While strong performance was anticipated for iFAST Corporation (SGX: AIY) in the second half of FY2025, its latest 3Q 2025 results were exceptional and significantly exceeded expectations.

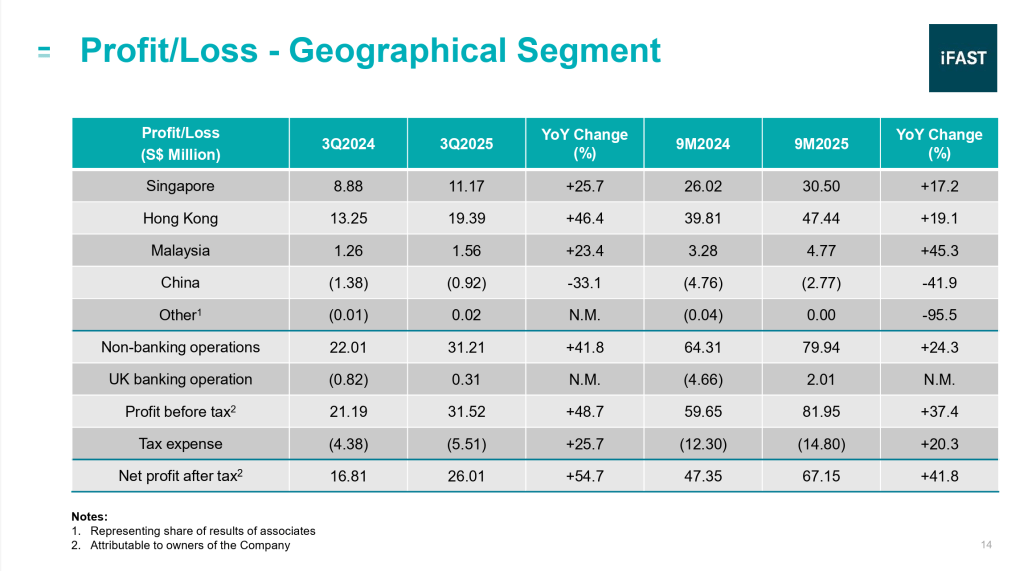

Revenue for the quarter grew a robust 37% year-on-year (YOY) to S$135.8 million, and net profit surged 54.7% to S$26.0 million for the same period.

The growth was comprehensive.

Besides the anticipated increased contribution from the Hong Kong ePension business, the core wealth management platform continued its strong momentum.

Singapore, iFAST’s core market, demonstrated clear acceleration, posting a surprisingly strong 26% YOY increase in profit (PBT) to over S$11 million. This is double the growth rate shown in 1H 2025, suggesting deep underlying momentum in the wealth platform.

This all-round robust performance propelled the group’s Assets Under Administration (AUA) to a record S$30.62 billion as of 3Q 2025, an impressive 29.6% increase over the previous year.

AUA is highly likely to surpass S$32 billion by the end of the year.

To reach the ambitious S$100 billion target by 2030 from this projected close, iFAST’s AUA will need to maintain a demanding Compound Annual Growth Rate (CAGR) of over 25% for the next five years.

While the latest quarterly AUA growth of nearly 30% indicates strong potential, sustaining the required 25% CAGR is a tall order, especially in today’s environment of heightened uncertainties.

For comparison, the average growth rate from FY2020 (AUA S$14.5 billion) to the projected FY2025 (AUA S$32 billion) is a more modest 17%.

It’s not mission impossible though.

iFAST’s current structure includes powerful new growth engines that were not present five years ago.

These new pillars are what make the S$100 billion target achievable.

HK ePension Business: New opportunities

While the Hong Kong ePension Project (eMPF) is not a direct contributor to the group’s AUA, its immense strategic importance lies in the new regional opportunities it unlocks for iFAST in the wider ePension business.

A direct benefit of this expertise is the advancement of the ORSO ePension Services.

This one-stop digital pension solution, designed for Hong Kong Occupational Retirement Schemes Ordinance (ORSO) Pension schemes, is now anticipated to begin contributing to the group in early 2026.

Furthermore, iFAST is also making initial progress with the Macau pension project, indicating a broader regional expansion of its pension technology and services.

Beyond these direct financial contributions, I believe iFAST’s presence in the regional ePension business is likely to generate a positive spillover effect on its existing Hong Kong wealth management business, enhancing trust and attracting new clients.

iFAST Global Bank: Planting the seeds

The key to the next stage of growth though must be iFAST Global Bank (iGB), and its recent results reflect the investment being poured into it.

While iGB’s profit decreased quarter-on-quarter (QOQ) for the second consecutive quarter, settling at S$0.31 million, the management attributed this to a moderation in non-interest commission and fee income.

I am not overly concerned by this short-term moderation, as the long-term growth potential remains huge, evidenced by several positive indicators:

- Robust Customer Deposits: The total customer deposit amount continues its strong trajectory, increasing at a rapid pace (93% YOY and 7.1% QOQ) to reach S$1.55 billion for the quarter.

- Expansion of Services: Key initiatives are launching, including the widening of iFAST payment capabilities like iFAST Bridge (for seamless fund transfers within the ecosystem) and the recent launch of the Commercial Banking division this August.

It’s still very early days for iGB.

If iFAST continues to execute well, these new initiatives are expected to drive substantial growth in the bank’s services, which will ultimately boost the group’s net inflows and profitability in the coming years.

Net Inflows: Bridging the Gap to S$100 Billion

The strong 3Q2025 results are a direct reflection of impressive client acquisition, fueling robust net inflows.

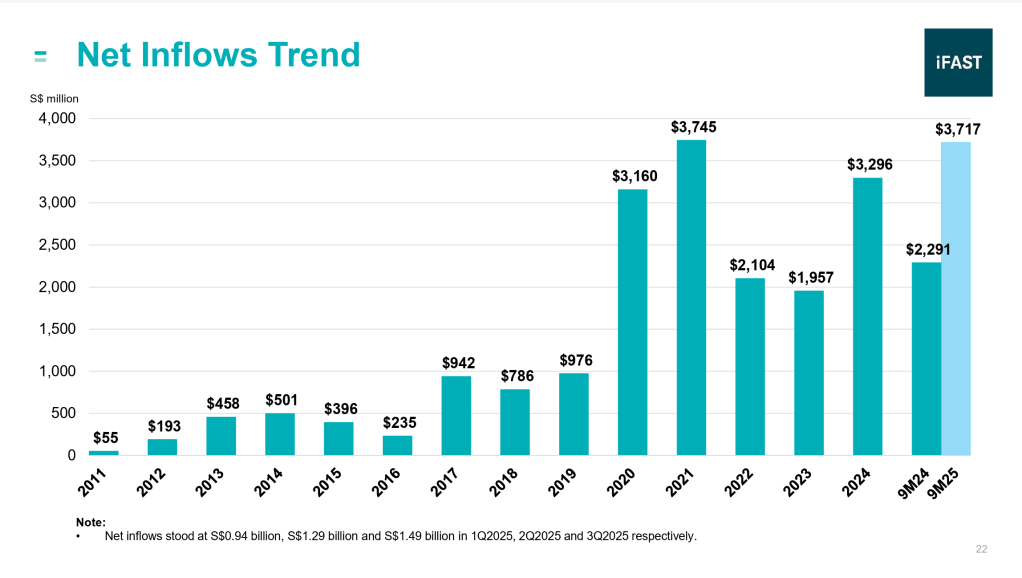

As the chart clearly illustrates, the Group is experiencing a significant uplift.

For the first nine months of 2025, net inflows have already reached S$3.7 billion, significantly surpassing the full-year FY2024 contribution of S$3.3 billion and nearly matching the record high in FY2021.

It’s important to note the surge in FY2020 and FY2021 arose from the increased work from home (WFH) population.

On the other hand, the resurgence in the past two years isn’t just temporary spike.

It’s driven by the synergistic efforts of the core wealth platforms, the expanding Hong Kong ePension business, and the transformative potential of iGB.

Hence, while the required 25% CAGR for the S$100 billion AUA target by 2030 is ambitious, the acceleration in net inflows might just make it achievable.

Is iFAST worth S$10 per share?

The share price closed at S$9.23 last Friday.

Given the excellent results and positive market momentum, the share price will likely move upwards on Monday.

While no guarantee exists, it’s interesting to consider whether iFAST is truly worth S$10 a share.

The answer boils down to your conviction in its long-term growth trajectory.

Assuming iFAST’s estimated FY2025 earnings per share (EPS) of S$0.31, a S$10 share price implies a Price-to-Earnings (P/E) ratio of approximately 32x.

This multiple is justifiable only if you believe the company can execute on its aggressive AUA growth targets.

Even if iFAST only matches its historical AUA growth of 17% (FY2020-FY2025), operational leverage suggests its EPS could still grow at least 25% on average annually.

In conclusion, a S$10 price tag isn’t expensive if iFAST can continue to execute well.

The risk, obviously, is the converse. You will need to weigh your own exposure to this investment.

For me, as iFAST is already among the top three positions of my portfolio, I will just be holding on to the current stake to participate in its growth.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.