HRnetGroup Ltd (SGX: CHZ), Singapore’s leading recruitment firm, just announced its results for the first half of 2025, and the numbers look good.

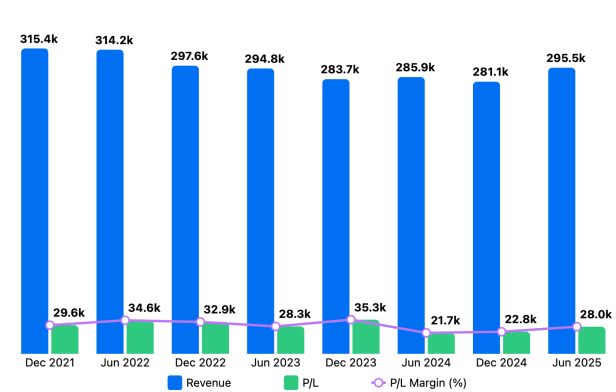

Revenue grew 3.4% year-on-year (YOY) to S$296 million, and net profit jumped by 29% to S$28 million.

Did that 29% profit jump catch your eye?

Before we celebrate, let’s look at what’s driving it.

This surge wasn’t a surprise.

It was primarily due to deferred government subsidies that had previously caused a 30% drop in profit during the last financial year (FY 2024).

This half’s increase was an anticipated rebound, not a result of explosive core growth.

A closer look at the results reveals a more accurate picture.

Gross profit, which excludes the impact of this “other income,” actually saw a slight decline of 2.8% year-on-year, and the gross profit margin dropped to 20.7%.

Despite these fluctuations, HRnetGroup’s stable performance reflects the resilience of its business model as it adapts to a rapidly changing and uncertain environment.

More importantly, the increase in revenue, after a few years of decline, offers optimism that the investments made during this period are beginning to pay off.

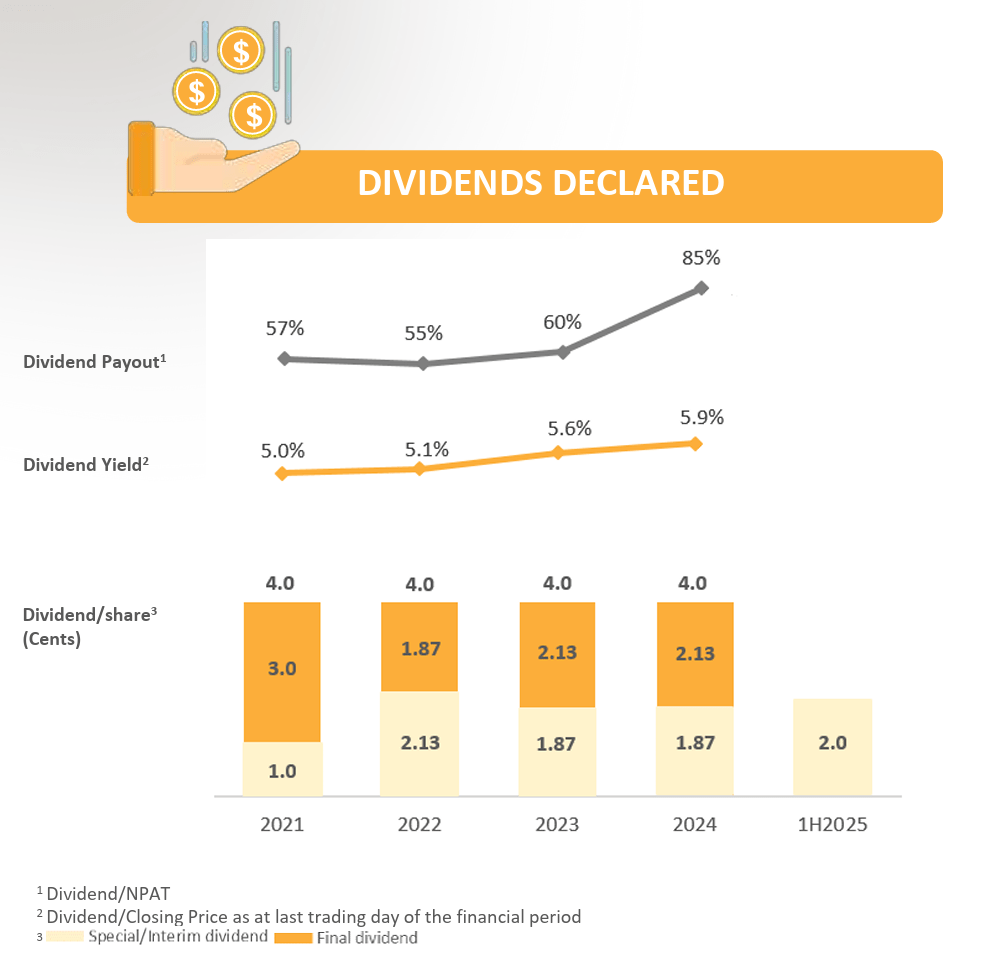

Even if it still takes a few more years for meaningful growth to materialise, HRnetGroup’s strong cash flow and robust balance sheet should allow it to continue paying out consistent dividends.

The current S$0.04 dividend per share offers an attractive yield of 5.6% at last Friday’s closing price of S$0.715.

While not guaranteed, it’s significantly higher than the latest Singapore Savings Bond’s 10-year average interest of 2.11%.

Furthermore, HRnetGroup has shown a clear willingness to share its profits with shareholders.

Despite lower sales and profits over the past two years, the company was able and chose to maintain its dividends.

With the improved performance for this period, the company even increased its interim dividend per share to S$0.02.

Hence, as long as its business can continue to grow, we can anticipate higher future dividends.

This naturally brings us to the next question: “Can HRnetGroup continue to do well?”

Nothing beats hearing directly from the key personnel to learn more about the company’s potential and challenges it faced.

I missed the AGM earlier in the year, and am glad that I could make it for HRnetGroup Investor Day 2025 held on last Friday’s evening.

Before sharing additional insights I gained from the event, I would like to give accolades to the staff of HRnetGroup and the trio from The Joyful Investor, for an event well-organised.

Grateful for the hospitality shown by the hosts, from the food to the book, and all the behind-the-scene work done.

Now, let’s dive into why HRnetGroup is likely to stay resilient, grow and increase its dividends.

Resilient Business: Adaptive Model and Mindset

“Headhunting” is probably the first word that you associate with recruitment companies.

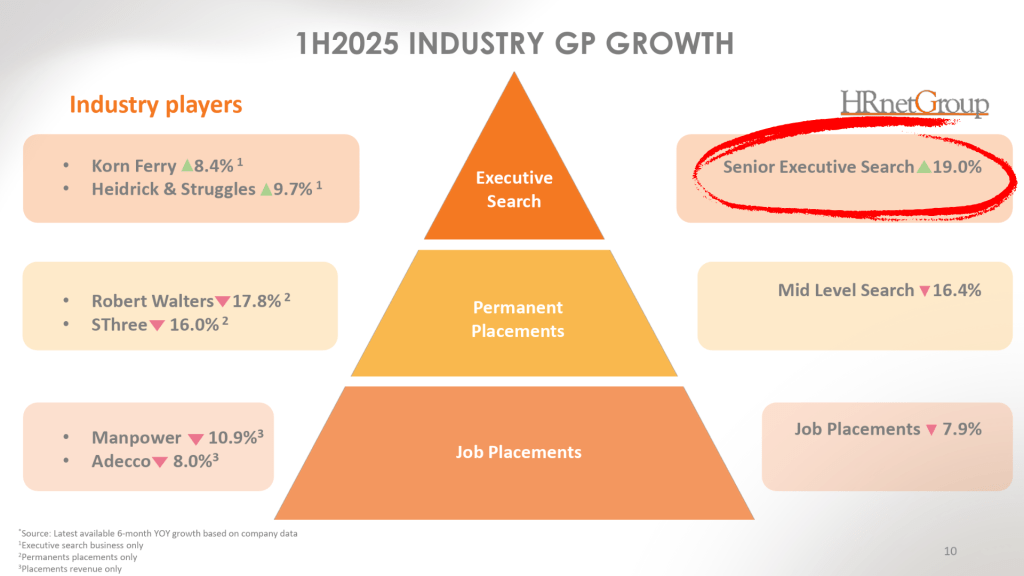

This is a competitive but lucrative business with high gross profit margin (GPM). However, its demand fluctuates with economic conditions and consequently earnings are volatile in this industry.

While this is what HRnetGroup faces in its Professional Recruitment (PR) segment, what differentiates the company is its Flexible Staffing (FS) segment.

Twin Engines of Growth

The FS segment comes with a lower GPM, but experiences increased demand during economic downturns, providing stability and recurring income during uncertain times.

Over the years, HRnetGroup has established itself in FS as it is one of the few companies that provide these end-to-end solutions efficiently and at scale.

Chief Corporate Officer (CCO) Adeline further added that FS is not only capital intensive but also system intensive. The company’s capability to customise its platforms to cater to clients’ diverse needs provided the company an edge.

A Culture of Adaptability

Crucially, what I observed is the company’s adaptability — how its people pivot accordingly to achieve favourable outcomes.

The growing of its FS segment is just one example. The company has also pivoted from an offline firm at its IPO to a technology-driven company today.

Last year’s renewed focus on PR for Senior Executives is yet another testament to this adaptability, and it turned out to be the bright spot for this segment in the first half of 2025.

The twin engines of PR and FS segments, combined with an adaptive mindset, provide the foundation for HRnetGroup to seek future growth.

New Avenues for Growth: Products, Places, and People

Besides adapting, business needs to plant new seeds for its future growth.

This is exactly what HRnetGroup is doing. The company is expanding into new products and services to capture a broader share of the HR market.

For example, it has launched HR consulting practices like LEAPS and established a brand, Doudou, to handle Employer of Record (EOR) services.

These new ventures, while still small, diversify the company’s revenue streams and allow it to offer a more holistic suite of HR solutions to its clients.

More importantly, HRnetGroup is driving its future growth with its co-owners, which after ten new invitations, total to 45.

This unique co-ownership model is a key differentiator.

It’s not uncommon for companies to have a presence in many cities, but HRnetGroup sets itself apart by empowering its co-owners to become the leading local player in each of its 18 Asian cities.

A co-owner’s motivation is fundamentally different from that of a salaried employee; their remuneration is tied directly to the business’s expansion and profitability.

As CCO Adeline shared, interviewees for a chance to be a co-owner are explicitly told they should expect to earn more from dividends than salary.

This system ensures a clear alignment of interest because the co-owners are also shareholders, with personal financial stake from their share purchases.

My Take

“万事俱备,只欠东风” (All is ready, all that is lacking is the east wind).

This is how I view HRnetGroup today.

The company, having laid a strong foundation with its resilient business model and unique co-ownership structure, has also planted new growth drivers.

With all the necessary elements in place, it’s only a matter of time before its growth returns.

For now, I’m content to maintain my stake and enjoy the attractive dividends.

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

Insightful

Thanks!

Thank you for your write-up.

Most welcome.