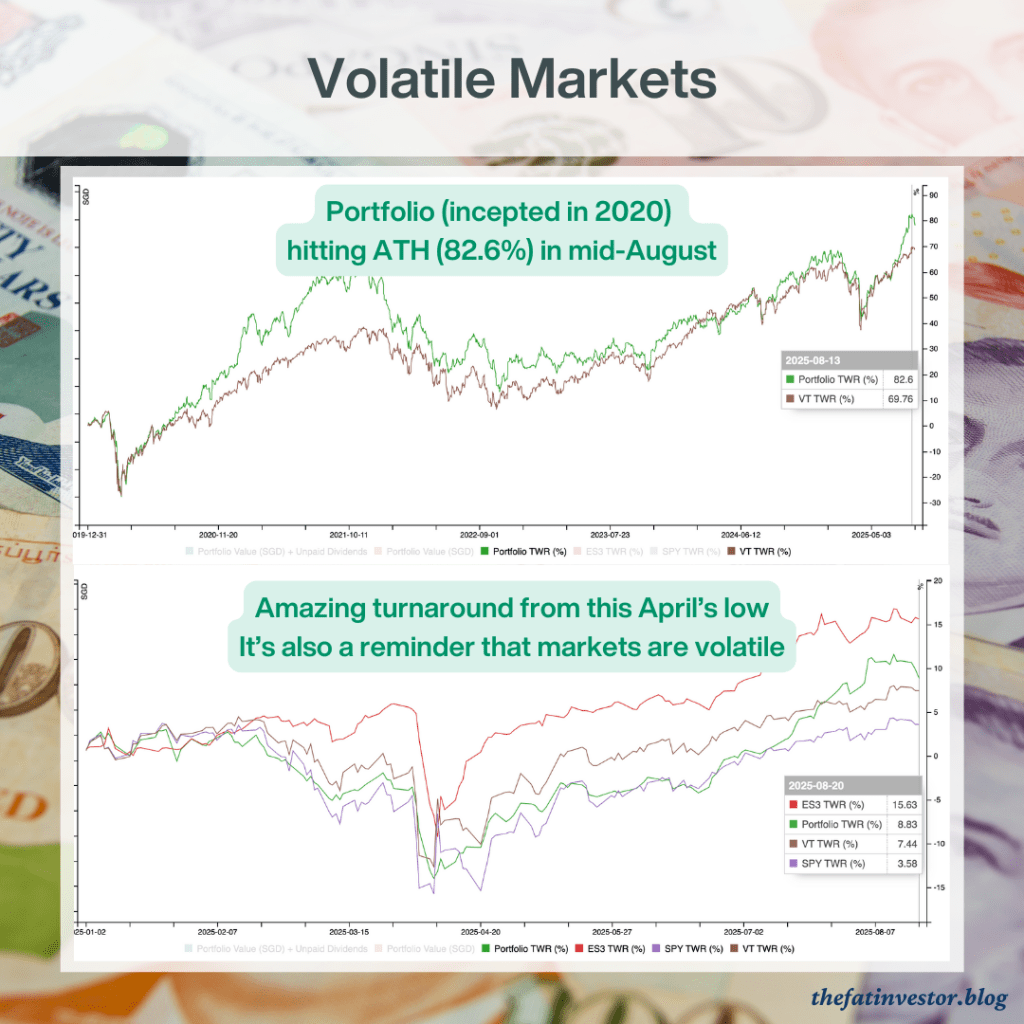

July’s exuberant markets saw my portfolio hitting an all-time high in mid-August. Since then, the dopamine level has dropped a bit, but it’s still a remarkable turnaround from the low point in April.

This journey is a great reminder of how volatile the stock market can be.

This volatility isn’t limited to individual stocks. Even if you invest in broad market indices through exchange-traded funds (ETFs), you’ll still experience these ups and downs.

For instance, the SPDR S&P 500 ETF (SPY) is up 8.8% year to date, but that gain came after multiple dips throughout the year and a significant correction in April.

The market simply doesn’t move in a straight line.

If you are wondering why the 8.8% return for SPY doesn’t match the 3.58% shown in the above chart, it’s due to currency fluctuations. Since the chart is in SGD, it includes a 5-6% loss from the US dollar’s decline this year.

This same currency effect also applies to other US-based ETFs, such as the Vanguard Total World Stock ETF (NYSEARCE: VT). As for my portfolio, with only around 30% US equities, the impact is more modest at 1.5-2%.

The market received a dose of dopamine last evening, following Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole event. Investors interpreted his comments as a signal that a rate cut is likely in the coming months.

This positive sentiment caused SPY’s year-to-date return to jump to 10.1% overnight, showing just how quickly market sentiment can change.

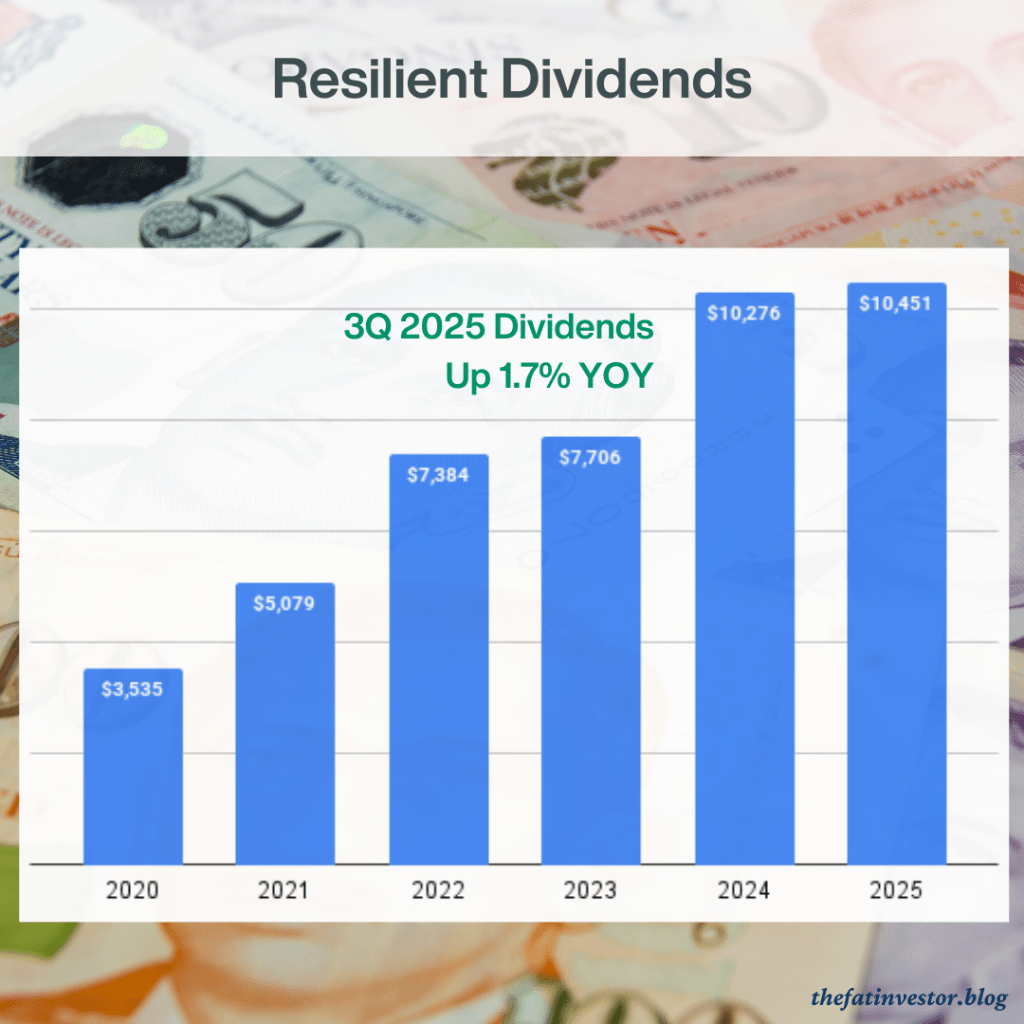

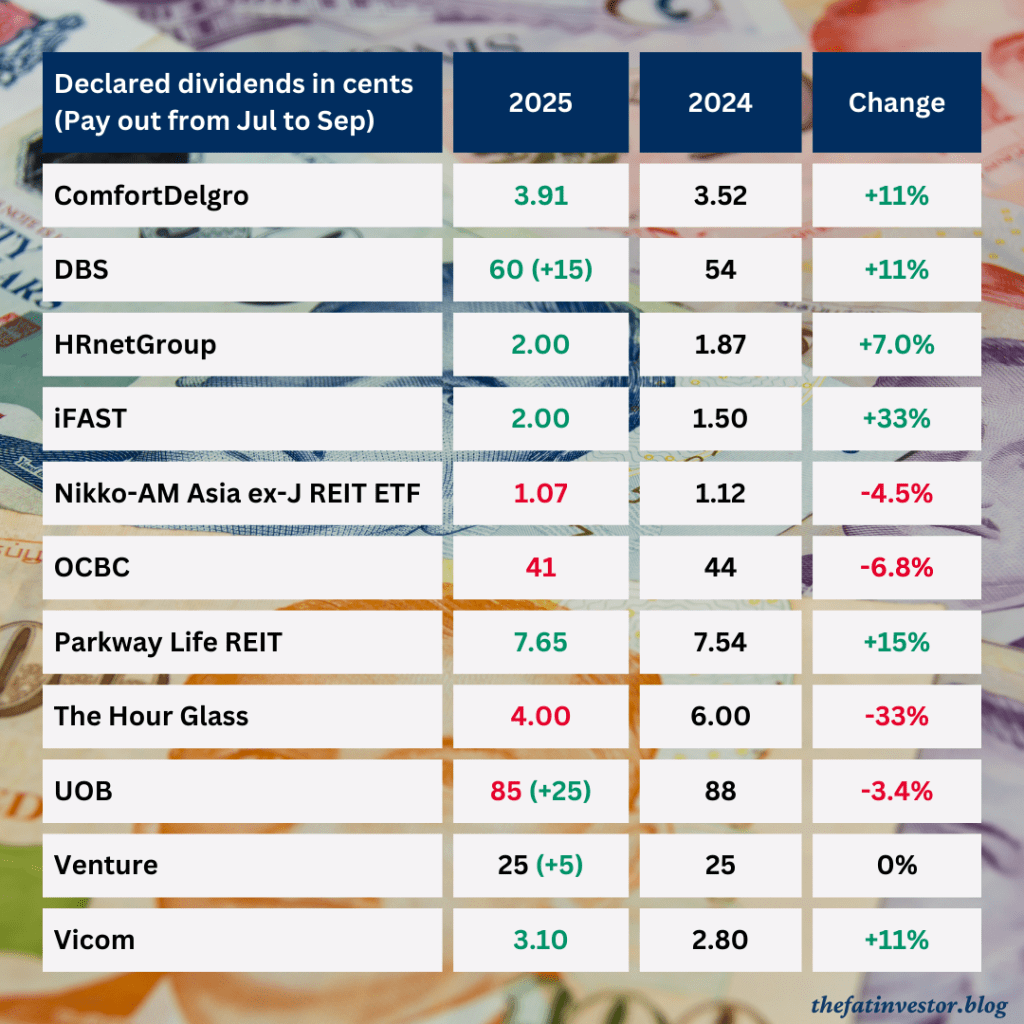

This quarter’s dividends, which pipped last year’s level by 1.7%, provide a much-needed stabilising effect amid market volatility. Unaffected by the market’s mood swings, dividends from businesses that managed to stay profitable, deliver a steady cash flow to the portfolio.

While it’s nowhere near the 33% jump last year, I am satisfied with its resilience after I adjusted my income portfolio in May (read here and here).

What’s more satisfying is that many of these companies, with their robust cash flow and balance sheet, are able to sustain the dividends.

Even for companies that declared less dividends, the drop wasn’t too significant. The one big exception was The Hour Glass (SGX:AGS), which I’ve written about it here.

For the full year, current projection indicates a slight decline in dividends.

However, with the stronger performance this year, Micro-Mechanics (SGX: 5DD) might declare a higher final dividend per share when it announces its full year results next week.

Combined with the possibility of higher dividends from NikkoAM-StraitsTrading Asia ex Japan REIT ETF (SGX: CFA) and Frasers Centrepoint Trust (SGX: J69U) in the final quarter, I might just surpass last year’s record of S$30,100 collected dividends.

Ultimately, it’s the steady stream of dividends that provides the peace of mind to navigate the market’s ups and downs.

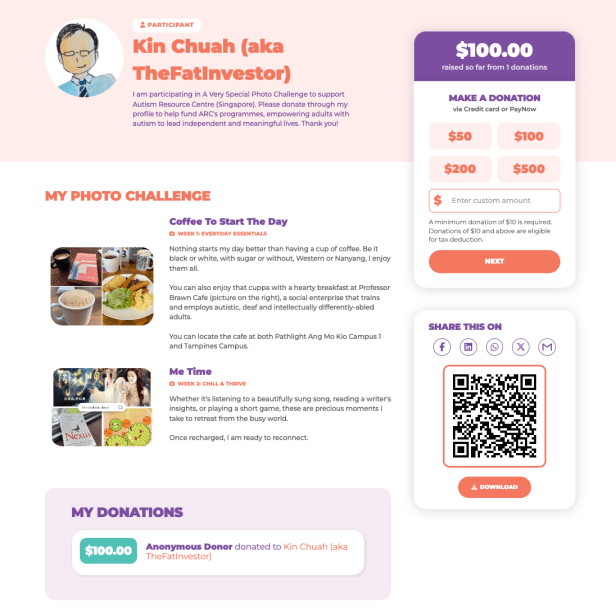

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.