Thinking about retiring early? I just published a new article on The Smart Investor about what you should consider.

I suggest you read it first, then come back here to find out how I personally dealt with some of the points I raised. I’ll also be sharing some related posts and books for your further exploration.

From my experience and conversations with others, taking the leap into early retirement is hard due to the uncertainties.

No matter how much you crunch the numbers, the fear of not having enough money still lingers, and the fear of not knowing what you will do next is very real.

When you fail in your wealth accumulation journey or career in your twenties or thirties, you can always pick yourself up and try again.

However in your forties and fifties, if your retirement plan doesn’t work out, it’s a lot harder to bounce back.

So, if there’s one thing to take away from my article, it’s this.

Adopting a mindset that you can adapt to the changes, whether in your money or lifestyle during retirement, would probably be the deciding factor whether you will enjoy your next stage of life.

Once you’re able to shift that mindset, it becomes a lot less scary.

That was me three years ago. I decided to take the plunge because I believed I would be able to adapt to any change that came along.

I’m not suggesting you should be reckless; you still need to do your planning, both monetary and psychological.

But there’s only so much you can plan for, and you can never be 100% certain, especially with the non-monetary aspects.

In fact, from my own experience, I’ve deepened my knowledge about finance, investment, and retirement over the past three years. Would you believe I didn’t even know about the 4% safe rule three years ago?

The past three years have also been a time of self-exploration, with new experiences and opportunities popping up along the way.

Further Reading

Before writing the article, I read “How to Retire: 20 Lessons for a Happy, Successful, and Wealthy Retirement” by Christine Benz, which was recommended by Chin(Co-Founder of The Smart Investor).

The 20 lessons are presented as interviews, covering different aspects of retirement comprehensively. I strongly recommend this book if you would like to explore the topic further.

The other book I’m currently reading is “Taking Stock: A Hospice Doctor’s Advice on Financial Independence, Building Wealth, and Living a Regret-Free Life.”

This book focuses more on the non-monetary aspects, and based on what I’ve read so far, I would recommend it as well.

Finally, the following are related posts where I’ve shared more about my journey. I hope my sharing has benefited you in your own exploration.

Enjoy the journey!

Achieving Financial Independence: A Sustainable Path

2 Years Into “FIRE”: What have Changed?

The Forties Crossroads: I Chose the “Slower” Path, Should You?

Thriving in My Fifties: Financial & Life Plan for the Next Decade

Don’t Follow Rules Blindly: Why I Ditched The 4% Rule

Work is NOT Just Paid Employment

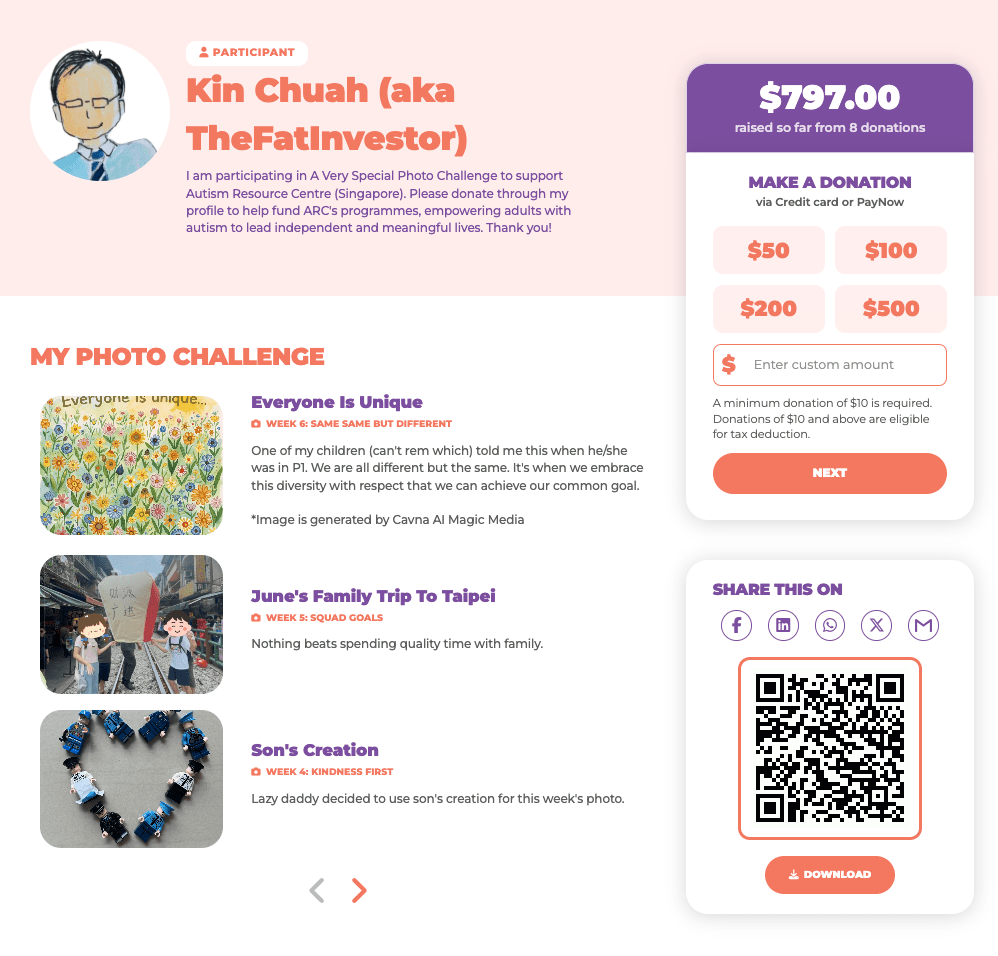

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.