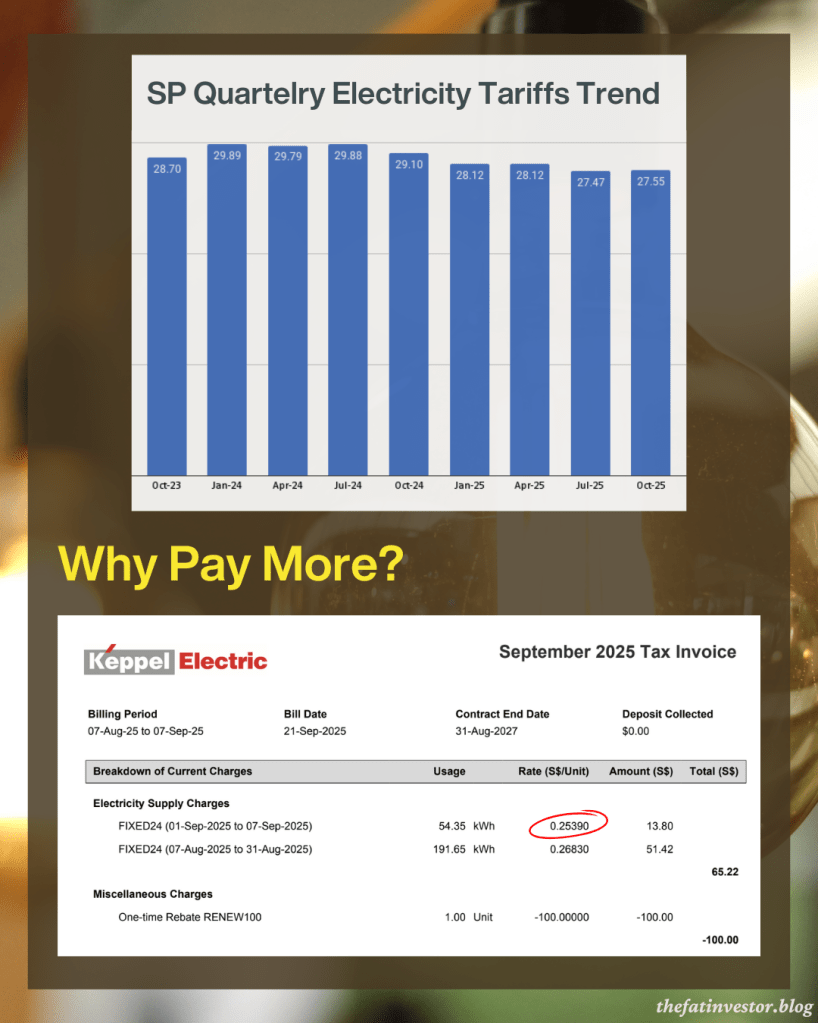

Electricity Tariffs

Households to pay higher gas and electricity tariffs from October to December

– The Straits Times

While the headline is factually correct, a mere 0.3% quarter-on-quarter increase is barely a blip on the radar. Moreover, compared to a year ago, the latest rate of 27.55 cents per kWh is actually more than 5% lower.

If you’ve explored further, switching to an electricity retailer in the open electricity market, would yield you more savings.

As shown in the above image, my new contract with Keppel Electric, which just kicked in last month, is almost 8% lower than the prevailing rate from SP Group.

Additionally, the S$100 one-off renewal rebate will pay about 1.5 months of my electric bill.

The downside?

I will be on the losing end if the electricity tariffs drastically dropped in the next two years. That could happen, but I have not experienced that yet since I made the switch in 2021.

Finally, the certainty from the fixed rate does help in budgeting.

If you would like to sign up with Keppel Electric, you can click on my referral link (code: REFER001) to get a further S$25 rebate for both of us, ie, S$125 bill rebate in total for you.

But enough about saving on utilities.

Let’s talk about increasing our income via investment — a strategy with no upper limit.

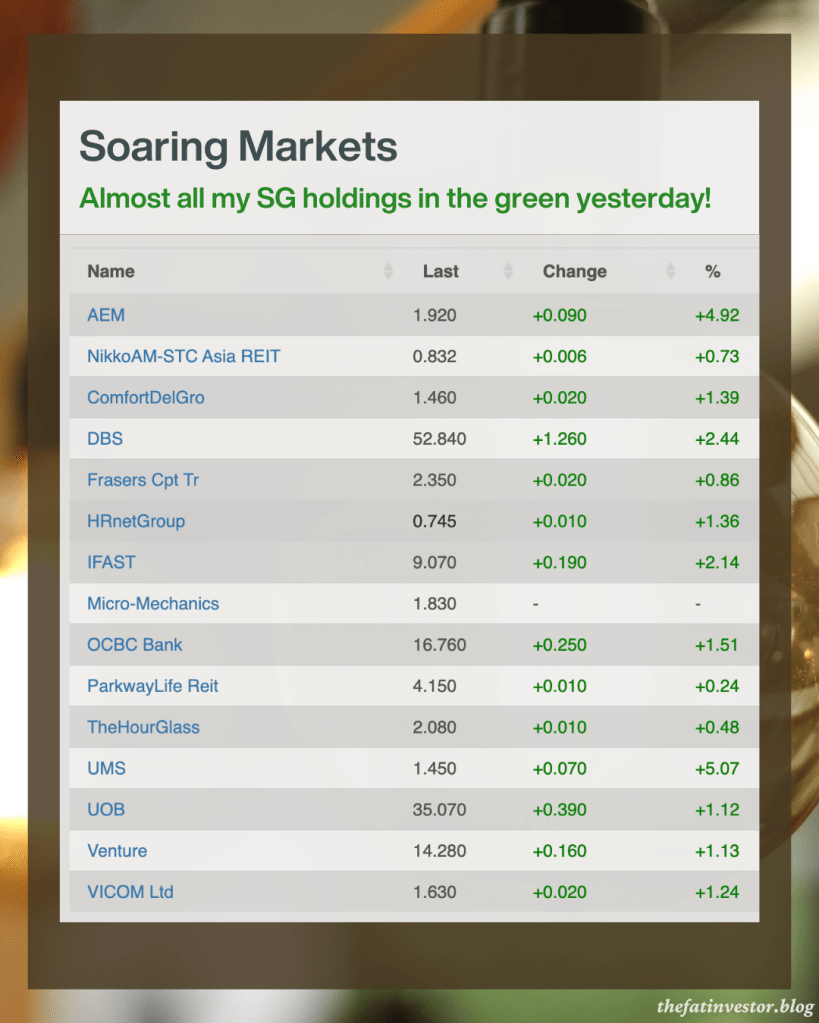

Soaring Markets

I was surprised by the strength of the markets over the past week.

Both SPDR S&P500 ETF (NYSE: SPY) and SPDR Straits Times Index ETF (SGX: ES3) hit new highs this week.

And yesterday, almost all my SG stocks, from banks to S-REITs to semiconductor-related players, all ended the trading day in green!

A rare sight indeed, though I can’t fathom the reasons that propel the exuberant. I’m sure there are headlines justifying these rallies, but as always, we shouldn’t invest solely based on them.

When the market runs hot, it’s a good reminder to focus on the fundamentals of the companies you actually own. This brings me to my final musings for this week: an insightful video on ComfortDelgro, or CDG.

The Fifth Person Roundtable Video: ComfortDelGro Group (SGX: C52)

I always welcome the opportunity to learn more about the company in which I’m a shareholder.

And given that I just invested in CDG this July, I’m glad that The Fifth Person invited CDG Deputy CFO Christopher David White for a roundtable session.

It’s my first time hearing from any CDG key personnel, and I must say I’m impressed with his clear understanding of CDG’s business.

“He’s the Deputy CFO, he better be!” You argued.

While I don’t disagree, the fact is CDG is a land transport conglomerate that provides a wide range of transport and related services, including bus, taxi, rail, and car rental and leasing, across multiple countries.

His ability to articulate various details from memory and answer questions with clarity and confidence spoke volumes about his quality.

The video deepens my understanding of the group’s business, and I would encourage you to watch it too if you are vested in CDG.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.