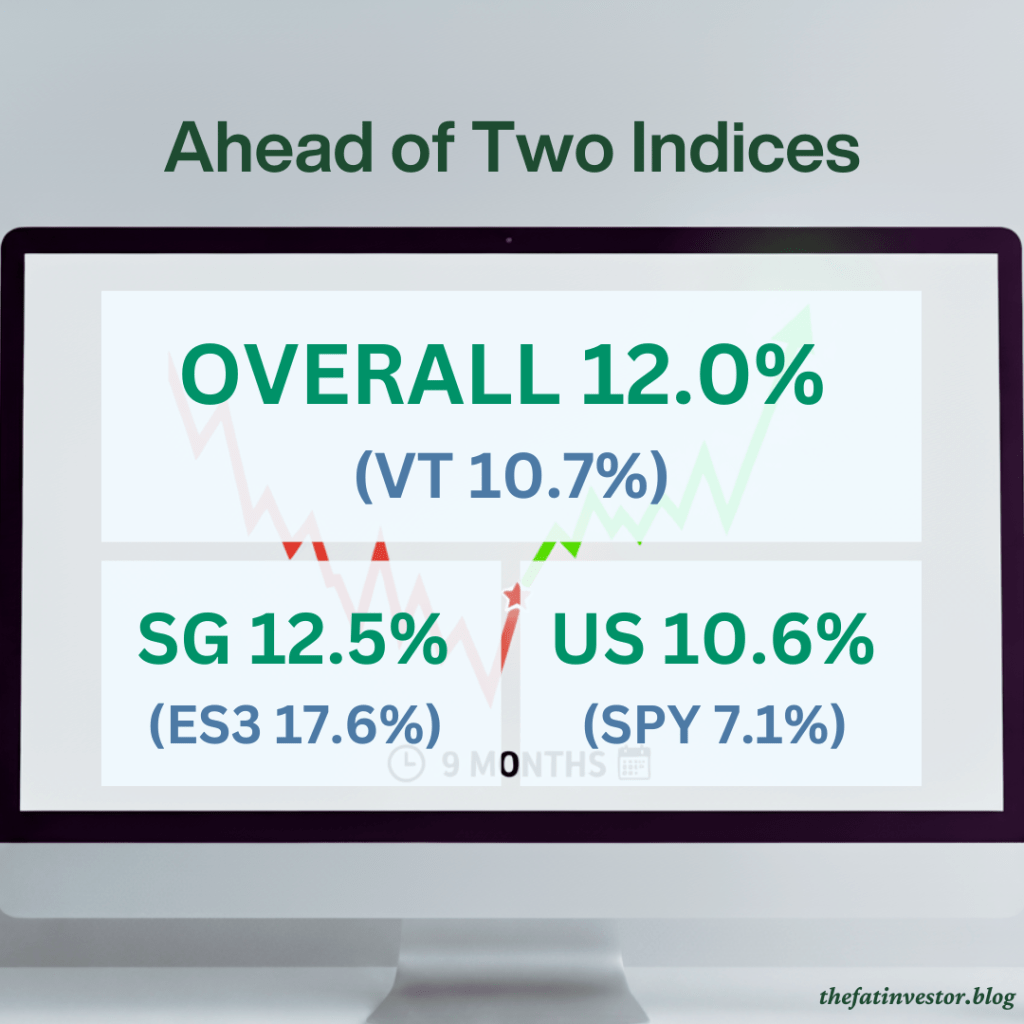

4% down in the first quarter.

Break-even by the first half.

And now, the portfolio hit a 12% return for the first nine months of this year!

The turnaround is even more amazing for my US portfolio as it reverses from a 20% loss in the first quarter to an 11% gain now. That’s a more than 30% gain in just half a year!

Now, let’s dive into the individual markets and stocks.

US Portfolio: Slaying SPDR S&P500 ETF (NYSE: SPY)

Surprise surprise! I’m taking a lead over the S&P500 ETF again.

If this continues until December, I’ll beat this monster index for the third consecutive year, and in four out of six years since 2020.

I’m obviously pleased with this progress, and it gives me the confidence to continue my stock picking journey in the US markets.

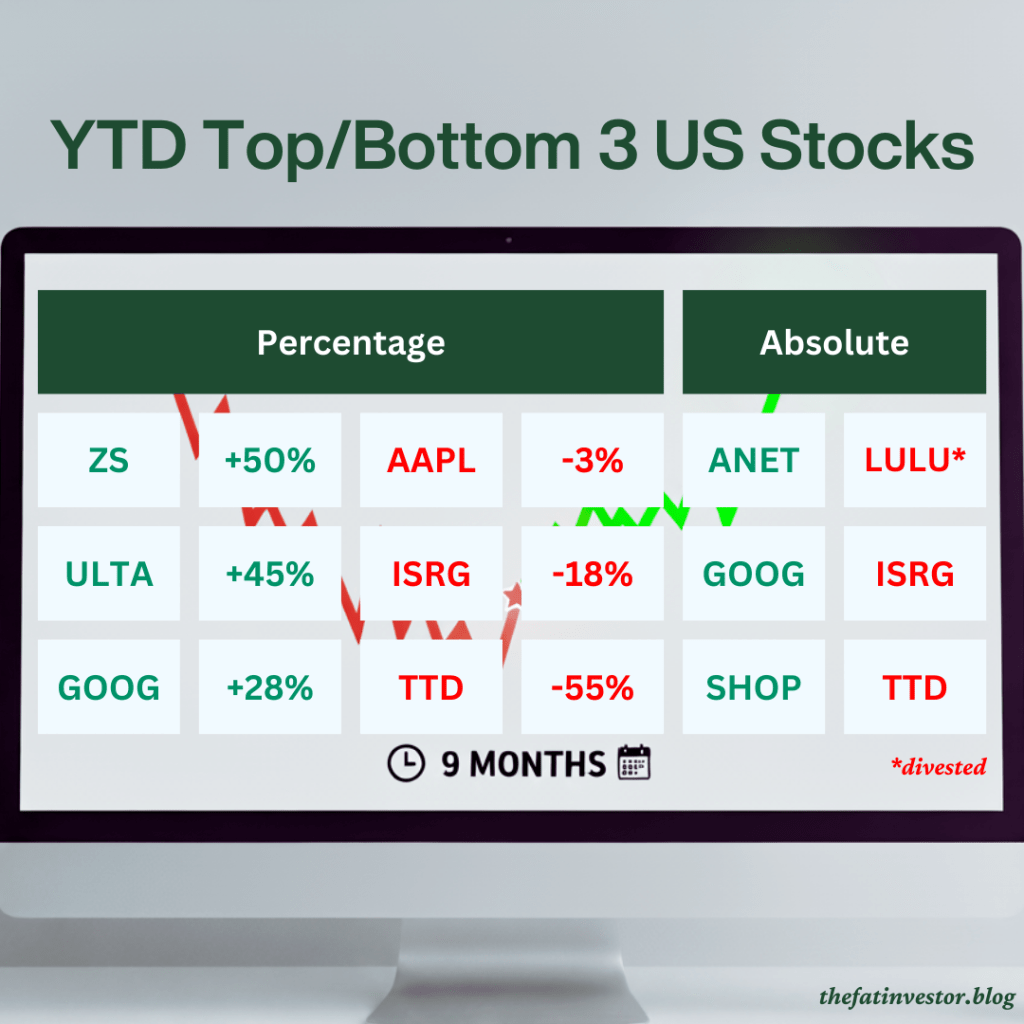

For this year, markets reacted positively to the robust performance of my top two stocks Arista Networks (NYSE: ANET) and Shopify (NASDAQ: SHOP).

Despite markets trending down in the past week, their share prices are up significantly by 22% and 27% year-to-date (YTD) respectively.

This is further boosted by my strategic actions in first half, where I took advantage of the lower prices to initiate a position in Ulta Beauty (NASDAQ: ULTA) and double my position in Alphabet (NASDAQ: GOOG).

Consequently, my Alphabet holdings are up 28%, and my confidence in Ulta’s new CEO is rewarded with an impressive 45% return!

And yet Ulta is still not my top US performer.

That honour goes to ZScaler (NASDAQ: ZS), leading the race with an amazing 50% gain! Its renewed growth momentum and above estimates guidance for the next fiscal year received the market’s approval.

On the other end of the spectrum is The Trade Desk (NASDAQ: TTD), where its below expectation results and guidance saw its share price plummet.

Unlike Lululemon Athletica (NASDAQ: Lulu) though, where I realised a 44% loss, I am holding on to my current stake as I remain convinced of its longer-term growth story.

However, having already invested a five-digit amount in Trade Desk, I won’t increase my holdings further.

SG Portfolio: Trailing SPDR Straits Times Index ETF (SGX: ES3)

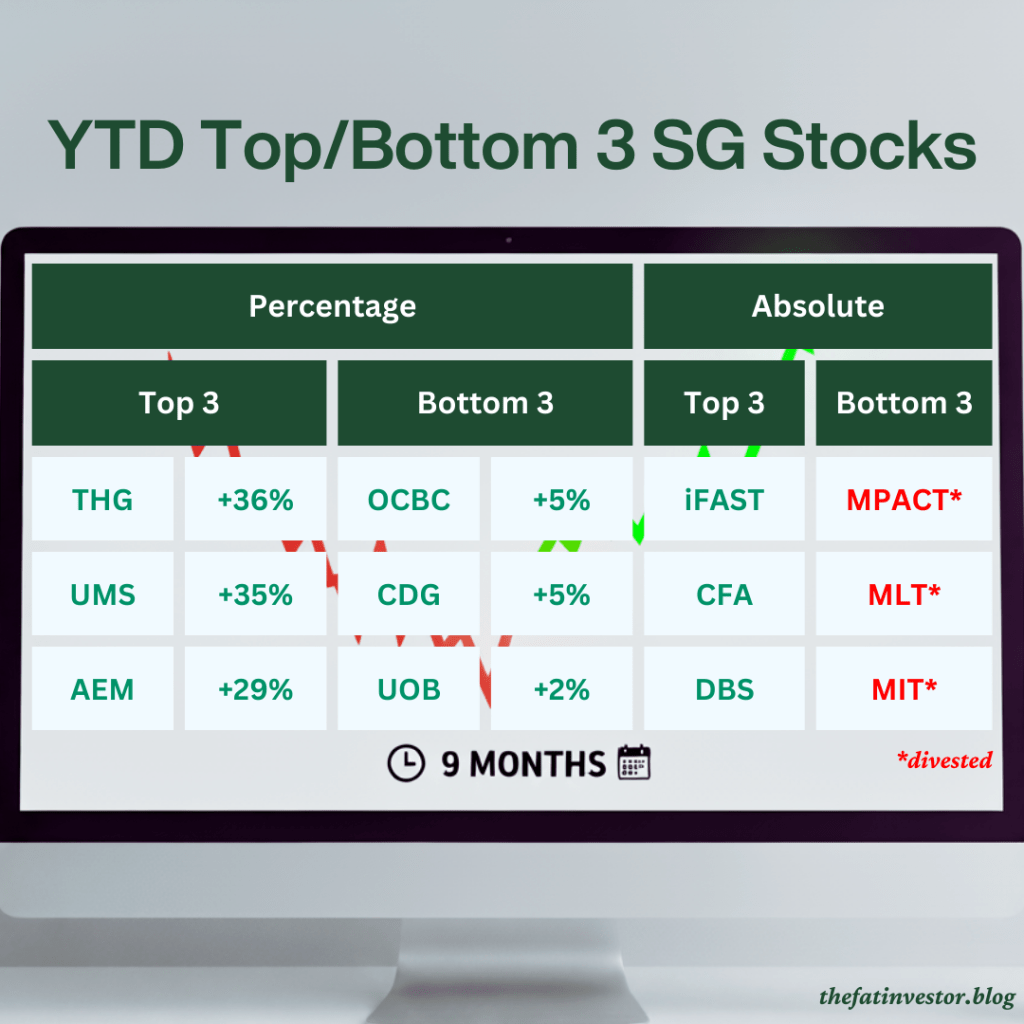

Switching gears to the local market.

What used to be an index that I beat easily, STI ETF has become a tough nut to crack in recent years.

It is up 17.6% YTD, and that’s on top of last year’s strong 22% return!

Besides DBS Group (SGX: D05), this year also sees the likes of ST Engineering (SGX:S63) and Singapore Telecommunications (SGX: Z74) contributing to this superb performance.

While my SG portfolio continues to trail STI ETF, it has kept pace with the rally during the past quarter.

The market reacted positively to iFAST Corporation (SGX: AIY) strong growth, propelling it from a top loser in my SG portfolio to the top gainer within a quarter.

My timely accumulation of Amova-STC AREIT (SGX: CFA) in May benefitted from the positive sentiment towards S-REITs due to the expected rate cuts.

In the percentage category, The Hour Glass (SGX: AGS) is the surprise leader. While the exact reason behind its strength is unclear, its share buyback program and low trading volume may have contributed.

Improved results, anticipated ramp-up in the coming quarters, and successful secondary listing in Bursa Malaysia (KLSE: Bursa) saw the surge in interest in UMS Integration (SGX: 558)

As for AEM Holdings (SGX: AWX), it’s simply a secondary effect of the announced US$5 billion deal between Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC).

Here’s the icing on the cake: the view from the other end isn’t too bad.

Besides the realised loss from the divestment of the three Mapletree S-REITs, even my bottom 3 performers are in the green!

What more can I ask for?

Cautious optimism for the quarter ahead

The final round of quarterly reporting for this year is coming soon.

I’m expecting positive momentum from most companies, even though management will probably continue to express cautiousness in the current topsy-turvy environment.

While markets will digest these latest developments, its temperament means stock prices can move in any direction.

For my current situation, these are the actions that I will take.

- If prices fall, I will simply hold my current stakes.

- If markets stay exuberant, I will take the opportunity to trim my positions further.

My plan remains simple: stay disciplined, let the winners run, and remain ready to take action as the final quarter unfolds.

Disclaimer

This content is for informational only. I am not a financial advisor, tax professional, or legal expert, and the information shared here does not constitute personalised financial advice, nor is it a solicitation to buy or sell any securities or financial instruments. All opinions and commentary reflect my personal views and are based on general market commentary.

You are solely responsible for your own financial decisions. Investing involves risk, and any action you take based on the information provided on this blog or channel is strictly at your own risk. Always conduct your own research and due diligence and consult with a qualified, licensed financial professional, tax professional, or legal advisor before making any investment or financial decision.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.