This is the second part on my coverage of the latest quarterly earning calls of Lululemon Athletica (NASDAQ: LULU), Ulta Beauty (NASDAQ: ULTA), Veeva Systems (NYSE: VEEV) and Zscaler, Inc (NASDAQ: ZS).

Click here if you missed the first post on Lululemon and Ulta Beauty.

Unlike these two leading retailers, I have invested and followed these two cloud software solutions companies, Veeva and Zscaler, for a longer period. In fact, both are in my current portfolio since it was incepted in 2020.

While I continue to like how their businesses have developed over the years, my investments haven’t performed as well as the companies themselves. This is primarily due to overpaying for some of my purchases during the market euphoria of 2021.

Nonetheless, I am glad that my continued investments over the years have seen these two investments turned positive in the past year.

Turning now to the latest quarterly earnings, let me highlight what caught my attention.

Veeva Systems: Measured Execution

After following Veeva for quite some time, my general sense is that the company is driven by a measured and laser-focused management.

AI is coming, but on their terms

I vaguely remembered just a year or two ago, CEO Peter Gassner was open that they did not know how AI could feature in Veeva yet.

However, now that they have better clarity on how it could improve their platforms, they are excited to share how its agentic AI will eventually enable large productivity gains for their customers.

Still, they are not jumping ahead, and will slowly roll it out over the next few years.

A patient, customer-oriented partner

Veeva is taking the same measured approach to the migration from Veeva CRM to Vault CRM, demonstrating its commitment to being a patient and customer-oriented partner.

Rather than forcing an immediate switch, they are providing ample time and support to ensure a seamless transition for their customers.

While this approach might result in a loss in customers, as some could take this opportunity to try another system, I personally think Veeva’s approach will ensure a robust long-term relationship with its customers.

Executive Vice President Paul Shawah provided more colour on this aspect during the earnings call and shared that Veeva now has 9 out of the top 20 biopharmas companies committed to Vault CRM, while Salesforce has 3.

The key difference lies in the implementation and execution.

From a customer’s perspective, migrating from Veeva CRM to Vault CRM is a much smoother process with minimal disruption.

On the other hand, Salesforce builds its systems from scratch for new customers, which requires extensive customization and comes with a lot more uncertainty.

And with the recent resolution of all legal disputes with IQVIA, allowing their data to be put into Veeva software, this is no longer a factor to consider Salesforce over Veeva.

Focusing on its long-term growth

While Veeva’s strategic moves are slow and deliberate, a closer look at its latest quarterly results reveals a potential disconnect with how the market reacted.

Having witnessed a surge in earnings for 1Q FY2025, the market might have reacted negatively to this quarter’s slower growth in billings and guidance. But as CFO Brian Van Wagener pointed out, billings are inherently a bit lumpy because of timing factors, hence it is better to look at the annual numbers.

As seen from the chart, the Non-GAAP operating margin is above 40% again, and a 20% YOY expected growth isn’t too shabby.

I remain focused on the company’s long-term outlook.

Given Veeva’s consistent history of achieving its targets and its current trajectory, I am confident that it will reach its US$6 billion sales goal by 2030.

ZScaler: Scaling Up

The above slide from Zscaler’s latest presentation summarises the investment thesis for the company.

In an ever-increasingly interconnected world, where businesses rely on digital networks for operations, cybersecurity must be a top priority to ensure minimal disruption.

While there are plenty of solutions out there, it’s just coincidental that I have stay invested in Zscaler, rather than the other companies.

And I am pleased that this investment has done well, with Zscaler reporting another year of robust growth with revenue growing YOY by 23% to US$2.7 billion. Consequently, its Non-GAAP EPS grew 26% to US$3.28 for the same period.

More importantly, based on the presentation slides and earnings calls, the company still has a long runway to grow into!

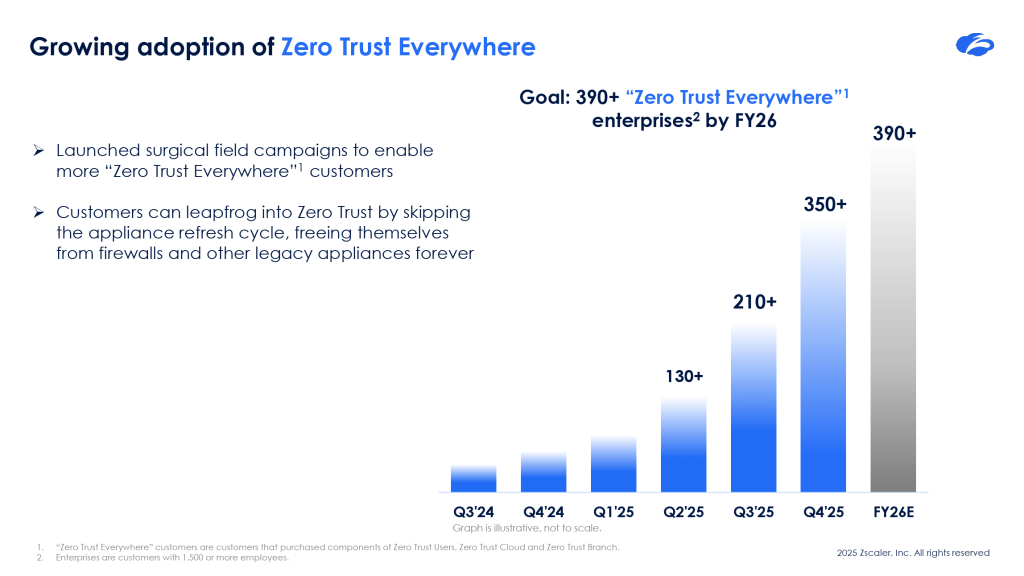

“Zero Trust Everywhere” continues to gain traction

Just six months ago, Zscaler set a goal of having 390 ‘Zero Trust Everywhere’ customers by the end of FY 2026. However, the momentum over the past half-year has increased its customer count by more than 2.5 times, making the initial target seem laughable

To be fair, they probably did not foresee how well their customers reacted positively to the new Z-Flex program, which provides its customers with the flexibility to buy and use various security modules as they need them.

It’s a smart tweak to the sales model that simplifies adoption and accelerates larger, multi-module deals.

AI Security: A new growing segment

AI Security is a rapidly growing segment, and Zscaler’s timely acquisition of Red Canary positions it well to capture a share of this market. As a leader in cloud security, Zscaler’s credibility and reputation should make it easier to upsell its new AI-powered solutions.

I’m still learning about the “Data Security Everywhere” segment, but from what I can gather, it appears to be a natural extension of the Zero Trust Everywhere model. The goal is to ensure sensitive information remains protected at all times, no matter where it is.

Making peace with its GAAP losses

While Zscaler’s growth story remains strong, a persistent concern for me is that the company is still reporting a GAAP loss. Like many SaaS companies, this is primarily due to high stock-based compensation.

That said, I am not overly concern, given its free cash flow positive and it operates at a “Rule of 50” (revenue growth of 23% and free cash flow margin of 27%).

Furthermore, its GAAP loss has decreased significantly over the recent years.

Specifically, the loss per share has fallen by more than 90%, from $2.77 in FY 2022 to the latest $0.27, even while diluted weighted average shares outstanding only increased by 9.6%.

If this trend continues, it is plausible that Zscaler could become GAAP profitable within the next three years.

From LUVZ to UVZ

After reviewing the latest quarterly earnings of the four companies Lululemon, ULTA Beauty, Veeva and Zscaler, it’s clear my heart is with the later three beauties.

Hence, I have divested Lululemon and used the sales proceed to increase my stakes in the other three. For transparency, it’s a 44% loss on the counter but less than 0.3% dent on the portfolio.

I would like to highlight that I’m not averse to holding stocks with depressed prices.

For instance, both Veeva and Zscaler were in the red for many years before turning green in the past year. This reinforces my long-term perspective on high-growth companies.

On a related note, I’m still holding on to The Trade Desk (NASDAQ: TTD) despite being more than 40% down. It plunged by 12% last night following a downgrade from Morgan Stanley, but I remain confident in its long-term prospects.

My decision was therefore based on my assessment of these businesses’ long-term potential.

I accept that I could be wrong, as I have been before, but for now, I remain confident that the long-term outcomes will be positive.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.