The share price of Food Empire Holdings (SGX: F03), or FEH, more than doubled this year.

It’s 350% higher than the price I divested in late 2020!

Ouch!

I initially blamed the Russia-Ukraine conflict for my divestment, but a check on the date shows that doesn’t check out. This is yet another reminder that our own memories aren’t the most reliable.

A check on my previous post indicates that I divested in 2020 to raise funds for better opportunities in the US markets.

Looking back now, it wasn’t a bad decision.

Part of the sales proceeds went to increasing my stake in Microsoft (NASDAQ: MSFT) and Tractor Supply (NASDAQ: TSCO), both of which outperformed FEH for a time until last year.

Moreover, even if I hadn’t let go of FEH then, I would’ve sold it when the Russia-Ukraine conflict began.

Having experienced how its results were significantly affected by the depreciation of the Russian Ruble, Ukraine Hryvnia, and other CIS currencies against the USD in 2014 and 2015, that would have been my natural, logical choice.

Therefore, the divestment wasn’t the mistake.

The mistake was not picking up the cues to do a quick check on the company when its performance was more resilient than expected.

I’m usually cool about missing the outperforming stocks, since I don’t expect to be able to catch all of them, and for some I’m not interested in their businesses.

But my familiarity with FEH and good impression of its management means I should’ve paid more attention to it.

Enough of regrets.

Time to look forward.

I finally took some time recently to look through its 1H 2025 results and 2024 Annual Report, and I’m glad that the company is making good progress with its diversification efforts both geographically and by products.

Here is a brief write-up of what I like and dislike from my reading.

What I Like: Growing Sales and Profits

Despite the uncertainties arising from the pandemic and Russia-Ukraine conflict, revenue grew at an impressive compounded annual rate of 14.9% from FY 2020 to FY 2024.

While earnings are more lumpy, normalised net profits after tax also almost doubled over the same period!

The growth is a clear indication that the company got its strategies and execution correct.

Key initiatives such as expanding beyond Russia and CIS countries, especially Vietnam, have borne fruit. Food Empire continues to gain market share for its coffee mixes with CaféPHỐ.

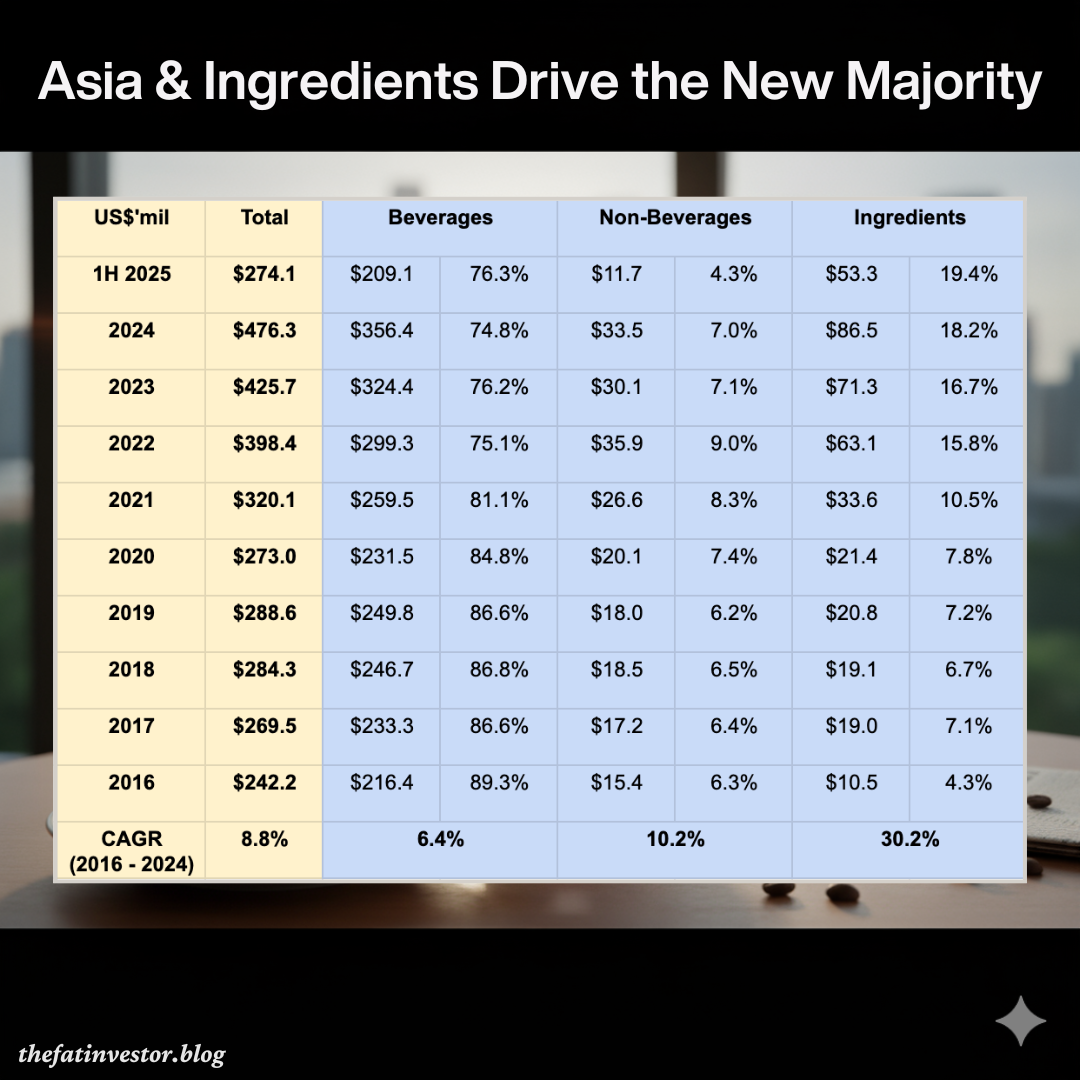

Furthermore, the upstream B2B ingredients business provided another essential growth channel.

Demand stays high for its expanded facilities in Malaysia (for non-dairy creamer) and India (for spray-dried and freeze-dried soluble coffee).

FY 2025 Poised to be Another Record Year

For 1H 2025, the company reported record results, with revenue climbing 21.7% year-on-year (YOY) to US$274.1 million and normalised net profit after tax leaping 35.7% to US$31.5 million.

Based on historical trend, its second half is typically stronger than the first, so sales could exceed US$500 million for FY 2025!

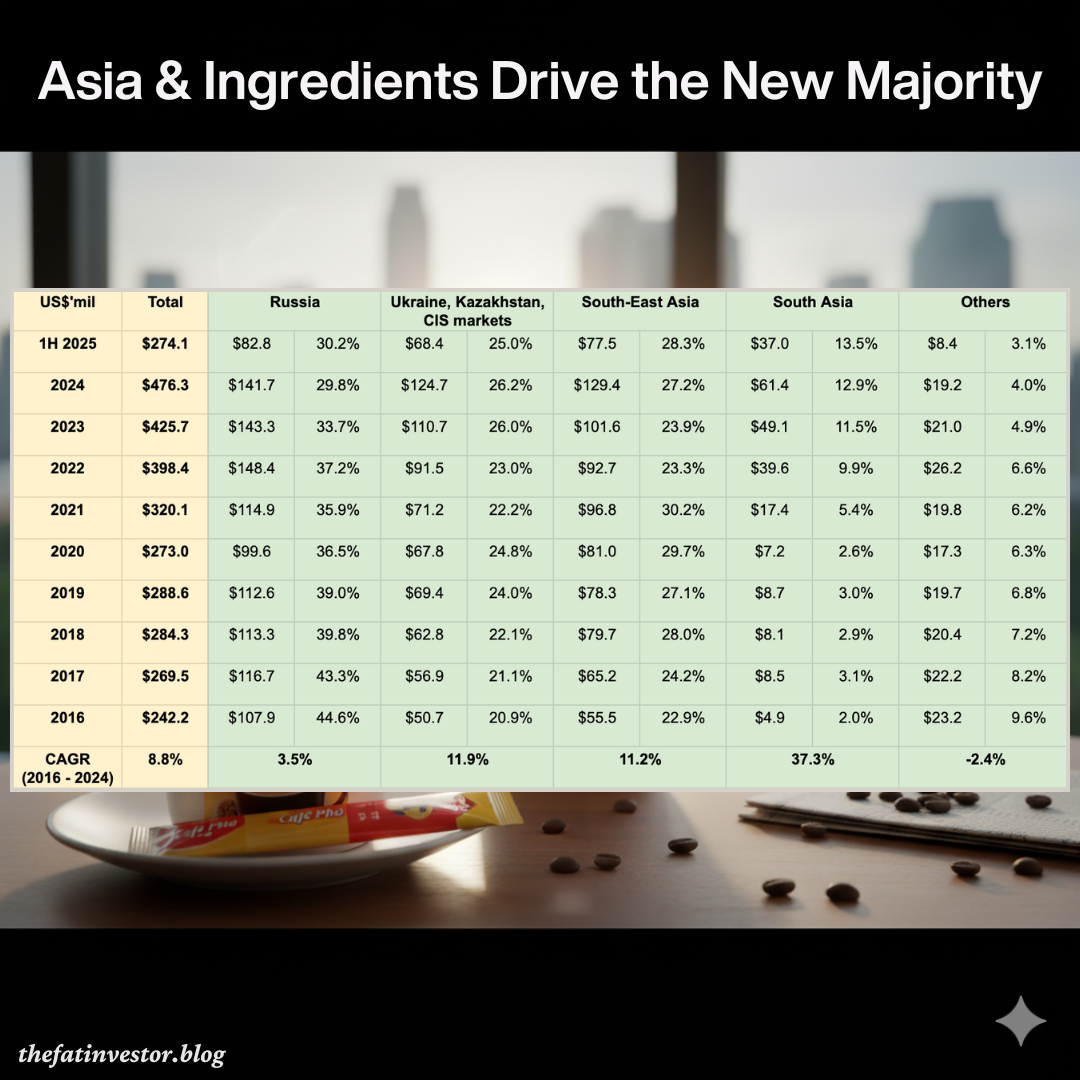

This robust growth was driven by double-digit sales increases across all core segments. Notably, South-East Asia and South Asia reported more than 25% YOY increase in sales.

The faster growth rate in these regions meant FEH continues its diversification journey, both geographically and by products.

Pivot Complete: Asia & Ingredients Drive the New Majority

As seen from the compiled data, the combined contributions from Russia, Ukraine, Kazakhstan and CIS countries have dropped from 65% in FY 2016 to the recent 55% in 1H 2025.

Guess what?

These regions used to contribute nearly 90% of the company’s sales in 2013!

It’s around that period which FEH made a strategic move upstream into the ingredients business.

The addition of B2B segment is pivotal to how FEH has grown over the past decade.

It’s amazing that the company grew that segment over ten folds and now contributes nearly 20% of the total sales!

Future Growth Drivers

With the following completed and planned expansion, you can expect more growth coming online.

- Completed expansion of Malaysia snack factory in 1H 2025 (output up by 50%)

- First Kazakhstan coffee mix facility by FY 2025 (boosting coffee mixes capacity by 15%)

- Expansion of India spray dried soluble coffee facility by FY 2027 (capacity up about 60%)

- New freeze-dried soluble coffee manufacturing facility in Vietnam by FY 2028

What I Dislike: Share Dilution and Forex Risk

While the expansion pipeline is exciting, it requires significant capital.

FEH over the past year has executed two such fund raising exercises.

- Issuing of Redeemable Exchangeable Notes (REN) in November 2024 to raise US$40 million

- Placement treasury shares in September 2025 to raise S$42.8 million

REN: Interests Payment and Accounting Headache

The REN which have a total term of five years, came with a 5.5% annual interest rate. Being used to the lower interest rates obtained by S-REITs in their financing, this rate initially felt steep to me.

My comparison was clearly flawed. Given the difference in business risk, a traditional bank loan for FEH would likely carry a higher interest rate.

Nonetheless, from hindsight, the issuer Ikhlas Capital made an excellent deal, as the 5.5% annual interest came with the substantial upside of exchanging the notes for shares at just S$1.09.

In short, due to the surge in FEH’s share price this year, the issuer is already looking at a potential gain of more than double its investment.

From the company’s perspective, this translates to a significant non-cash fair value loss, which was the primary reason for the reported net loss in 1H 2025.

However, the company has since reclassified these notes such that, going forward, they will no longer be measured at Fair Value Through Profit or Loss (FVTPL).

This change is intended to ensure that the P&L statement shows a cleaner reflection of FEH’s underlying operating businesses, eliminating future non-cash mark-to-market volatility.

Beyond the accounting mambo-jumbo, what remains is the annual interest payments and the likely dilution of shares at the end of the five-year term.

Further Dilution: Placement of Treasury Shares

In September, FEH placed out 17 million treasury shares as S$2.52 per share to institution investors for another S$42.8 million.

While this indicates the confidence from the investors, it also means a further dilution of shares to existing shareholders.

For reference, FY 2024 earnings-per-share (EPS) would drop by slightly more than 3% to US$0.0967 if the shares were placed last year.

Forex Risk

This has been a pertinent risk that FEH and its investors need to deal with.

The volatility primarily stems from two layers:

- The currencies of its major markets, especially Russia, Ukraine, and CIS markets, are highly volatile to its reporting currency of USD.

- The strengthening of Singapore dollars against USD over the past year adds another layer of risk that local investors need to be aware of.

Initiating a Small Stake for its Growth Potential

Despite the increased capex and borrowing costs in the coming years, FEH should be able to manage it with its robust balance sheet and operating cash flow.

Based on my brief impression of Chairman Tan Wang Cheow and CEO Sudeep Nair during the AGM I attended in 2018, both are risk takers but not reckless.

Hence, I am confident that they could manage the costs and risks that come from the planned expansion.

Has the Rocket Run Out of Fuel?

Of course, I would love to rewind the clock and rediscovered FEH early this year and bought the shares at a much lower price.

Obviously, I don’t have that superpower and more importantly, the past prices are no longer relevant.

What is more important is to evaluate if Mr Market is offering a good price for its future growth.

When I first took a look at the shares early this month, it was trading at around S$2.44, which translates to a trailing PE ratio of around 18.7x.

It’s definitely not cheap but isn’t too costly too as it has been growing its normalised net profit at a compounded rate of 17% over the past four years.

And excluding the non-cash fair value loss due to REN, 1H 2025 normalised net profit jumped by 35.7% YOY to US$31.5 million!

While I don’t think that this growth rate is repeatable over the longer term, with the various growth drivers, I think FEH might be able to achieve a 12-15% growth on average for the next five years.

With limited cash reserve, I hesitated.

But when I saw the price dropped to S$2.24 last Friday, I decided to initiate a small stake. Not only was the price cheaper, my cash reserve increased when I trimmed my US portfolio a week ago.

Cheap became cheaper and FEH closed at S$2.16.

Ouch (smaller) again.

The consolation is my stake is 10% cheaper than the placement shares, and I am ready to increase my stake if the price continues to trend downwards.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments.

All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk.

Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.