I won’t deny it.

It felt great when Arista Networks (NYSE:ANET) became my first 10-bagger in my current portfolio.

It’s like completing one of the Great Wonders in the Civilization game or finally finishing the 9,000-piece LEGO Titanic.

However, beyond that brief exhilaration, is the effort worth it?

The surprising answer is, “no, it’s not!”

“Wait, what?! After two posts on how to find multibaggers, you’re telling me it’s not worth it?

Let me explain.

Setting out just to find the elusive 10-bagger will cloud your investment objective. Inevitably, you’ll be drawn more to the price movement, rather than the underlying business fundamentals.

Rather, the focus should be on achieving your investment portfolio’s return through consistent analysis of quality businesses.

And whether that performance is obtained through multibaggers or just an above-average return by most of the stocks really doesn’t matter.

Think of it this way.

Soccer team A has a prolific strike force but doesn’t defend well, resulting in getting more draws than wins. Whereas soccer team B doesn’t score as many goals, but defends well and have more wins.

Which is the better team?

It’s the absolute gain that matters

Now, don’t get me wrong.

I still cherish the success of those multibaggers.

However, if you allow the percentage return to become your primary measure, you stand to lose out more. This fixation on the initial low price is a form of anchor bias, and it’s holding back your total returns.

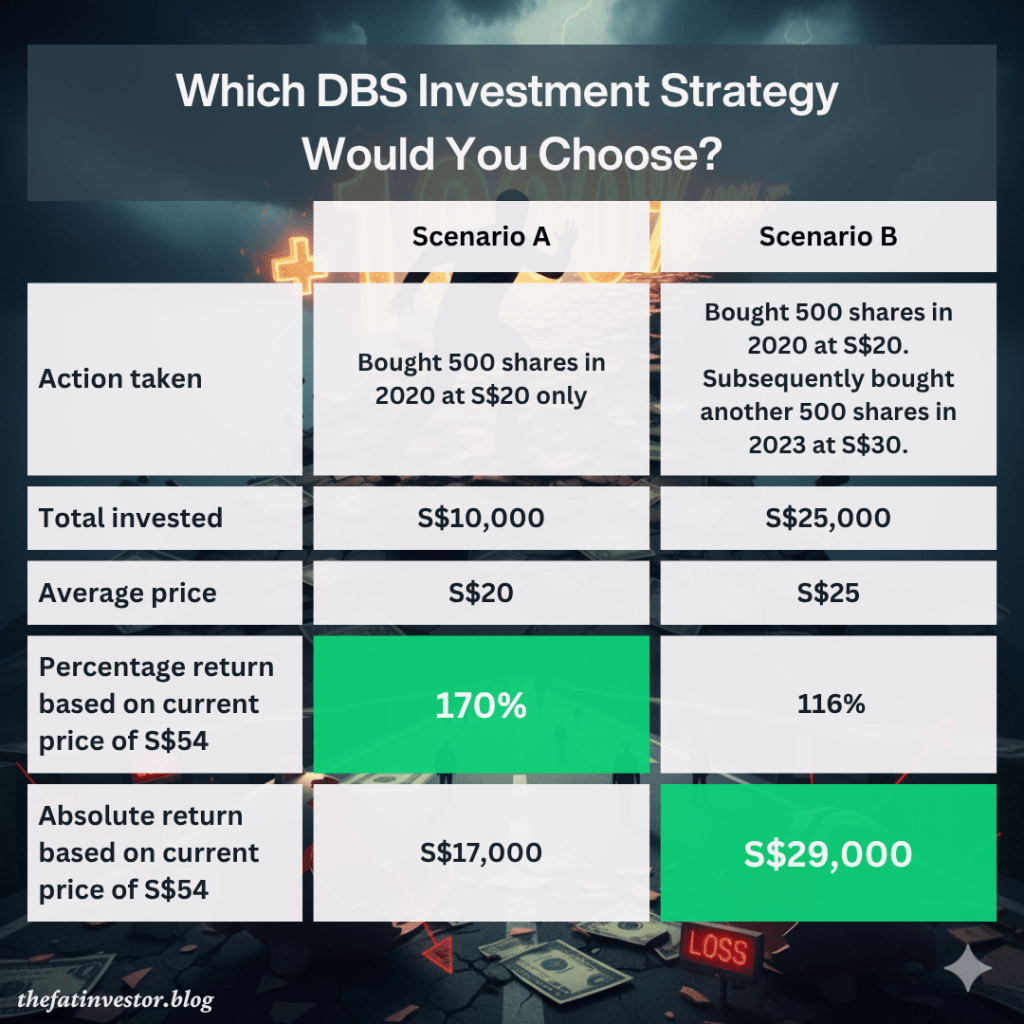

Let’s illustrate this with an example on investing in DBS Group Holdings (SGX: D05).

Say you managed to invest S$10,000 to buy 500 DBS shares at S$20 per share during the Covid-19 pandemic.

At the current trading price of about S$54, your investment would have gained 170% and you would have made S$17,000 (excluding the dividends)!

What if you have instead chosen to further invest in this largest bank in Southeast Asia a few years later, and bought another 500 shares at S$30?

Your total investment would then increase to S$25,000 and your average purchase price is now S$25.

The percentage gain would drop to around 116% (S$54 / S$25), but the absolute profit would jump to S$29,000!

That extra S$12,000 in profit is a significantly better deal than simply sticking to your original low-cost-basis shares just to boast the 170% return.

Multibaggers is a byproduct, not the goal

The idea is to add to your winners and focus on how their absolute returns achieve your overall investment goal.

Multibaggers are simply a byproduct of long-term holding a high-quality stock, not the goal itself.

And that’s exactly what happened to my portfolio.

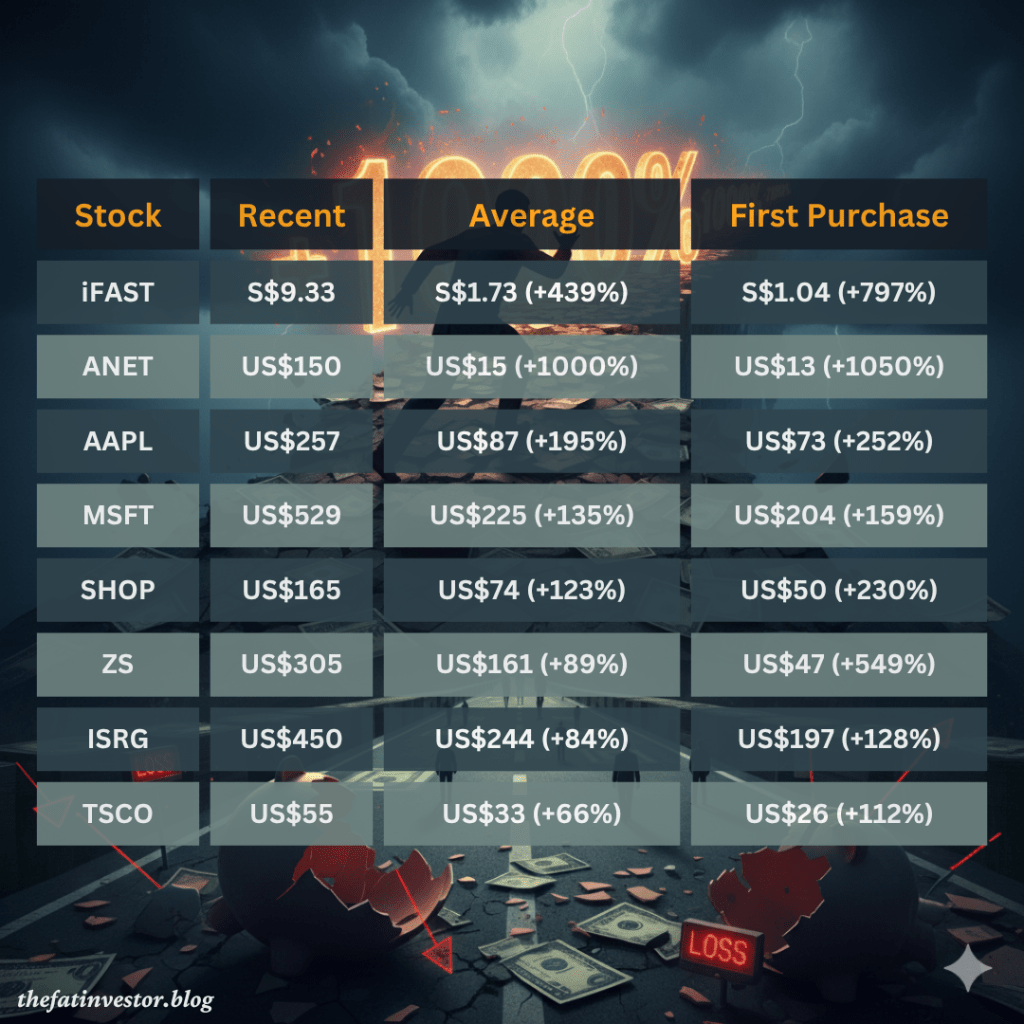

While it wasn’t the primary goal, the above eight stocks have appreciated the most (excludes dividends) and some have become multibaggers in my portfolio.

Besides being quality businesses, my prioritisation of portfolio allocation to manage downside risk has also contributed to this outcome.

For example, two of my largest positions, Arista Networks and iFAST Corporation (SGX: AIY), already occupy about 10% of my portfolio each.

This means I no longer see the need to inject more capital into them, allowing their existing, significant position size to drive multi-fold gains as the businesses continue to grow.

On the other hand, for a stock like Apple (NASDAQ: AAPL) which I last added my stake in 2021, I wasn’t really excited about their latest business development.

Despite that hesitation to add, there’s no compelling reason for me to fully divest my current holdings.

The business continues to be profitable and with the massive share buybacks, its earnings per share is still growing, albeit at a lower pace.

Its stable growth is akin to a midfielder in a soccer team.

In essence, the multibaggers mindset focus on the portfolio, not the individual stocks.

Team B (the consistent winner) is the one with a “portfolio mindset”, where every player contributes to the overall win, not just one star striker.

Related posts

Finding Multibagger Without Timing the Market

The Multibagger Trap: Why a “Perfect” Stock Is Never Enough

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.