The Advantage of Access 🤝

A key advantage of investing in local companies is the easier access to management. Nothing beats hearing directly from the very people who are running the show on the ground.

Besides attending an Annual General Meeting (AGM), you can also attend events organised by the Securities Investors Association (Singapore), or SIAS. These forums give you a chance to hear from and ask questions directly to a company’s key management.

“Where got time?” you may lament.

Here’s the good news. Thanks to the advancements and accessibility of technology, a large number of these sessions are recorded and uploaded to YouTube.

My Take on Alphabet (NASDAQ: GOOG) 🚀

Speaking of which, the stock price of YouTube’s parent company, Alphabet (NASDAQ: GOOG), jumped 9% yesterday.

This came after a federal judge, in a major antitrust case, ruled that Google would not be forced to sell its Chrome browser.

I was of course happy with the outcome and pleased to have doubled my holdings in the first half of the year.

Though I’m not increasing my position further, I believe that even after the surge, the company trading at at a forward Price-to-Earnings ratio of around 21 times, is still not expensive.

Back to Local: iFAST Corporation (SGX: AIY) 🇸🇬

Returning to the topic of investor outreach recordings, I just watched the recent Corporate Connect of iFAST Corporation organized by SIAS.

And you know what?

Despite having invested in iFAST for eight years, I still took away new insights from the sharing!

I’ll highlight a few points that caught my attention and leave you to watch or listen to the video for more.

Making B2B Stickier

The information was always there, but it simply didn’t catch my attention. iFAST’s Business-to-Business (B2B) segment is larger than its Business-to-Consumer (B2C) segment, accounting for roughly two-thirds of its net revenue.

In this segment, iFAST provides a comprehensive wealth management platform to its partners, including banks, financial advisory firms, and other financial institutions.

By setting up the IT infrastructure, systems, and securing the necessary licenses, iFAST allows its partners to focus solely on their core business of serving clients.

This creates a high barrier to entry and a “sticky” relationship, as these partners become reliant on iFAST’s platform. More importantly, this model means iFAST also benefits when its partners do well.

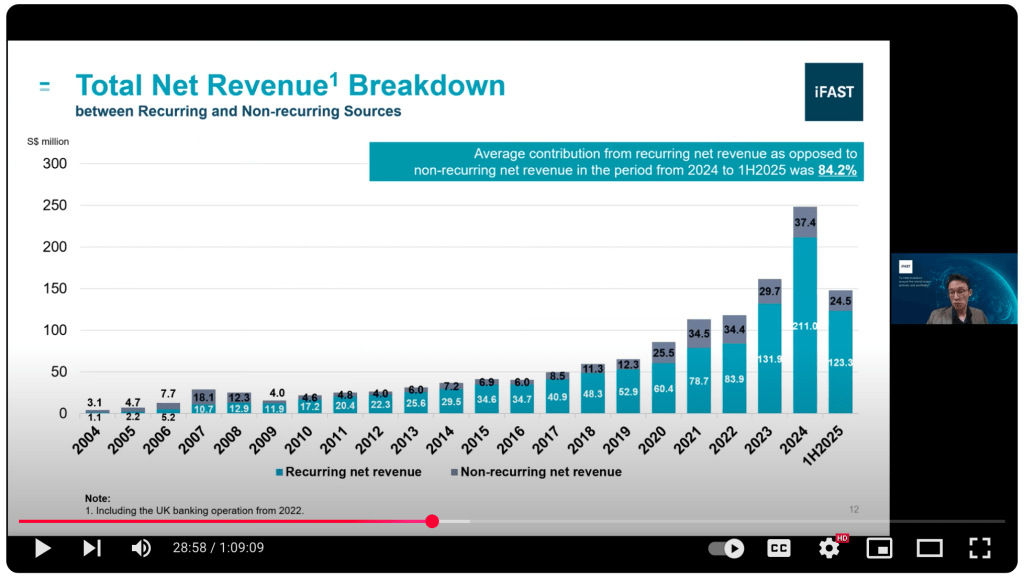

The success of this model is evident in its numbers: iFAST’s Assets-under-Administration (AUA) has grown steadily over the years, with 84% of its net revenue recurring in the first half of 2025.

A Differentiated Model

This business model is strikingly similar to Shopify‘s (NASDAQ: SHOP) approach, which is built on the philosophy of “when our merchants succeed, we succeed.”

The key difference is that, unlike Shopify, iFAST also has a significant B2C segment.

You might notice a unique relationship between iFAST’s B2C and B2B segments, as some of its B2B partners are also direct competitors in the B2C space.

While this may sound strange at first, it’s like a wholesaler who also sells a portion of their products directly to the public. It’s a sound strategy, especially when the market is large enough for everyone to grow into.

More importantly, iFAST isn’t resting on its laurels.

The recent approval by the Monetary Authority of Singapore for a Trust Business License and the approval-in-principle from Bank Negara Malaysia to operate as an Electronic Money Issuer are examples of how iFAST is continuously improving its platform to integrate solutions for both its B2C and B2B segments.

Other Recordings

Besides the iFAST video, I also watched recent recordings for two other companies I’ve invested in: HRnetGroup (SGX: CHZ) and Micro-Mechanics (SGX: 5DD). Similarly, despite investing in both for many years, I still had new takeaways from their presentations.

I highly recommend seeking out these opportunities to learn directly from management as it can provide an invaluable edge to your research.

Enjoy the recordings!

Related posts

iFAST 2Q 2025: 38% Profit Surge, More Growth on Horizon

Is HRnetGroup a Dividend Play? Investor Day Insights

Micro-Mechanics Profits Surged 54%: Balancing Growth Potential and Dividends

Alphabet 2Q2025: More than Search, Cloud’s the Growth Driver

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

Thank for sharing the videos, they are very relevant and also gives an insight into the companies. Thank you.

Regards Grace

Most welcome. I’m glad you found them useful.