It wasn’t intentional, but I love the acronym of the last four stocks that reported their earnings this quarter: Lululemon Athletica (NASDAQ: LULU), Ulta Beauty (NASDAQ: ULTA), Veeva Systems (NYSE: VEEV) and Zscaler, Inc (NASDAQ: ZS).

However, there wasn’t much “luvz” from the market. The price of all these stocks ended lower on the next trading day after their earnings calls, with Lululemon and Veeva seeing a double-digit plunge!

If you zoom out from the beginning of the year, though, with the exception of Lululemon, the other three stocks have appreciated significantly.

To keep the post from getting too long, I’ll be splitting this post into two parts.

In this first post, I’ll dive into the retail sector and briefly highlight what caught my attention about Lululemon and Ulta Beauty, and I’ll share what I will do with my holdings.

Lululemon: Is International Growth Enough?

The recovery exhibited towards the end of last year did not continue into this fiscal year.

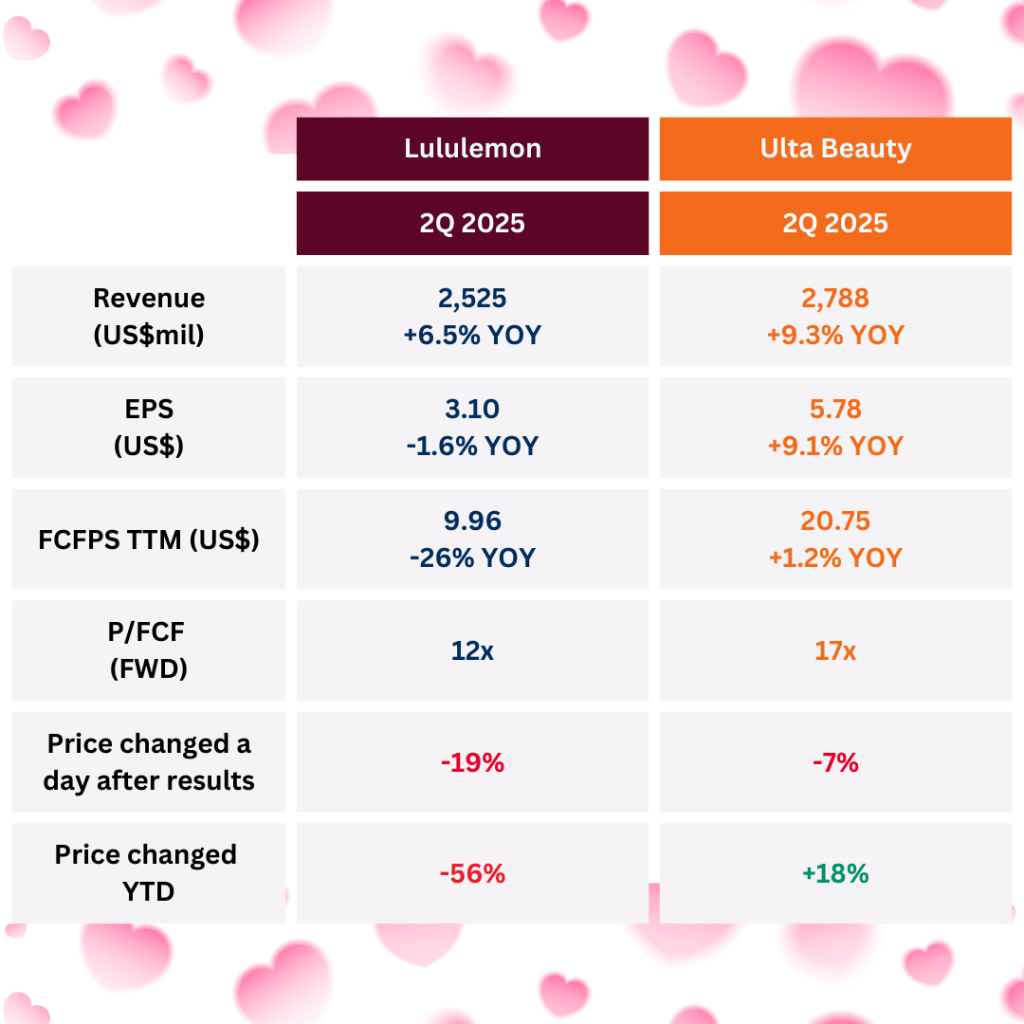

After a tepid 1Q 2025, Lululemon reported another disappointing quarter with revenue up by 6.5% year-on-year (YOY) to US$2.5 billion, but earnings per share (EPS) down by 1.6% to US$3.10 for the same period. And that’s after share buyback of about 1%.

Furthermore, while inventories increased by 21%, Lululemon lowered its guidance for both top and bottom lines for the full year. U.S. is expected to see a decline in sales, and EPS guidance is reduced to just $12.77–$12.97, from $14.58–$14.78 previously.

It’s no wonder then that market sent its share price down by 19% in a day.

The only bright spot is the 22% growth in its international market. It’s impressive and if this trend continues, then the international business will soon account for 30% of Lululemon’s total sales.

But is that enough?

For the short-term, I think it will underperform, and its mid-term future remains in question for me. While I can see the potential of its international business, I’m also wary of a repeat of its U.S. trajectory!

Moreover, after following Lululemon for a year, my sense is that the company’s internal operations seem pretty chaotic.

This is not only supported by CEO Calvin McDonald’s repeated admissions of misreading customer reaction but also by the recent departure of key executives, including the Chief Product Officer and Chief Information Officer, and the creation of a new Chief AI & Technology Officer role.

This significant change in leadership makes me unsure if the current team is able to effectively resolve the headwinds.

I’m not in a rush to get rid of my tiny stake, but it will be the first to go if I’m adjusting my portfolio.

Ulta Beauty: Beautifying the International Market?

While Lululemon struggles with its core market, another leading retailer, Ulta Beauty’s performance for the second quarter was a pleasant surprise for me.

If last quarter’s 2.9% increase in its comparable store sales (comp sales) was strong, this quarter’s 6.7% increase is phenomenal. Consequently, both revenue and EPS increased by more than 9%.

You might wonder why then did its price dropped by 7% the following day.

It turned out that while Ulta up its guidance for the full year, its new higher estimate of only 2.5% to 3.5% comp sales for the full year, fell short of expectation.

Given that the same measure was up by 4.7% for 1H 2025, this new estimate means that management is anticipating a tougher second half — a flat to single digit increase in comp sales.

My sense is the management is being cautious as CEO Kecia Steelman highlighted during the earning calls that “the operating environment continues to be really dynamic”.

Besides that, I get a very different feel of what is happening on the ground at Ulta, as compared to Lululemon. There’s a feeling of excitement on the ground at Ulta, as they are executing their new strategies with a series of key developments.

They recently acquired Space NK in the U.K., opened their first store in Mexico, and are on track to open their first store in the Middle East. In addition, the launch of their new online marketplace model this fall sounds promising.

It’s an exciting time, and whether my investment works out depends on Ulta’s execution.

As you can see, my stake in Lululemon is on shaky ground, while my confidence in Ulta is growing with every new strategic move.

The consumer world is proving to be a challenge, but what about the world of enterprise technology?

In Part II, I’ll open the books on Veeva Systems and Zscaler, two tech companies with very different business models, to see if their performance has me feeling the love.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.