Prefer to listen instead of read? Here’s the full video on this topic.

If you missed it, Nvidia (NASDAQ: NVDA) announced on Thursday that it will jointly develop data center and PC products with Intel (NASDAQ: INTC). At the same time Nvidia will invest US$5 billion in Intel common stock at US$23.28.

Market reacted positively to this announcement, and propelled Intel’s stock price up by a whooping 23% to more than US$30 on Thursday’s night.

While I don’t own Intel, I have a stake in AEM Holdings (SGX: AWX), a company for which Intel is a key customer. Thanks to the association, its share price also rocketed by a good 18% to close at S$1.85 yesterday!

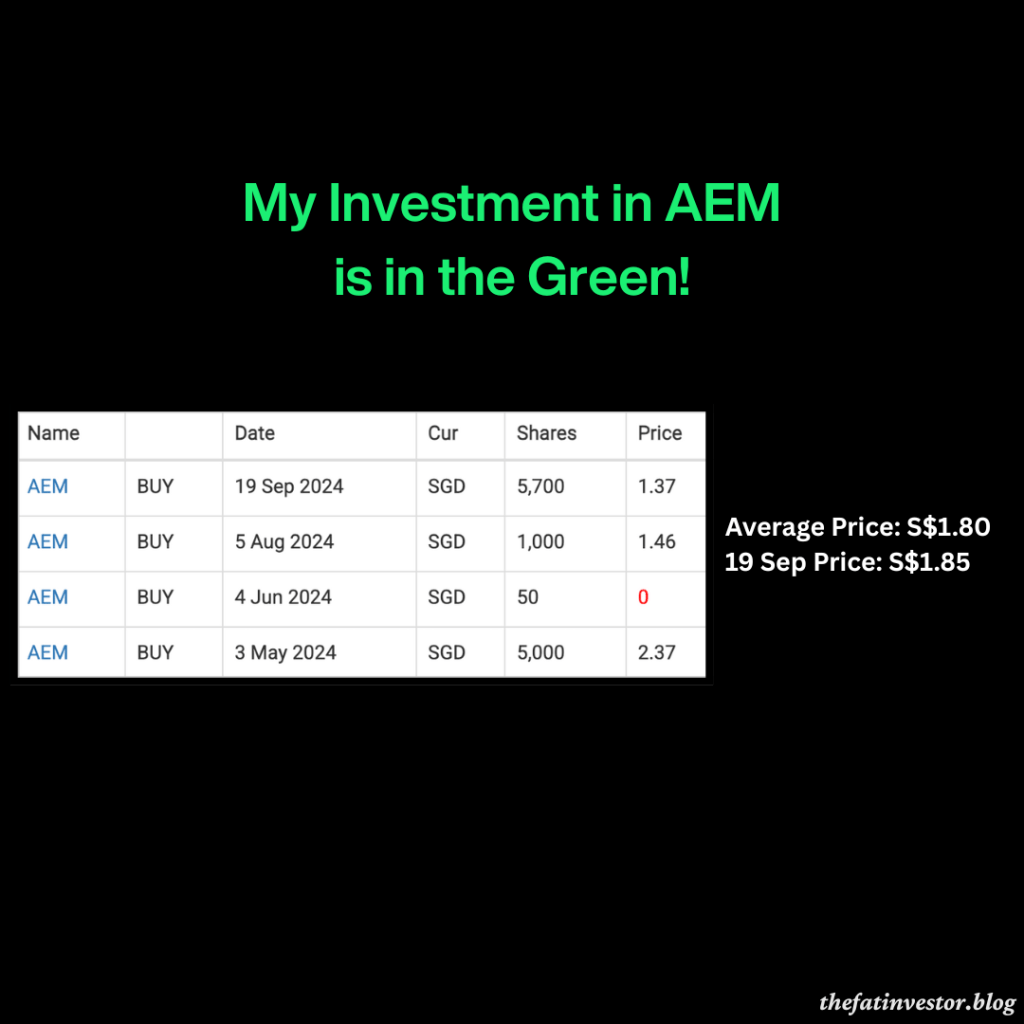

This unexpected surge meant my investments last year in AEM are finally in the green! And once again, my approach to accumulate my holdings in tranches works out for me.

As seen from the above image, my initial purchase last May was S$2.37. But I took advantage of market’s pessimism on the stock later in the year to increase my stake.

To be clear, it’s not just about averaging down the price.

I was and still am excited about AEM’s long-term potential, especially after I used the SWOT analysis structure to understand its business last September.

You might wonder what if the price has gone up after my initial purchase?

Well, if the company’s latest results and outlook is brighter, than I have no qualms averaging up too. While this means I would have made less, limiting the downside risk is worth the trade off.

So while I’m pleased with the sudden “windfall”, it does not change that I am investing in AEM for the longer term. I am positive about this new deal between Nvidia and Intel as it might create more opportunities for AEM test systems.

But what’s more important for AEM for the moment is to get its execution right with its new customers, and that will bring in multi-years of growth.

As for its stock price movement next week, I have absolutely no idea. It will feel nice if the price continues to march northwards, but even if market decides to sell it down, I’m perfectly fine.

Ultimately, this news reinforces my belief in AEM’s long-term prospects, and I’ll continue to focus on the company’s fundamentals over daily price swings.

Trimmed My Stakes in Singapore Banks

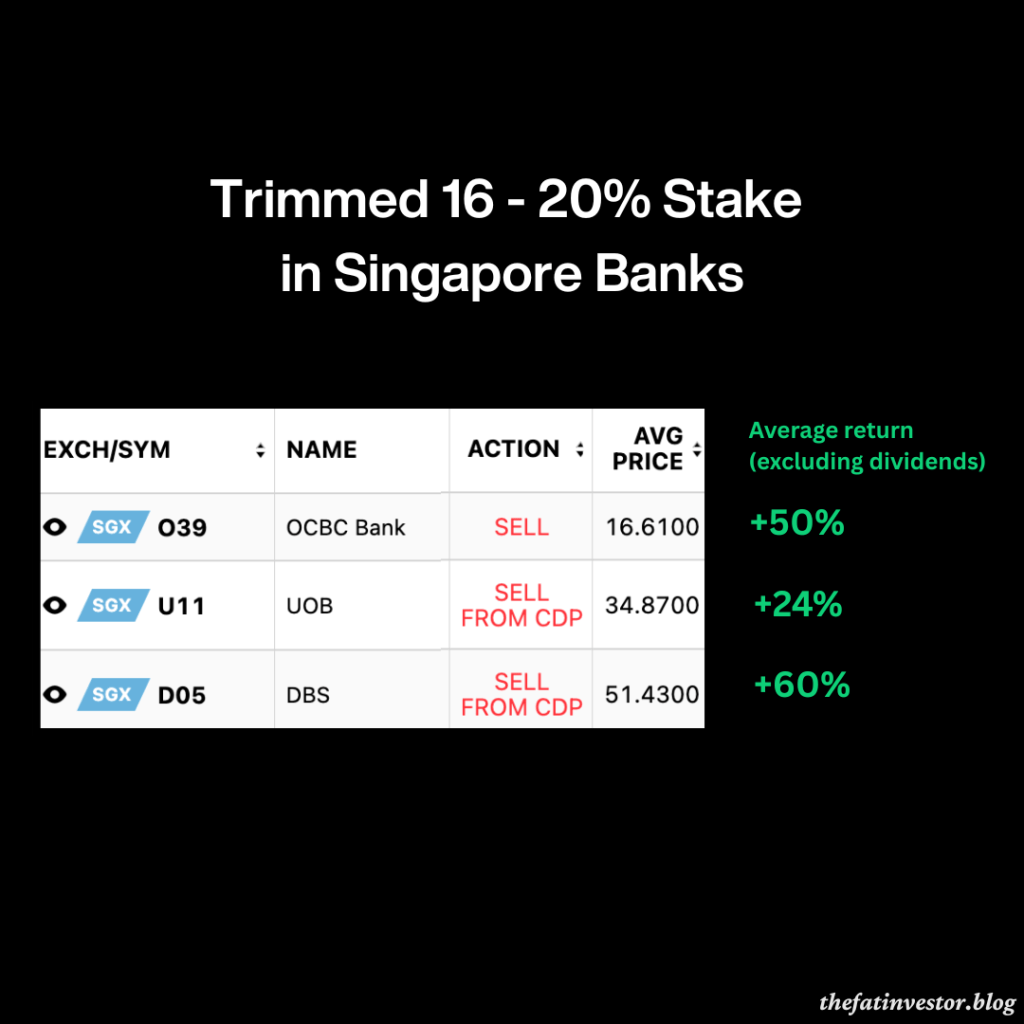

Moving on to something totally unrelated: I trimmed about 16-20% of my stakes in the three Singapore’s leading banks DBS Group (SGX: D05), OCBC Ltd (SGX: O39), and United Overseas Bank Ltd (SGX: U11) on Thursday.

It wasn’t a planned move, nor was it solely due to the U.S. Federal Reserve’s (Fed) rate cut on Wednesday.

While Fed’s rate cut decision might play a part, the strong performance by the equities market this quarter probably set the stage for it.

My portfolio is riding the market rally. Because of this, I’ve started to consider selling some holdings toward the end of the year to fund my 2029 expenses.

So as I looked at my spreadsheet, the idea to bring forward the selling of the three banks just popped into my mind.

Interestingly, there weren’t any alternative voices that counter argue the idea. Just 10 minutes before noon, I logged into FSMOne to complete the transactions.

I acted on impulse, but I wasn’t impulsive.

The idea of selling had been on my mind, and more importantly, I wasn’t feeling hyped up or anxious when it happened.

Now, let’s turn to the core of the matter: the impact of these rate cuts on the banks’ business.

My superficial understanding is that these rate cuts will definitely create headwinds, likely reducing the banks’ net interest income (NII).

But I believe the banks have ways to mitigate the impact, as long as the cuts aren’t too aggressive or rapid. They can adjust their CASA (current accounts, saving accounts) interest rates and possibly increase their loan books.

In addition, we shouldn’t forget about non-interest income (Non-II). If this segment’s growth continues to surprise, the three banks might still manage to achieve a small increase in profits.

My sense (read unreliable) is earnings would be flat or slightly lower in next one to two years. Consequently, their stock prices have limited upside.

Similarly, since the banks typically pay out 50-60% of their earnings, I expect dividends to stay at this level or slightly lower in the near-term.

Barring any drastic changes, I am holding on to my remaining stake in the three banks.

For further elaboration of how NII and Non-II affect banks’ earnings, you can read the following articles I wrote earlier on The Smart Investor.

Imminent Interest Rate Cut: Is It Time to Sell Singapore Banks? (published September 2024)

Is It Still A Good Time to Buy Singapore Banks? (published March 2025)

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.