Last September, I reinvested in UMS Integration (SGX: 558) as I was impressed by the significant developments that had occurred since my previous divestment.

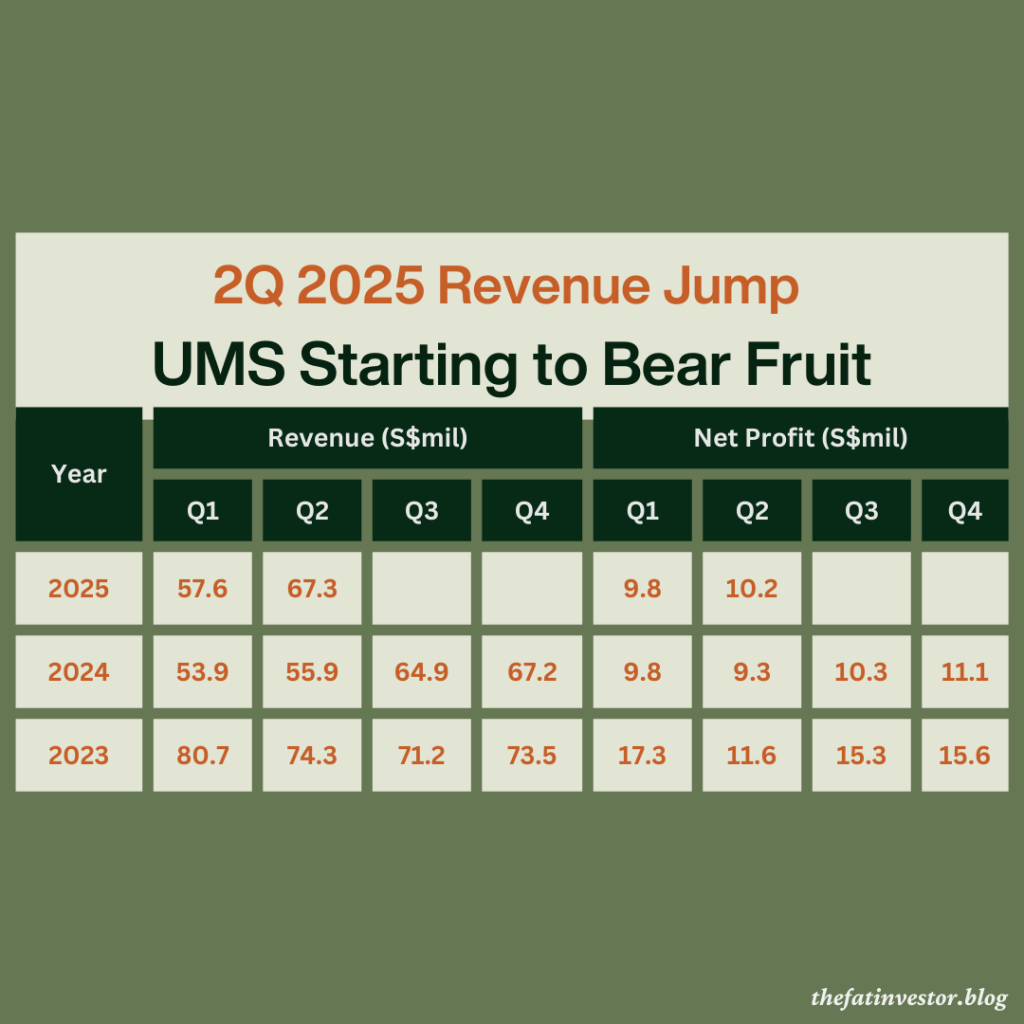

The seed planted has grown well over the past year, and latest 2Q 2025 earnings provided evidence that this investment is starting to bear fruit.

Revenue for the quarter surged by 20% year-on-year (YOY) to S$67.3 million and net profit grew by 10% to S$10.3 million for the same period.

Even more promising is the quarter-over-quarter progress: its top and bottom lines grew by 17% and 4% respectively, which indicates strong positive momentum.

What else caught my attention?

Beyond the headline numbers, here are some other data that caught my attention.

It’s the second consecutive quarter that UMS piled on its inventories, increasing to a hefty S$22 million for the first half of this year, as compared to S$3 million in the previous year. That’s a staggering 645% increase!

As an investor, I’ve learnt to be wary of such exceptional figures, as they could artificially inflate a company’s revenue and mask weak performance. Such a move could also strain a company’s cash flow and affect its daily operations.

However for UMS, the significant increase in inventories is due to the anticipated ramp-up in production in the coming quarters. As mentioned in the press release, its two key customers have committed to major expansion plans and have announced robust earning guidance.

Interestingly, from a reference that UMS shared about its outlook, it indirectly confirmed that Lam Research (NASDAQ: LRCX) is its new key customer.

It’s a relief that despite the inventory jump and increased depreciation, net cash flow from operations has remained relatively stable due to an increase in trade payables. This probably means UMS has not paid for some of the inventories yet.

This indicates that UMS is not overly aggressive when managing its current expansion.

Furthermore, it means the company is likely to at least maintain its dividends, striking a balance in its growth and rewarding shareholders. At S$0.05 per share, that’s a decent yield of around 3.4%.

Beyond dividends, its business recovery and successful secondary listing in Bursa Malaysia appeared to have boosted its share price, which appreciated by about 40% year to date.

I am pleased with the progress made by UMS and am looking forward to its continued recovery.

I will be holding on to my current stakes as I believe that more fruits will be borne in the coming quarters and years.

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.