Vertical Edge in CapEx

As mentioned earlier, Alphabet experienced a surge in its FCF to US$25.0 billion for 3Q 2025, which is a significant increase from US$13.7 billion in the previous quarter.

This surge is impressive, especially when you consider that CapEx has continued to increase in this quarter.

While you can argue that this quarter’s OCF included a one-off cash tax benefit, the underlying operational strength (steady growth in ad, strong growth in GC, and operating leverage) suggests that going forward, OCF should be at least US$40 billion per quarter.

This would enable Alphabet to internally fund its accelerating CapEx to fulfil the increasing demand of Google Cloud Platform (GCP).

Microsoft is also seeing an increase in OCF, but the growth rate is not as high as Alphabet’s

Its CapEx appeared to be more measured than Alphabet.

While this might be intended, I opine that Microsoft’s reliance on NVIDIA‘s (NASDAQ: NVDA) Graphics Processing Unit (GPU) and the OpenAI model creates a margin and strategic dependency.

This dependence may result in a higher long-term cost per inference/training and lower potential cloud margins compared to Google.

In comparison, Alphabet with its own Tensor Processing Unit (TPU) and AI model Gemini, allows it to scale up its CapEx with greater efficiency and strategic flexibility.

This vertical integration suggests a lower cost structure for AI training and inference.

This proprietary advantage is likely to play out more going forward — Alphabet wins.

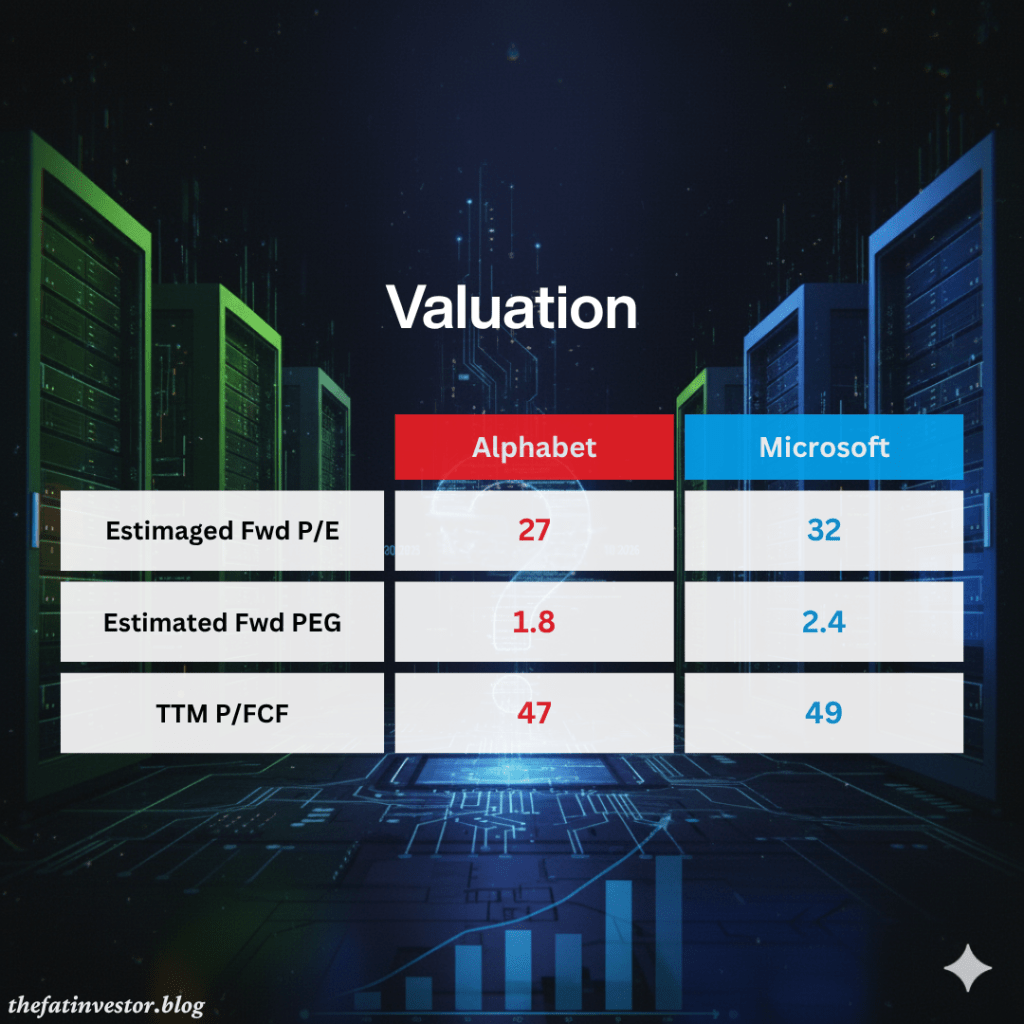

The Growth Premium: P/FCF at 50x and the Value Play

There’s no doubt that both are great companies to have a stake in.

However, the question remains whether the market is offering a good price for these quality products.

It’s like asking: While the iPhone 17 Pro is a top-of-the-range product, would you pay S$5,000 for it?

Alphabet is clearly trading at a much lower forward P/E and PEG ratios than Microsoft.

The market could have provided a premium to Microsoft for its consistency and greater near-term revenue visibility.

It might also simply be due to anchoring bias, as Alphabet’s current price of US$281 is nearly double of its 52-week low of US$142, and the market could find it psychologically hard to push the price higher.

Considering the massive and accelerating CapEx, both Alphabet and Microsoft are trading at a much higher P/FCF than their historical averages.

At nearly 50x, it’s a real premium that you’ll be paying for their future long-term growth. However, this high P/FCF is a direct result of the heavy AI CapEx.

Given Google’s TPU advantage, the market may eventually re-rate Alphabet, expecting its custom silicon to drive a faster return from its CapEx, thus making its current valuation more compelling than Microsoft’s.

My vote goes to Alphabet for its relatively cheaper valuation and potential CapEx advantage.

Verdict: Consistency or Strategic Efficiency?

It really depends on what you prefer.

Microsoft provides better consistency, higher revenue diversity, and greater near-term earnings visibility.

Whereas Alphabet wins on value and strategic efficiency. Its vertical integration with TPU/Gemini is a powerful, proprietary advantage that promises better operating leverage over the long-term.

Me?

I’ve always preferred Alphabet for a non-logical reason: I use many of its products and none of Microsoft’s.

More importantly, Alphabet was trading at a larger discount in recent years due to the fear of AI disruption and US antitrust case against its search engine and search advertising markets.

That provided me the opportunities to accumulate its shares over the past two years, ranging from US$138 to US$188.

I’m not adding to either position. In fact, considering the overall portfolio allocation, I might consider further trimming my positions if market stay elevated by the end of this year.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.