The peril of investing in highly valued stocks lies in the market’s high expectations.

Even if a company performs well, its stock price can be hammered down if it merely meets expectations or lowers its short-term guidance.

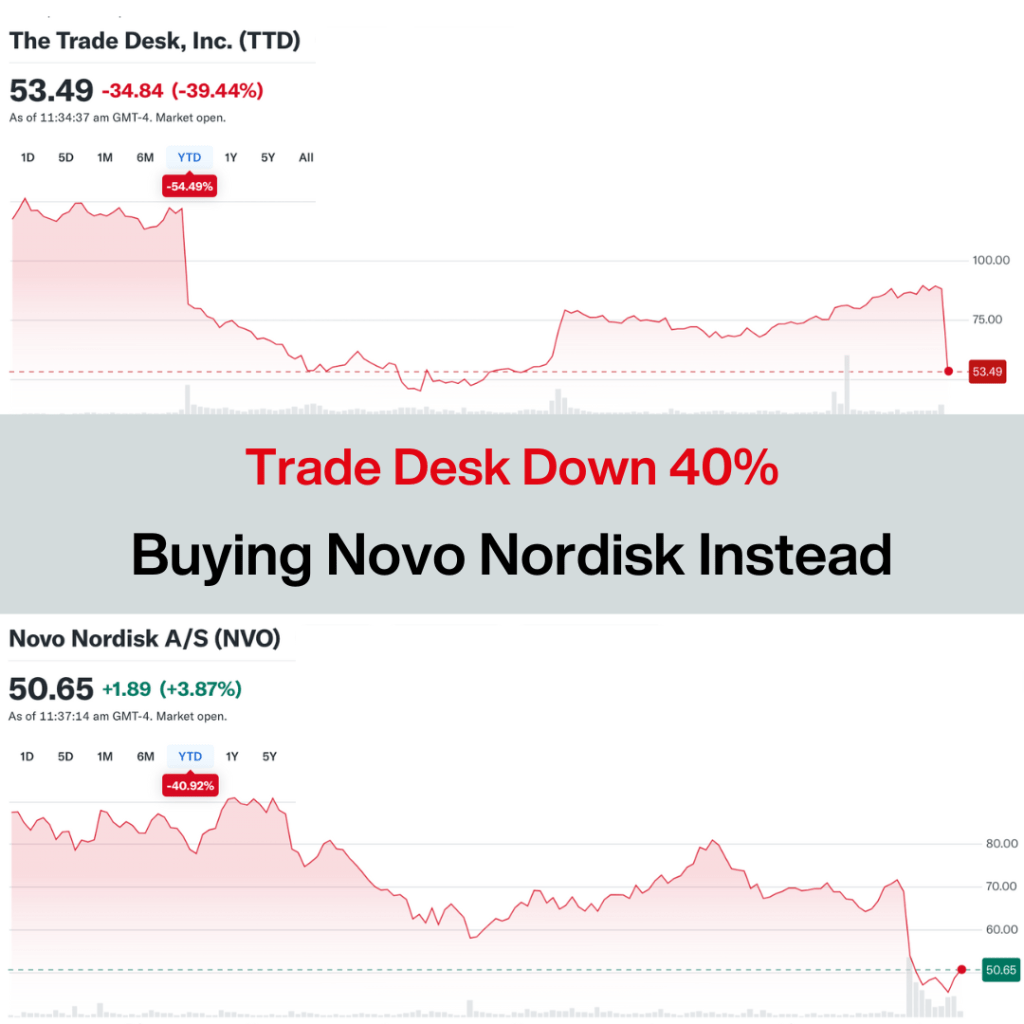

This is exactly what happened to The Trade Desk (NASDAQ: TTD) after it reported its 2Q 2025 results.

While revenue increased by a respectable 19% year-on-year (YOY) to US$694 million, beating the consensus estimate of US$686 million, market was likely hoping for a growth rate above 20%.

To make matters worse, the Q3 2025 guidance is only US$717 million. This translates to just an anticipated growth of just 14% YOY, or approximately 18% after excluding the benefit of U.S. political ad spend in 3Q 2024.

Consequently, its share price plunged by almost 40%, and closed at less than US$55 by the end of the trading day.

Personally, I was disappointed with the sub-20% growth, especially since Trade Desk has consistently achieved more, including a 25% YOY growth as recently as 1Q 2025.

This might indicate that growth is slowing further.

However, knowing that the company underwent significant strategic transitions toward the end of the last fiscal year, I wonder if this year’s growth rate is just an anomaly.

My hope is buoyed by what CEO Jeff Green mentioned during the earnings call: “We see clearly what is on the horizon for our space, and we’re convinced we’re the best-positioned company in adtech to accelerate our growth in 2026.”

This gives me reason to be optimistic that growth could rebound above 20% again next year.

So why am I not adding more?

At US$55, the estimated Price-to-Sales (P/S) ratio for the current year is just over 10x, nearly half of its historical P/S ratio.

Even if we assume a conservative sales growth of just 15% going forward, the Price-to-Sales-to-Growth (PSG) ratio would be less than 0.7x.

To me, this is a very reasonable price, provided you believe in CEO Jeff Green’s vision for the immense potential of the open Internet, a space Trade Desk can continue to dominate.

I’m currently leaning toward the belief that Trade Desk still has a long runway for growth, and I did immediately consider adding to my position.

However, the evening before, I stumbled upon another opportunity and initiated a small position in Novo Nordisk A/S (NYSE: NVO) at around US$48.22.

Similarly, I felt the market had overreacted to its lowered guidance, sending its beleaguered stock price down by another 35%.

Paying just 12x its forward Price-to-Earnings (PE) ratio for this mega pharmaceutical company, which is still growing in the double digits, seemed like a great deal to me.

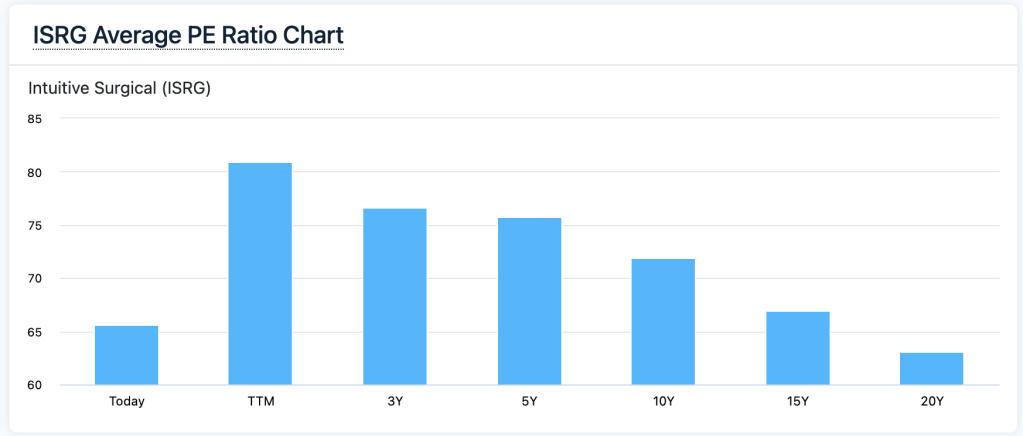

Furthermore, I increased my position in Intuitive Surgical (NASDAQ: ISRG) just a week ago.

I was impressed by its latest results and am confident that it can sustain the current growth momentum in the foreseeable future.

When the share price dipped, I took the opportunity to buy it at a forward PE of 48x. While this may appear expensive, it’s actually cheap compared to its historical valuation.

With the above purchases, I used up the spare cash in my U.S. portfolio, so I’m holding back on adding more Trade Desk for the moment.

I do not rule out a future purchase though if its price drops further and presents a better opportunity than some of my current holdings.

For transparency, Trade Desk only took up 1.4% of my portfolio. Hence, the massive plunge only impacted my portfolio by only 0.5%.

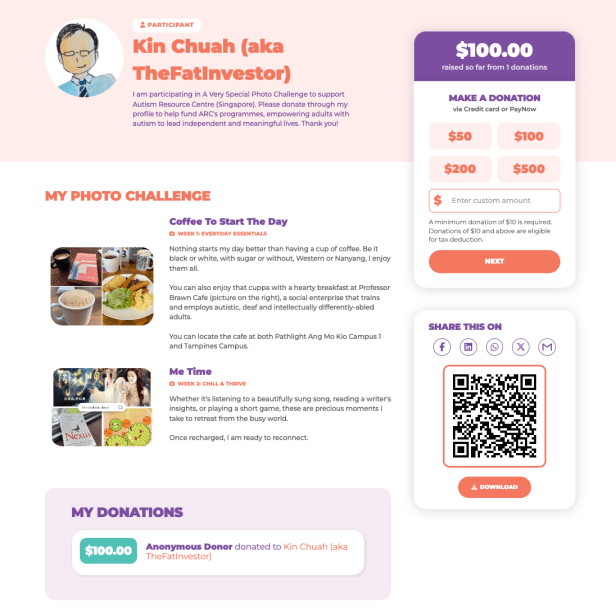

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.