This is the first set of results reported by VICOM Ltd (SGX: WJP) and ComfortDelGro Corporation (SGX: C52), or CDG, after my reinvestment last month.

I am pleased to learn that both companies performed well for 1H 2025, and consequently declared an interim dividend which is more than 10% higher than the previous year.

I will highlight what caught my attention, starting with VICOM as its business is a lot more straightforward.

OBU driving VICOM sales and ongoing capex for Jalan Papan

Primarily due to the Onboard Unit (OBU) project and partly by increase in testing volume from the manufacturing and construction sectors, revenue for the first half surged by 24% year-on-year (YOY) to almost S$70 million.

Higher operating staff costs from OBU subcontractor fees dampened the increase in net profits, which nonetheless grew by a respectable 10% YOY to S$15.6 million.

As a result, its net profit margin for 1H 2025 stands at 22.3%, significantly lower than last year’s 25%.

This implies that the profit margin for the OBU project is likely lower than its core business.

Keep this in mind as I project about its business after this OBU project.

Next, onto its balance sheet and cash flow.

While net cash flow from operation is a robust S$19.2 million, VICOM continues to spend significantly, on the development of Jalan Papan site.

Its capital expenditure (capex) for this half is more than S$13 million, and combined with the S$10.2 million paid out in dividends, its cash and equivalent decreased by about S$5 million to S$55.6 million.

Though the capex is hefty, it’s much lower than the anticipated S$50 million for the year, which raised my hope that there might be a revised lower capex for the year.

However, in response to my email inquiry, VICOM maintains the same anticipation, which means another S$37 million will be spent in the second half.

What this meant is if the second half’s results mirror the first, its cash and equivalent will drop to around S$28 million, as shown in the calculation below.

projected cash & eqv ≈ current cash & eqv + proj op cash flow – capex – dividends

= 55.6 + 19.2 – 37 – 10.2 = S$27.6 million

While this might not feel as secure as having a S$50 million cash kitty in the balance sheet, I believe this investment in Jalan Papan site would drive VICOM’s future growth, especially in the non-vehicle testing segment.

Furthermore, the expected operation of this facility in the first half of 2026 is well-timed to offset the revenue impact from the OBU project, which will cease by the end of 2026.

And given that the OBU project has a lower margin than VICOM’s core business, the impact on its net profit and operation cash flow should be even lower.

More importantly, with capex normalising, there is a high chance that VICOM could at least maintain its dividends.

Overseas acquisitions boosted CDG’s return

Turning to CDG, the analysis is far more complex.

Besides the Inspection & Testing segment provided by VICOM, its other segments include Public Transport, Taxi & Private Hire, Other Private Transport, and Other Segments.

I will not provide a detailed breakdown, as that information is available in the company’s presentation slides.

Instead, I will share the table that I compiled to help my understanding of its various segments and my thoughts on its future prospects

I hope the above table provides you a sense of CDG’s business from its various segments.

It certainly helps me to have a better clarity of how CDG earns its money.

While Public Transport segment contributes most to CDG’s top line, its profit margin is low.

Conversely, the bottom line is boosted by both the Taxi & Private Hire and Inspection & Testing Services segments, with the former having a larger impact.

For 1H 2025, the revenue was flat for the Pubic Transport segment, but it should receive a boost in the coming quarters and years with the commencement of the new contracts such as Victoria bus services (July 2025), Stockholm Metro (late 2025), and Singapore Jurong Regional Line (2027).

Hopefully, the operating margin can at least maintain at 4 to 5%, which will then give the bottom line a meaningful boost.

As for Taxi & Private Hire segment, the acquisition of A2B Australia and Addison Lee definitely boosted its top line, but this comes at a cost of lowered margin.

That said, given the significant increase in revenue, the lowered margin is worth the trade-off.

This is especially so if there’s further growth potential. Also, there’s a possibility that with integration and synergy, the margin might improve in a year or two.

Earlier, I have discussed the Inspection and Testing Services, and any growth for VICOM will benefit CDG’s net profit.

My sensing is that CDG is moving in the right direction. However, unlike VICOM, there’s so much more moving parts that will cut both ways.

Well managed, CDG has longer growth runway, but any hiccup in any business or geographical segments will drag its overall performance.

Adding foreign exchange and borrowing costs to the picture, made its visibility even lower.

I will keep this consideration in my mind and continue to monitor how things unfold in the next year or two.

Then, I will decide if I want to keep both stocks or just one of them in my portfolio.

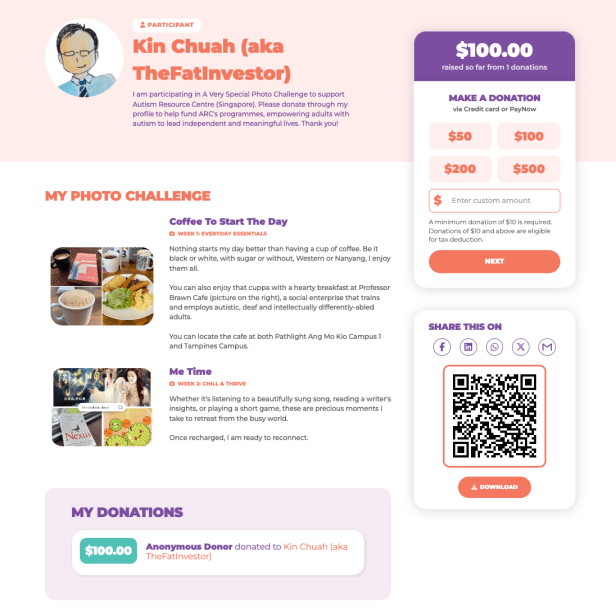

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.