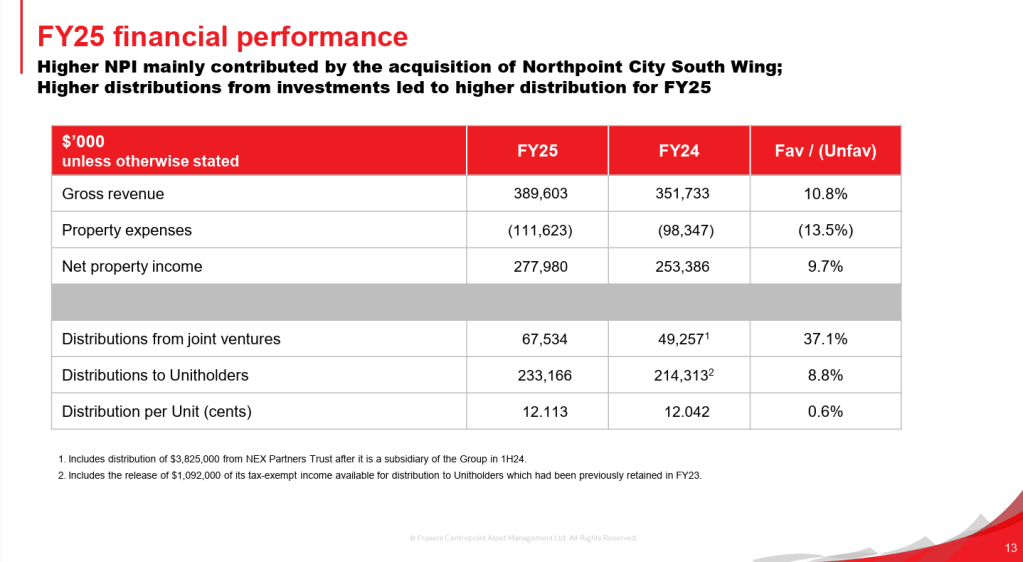

Mr A was shocked yesterday morning when he saw that the dividend-per-unit (DPU) of Frasers Centrepoint Trust (SGX: J69U), or FCT, only increased by 0.6% year-on-year (YOY) to S$0.12113!

“P, didn’t you suggest in January that FCT will raise its DPU for FY 2025?”

“I was sold that with the completion of Tampines 1 AEI and stabilising interest rate, your suggestion would come true.”

“What’s happening now?”

Mr P, in his usual calm demeanour, replied.

“Well, DPU did increase, didn’t it? Just not as high as expected.”

“And the main reason is due to the acquisition of the North Point City South Wing (NPCSW) this May.”

Strong Performance, DPU Dampened by Increased Share Count

Yes, that’s the inner monologue between my Amygdala and Pre-frontal cortex again today.

There’s no doubt FCT posted a strong second half and full year operation performance.

- Shopper traffic and tenant sales are up 1.6% and 3.7% YOY respectively.

- Rental reversion, on average, remained robust at +7.8% (excluding Hougang Mall, which is undergoing an AEI).

- Occupancy dipped to 98.1% in 4Q 2025 due to the exit of Cathay Cineplexes.

- Retail portfolio occupancy cost stays stable at 16.1%.

This led to an increase in Net Property Income (NPI) of 9.7% and Distributable Income (DI) of 8.8% for the year.

Then why did DPU only grow 0.6%?

The answer lies in the massive increase in the shares from the placement and preferential offer (PO) during the equity fund raising (EFR) early this year for Northpoint City South Wing (NPCSW).

The share count increased by more than 11% after the EFR, diluting the positive impact of increased NPI and DI.

Crucially, the new units created in early FY2025 were fully diluted for the entire year, while the NPCSW acquisition that they funded only contributed less than five months of income (from May 2025).

This temporal mismatch severely dampened the DPU.

The Bigger Picture: A Strong Total Return

While the DPU growth was a disappointment, it’s vital to look at the total return for the year. This annual return combines both the DPU yield and the unit price appreciation.

If you’ve participated in the PO at S$2.05, yesterday closing price of S$2.45 translates to a capital gain of more than 19.0%.

When you factor in the DPU of S$0.12113, the total return on the new units is approximately 25%! A fantastic return that helps put the DPU dilution into perspective.

Reasons To Be Optimistic for FY 2026

The obvious upside comes from NPCSW.

Besides the full-year contribution, there should be synergy arising from the integration of both the North and South Wings.

Furthermore, units from Hougang Mall first phase AEI are expected to launch from next month, which should provide a lift to the income.

Finally, the quarter average cost of debt has reduced to 3.5% from previous quarter’s 3.7%. With rates coming down, this likely means that FY 2026 average cost of debt will be lower than this year’s 3.8%.

Hence, barring unforeseen circumstances or another significant equity-funded acquisition, I’m projecting a DPU growth of 2% to 4% for FY 2026, which would represent a much stronger and more reflective increase of FCT’s core operational performance.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.