The U.S. Federal Reserve’s (Fed) fastest interest rate hike in 2022 led to a significant decline in the prices of S-REITs that year.

Since then, performance has been a mixed bag, with differing results due to the REITs’ varied property types and geographical exposure.

With the expected rate cuts from the FED for the rest of this year, will the S-REIT market finally shine again? If so, will it be better to ride this recovery with S-REIT ETF, rather than individual REITs?

Read this latest article I wrote for The Smart Investor, where I explore the case for and against of doing so.

You will also find a comparison of these three S-REIT ETFs in the article: Lion-Phillip S-REIT ETF (SGX: CLR), CSOP iEdge S-REIT Leaders Index ETF (SGX: SRT) and Amova-StraitsTrading Asia ex Japan REIT Index ETF (SGX: CFA), or Amova-STC AREIT.

Did my switch to Amova-STC AREIT work out?

Writing the above article piqued my curiosity if my switch from the three Mapletree REITs to Amova-STC AREIT in May worked out well.

A check shows that including the last quarter dividend, the S-REIT ETF has made an impressive 13.5% return in less than four months.

However, as shown in the table below, I would have gotten an even higher return if I did nothing!

I have no regrets, though.

The main reason for the switch was to use my CPF to invest in Amova-STC AREIT, freeing up my cash that was invested in other S-REITs.

But wait!

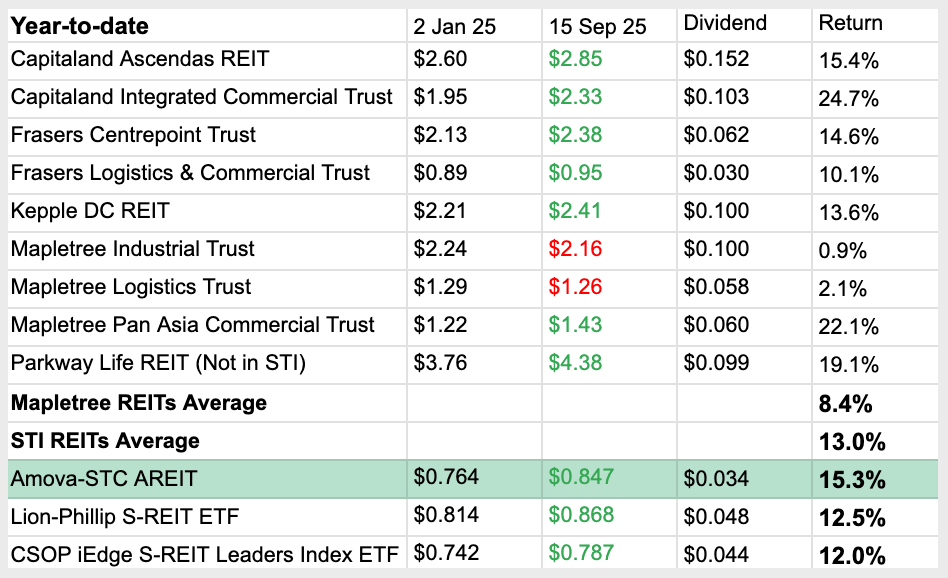

What about the year-to-date return? Would it reflect a similar relationship?

To gain a broader perspective, I decided to expand the comparison to include all eight individual S-REITs in the Straits Times Index (STI), my top REIT holding (Parkway Life REIT), and the three S-REIT ETFs.

Different picture: Amova-STC AREIT did well this year

A change in the time period reveals a different picture.

Unless you managed to pick up the following three individual S-REITs, which significantly outperformed the chosen REITs and S-REIT ETFs in the table, you are better off by simply investing in Amova-STC AREIT!

- Capitaland Integrated Commercial Trust (SGX: C38U), or CICT

- Mapletree Pan Asia Commercial Trust (SGX: N2IU), or MPACT

- Parkway Life REIT (SGX: C2PU), or PLife

Interestingly, Amova-STC AREIT demonstrated an edge over the two pure-play S-REIT ETFs.

This is likely due to the relatively better performance of Link REIT (HKSE: 0923) and Embassy Office Parks REIT (BOM: 542602) when compared to Mapletree Industrial Trust (SGX: ME8U) and Mapletree Logistics Trust (SGX: M44U) during this period.

But before you conclude that Amova-STC AREIT is the best choice to invest in, let’s see how it has fared since the aggressive rate hikes began.

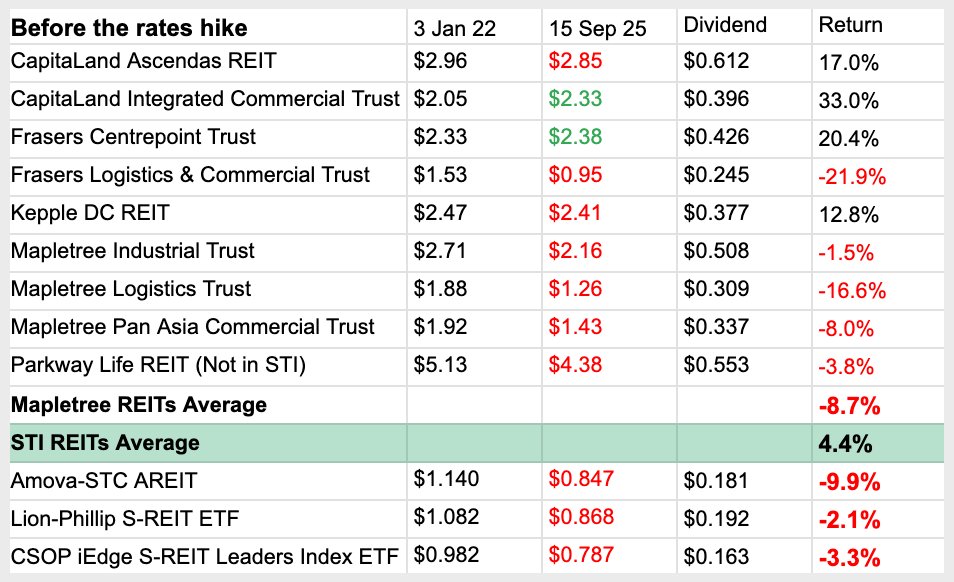

Another picture: The surprising underperformance of Amova-STC AREIT

Were you surprised by the data? I was.

I didn’t expect Amova-STC AREIT to underperform the other two S-REIT ETFs by as much as 7.8%.

This significant variance prompted a closer look. It appears there was a temporary spike in Amova-STC AREIT’s price around the ex-dividend date.

Using the price from the following day, the calculated return becomes a more representative -5.5%.

While this is still lower than the other two S-REIT ETFs, the difference is far less extreme and makes more sense within the context of the overall market.

How now, brown cow?

Are you feeling overwhelmed by the numbers and the conflicting information?

Personally, these exercises serve as a reminder to take a pinch of salt with any presented data.

While these snapshots provide a general sense of performance during a period, they are not meant to be conclusive on their own.

Here are my key takeaways from the data.

S-REIT ETF reduces the risk

Investing in an ETF does reduce the risk of investing in a dud.

It’s easy to say that avoiding the three Mapletree REITs and Frasers L&C Trust, your return would be significantly better than the S-REIT ETFs.

But that’s hindsight. We also shouldn’t forget these REITs were doing very well before 2022.

Going forward, it’s near impossible to tell which of these REITs would perform better. As a result, S-REIT ETFs give you an average performance by including both the strong and weak performers.

Perhaps you’re thinking, “But this average performance, including dividends, since 2022 is still in the red!”

I get your frustration, as I went through the same predicament with my REIT holdings.

But investing is never a theoretical snapshot.

Here’s how you can still be profitable in the long-term even when the stock and sector is not doing well temporarily.

Accumulate in tranches, and never “All-in”!

Despite increasing its dividends over the past three years, PLife still shows a negative return today. However, this is true only if you bought it at the high before the rates hike.

While I never bought PLife above S$5 before, I had two purchases at S$4.74 and S$4.67 in 2021. The key is these weren’t my only purchases of PLife.

I already had PLife since the inception of this portfolio in 2020, and took advantage of the lower prices over the past few years to increase my stake further.

As a result, the average price of my PLife investment is around S$3.5, and I’m currently sitting on a return of more than 40%.

If you are into long-term investing, there’s really no hurry to get everything at one go.

Outperformance over S-REIT ETF might not be as significant?

This final point is my own perception, not backed up by any evidence.

I have always been a stock picker.

I enjoy learning about individual businesses, but I also like the challenge of beating the indices. And getting just a few percentage points higher annual return over the long term does matter.

However, due to the business nature of S-REITs, where they typically distribute 90% of their earnings, their growth is limited.

Consequently, the chance of achieving an outlandish return over S-REIT ETFs is likely lower than with individual stocks outperforming the broader market.

Hence, nowadays I feel little impetus to stock pick on individual S-REIT.

Whichever side you are on, let’s hope the decreasing rates continue to bring some cheers to the S-REIT sector.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.