Following the strong results from my top U.S. holding, Arista Networks (NYSE: ANET) yesterday, my second top U.S. holding, Shopify Inc (NASDAQ: SHOP), also delighted with a sparkling 2Q 2025 performance last evening!

Revenue for the quarter jumped 31% year-on-year (YOY) to US$2.68 billion, and free cash flow increased by almost 27% to US$422 million, maintaining a margin of 16%.

“When our merchants become more successful, Shopify becomes more successful,” the company’s core approach, is key to its growth.

Indeed, Shopify exemplifies this by expanding its foothold with existing customers, providing them with the necessary tools to thrive.

Furthermore, its growing reputation attracts new brands to migrate to its platform. Notably, in this quarter, Starbucks Corporation (NASDAQ: SBUX) and Miele are new logos captured by Shopify.

Consequently, this is reflected in the numbers. As the chart illustrates, there is a high correlation between Shopify’s revenue growth and Gross Merchandise Volume (GMV) growth.

The growth of GMV accelerated this quarter to more than 30%, reaching a high of almost US$88 billion. At the current expansion rate, GMV is likely to breach US$350 billion for the full year.

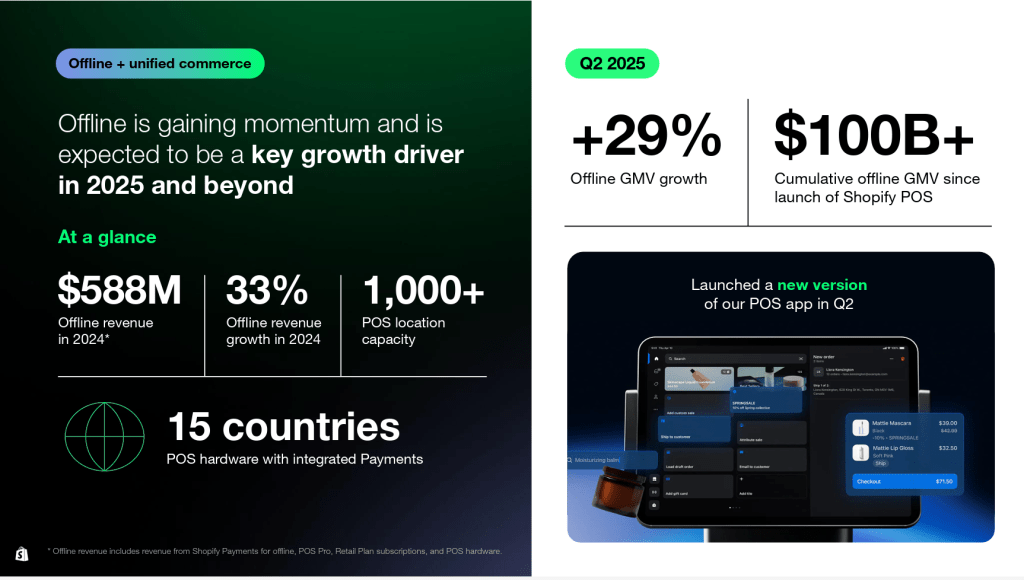

One interesting growth driver that caught my attention is its Offline revenue and GMV.

Despite the “noise” that physical stores are dying in the age of e-commerce, Shopify—a platform known for assisting merchants with online businesses—is gaining market share in physical commerce!

This is a strong indication that the way forward for retail is not just online, but truly omnichannel.

Solid business but expensive stock

There is no doubt that Shopify has a solid business model with tremendous growth potential. However, owning this business comes with a huge price.

After the price surged by more than 20% last night to US$155, it is now trading at a price-to-free cash flow (P/FCF) ratio of 116x!

That said, this is not much higher than its three-year average of 94x. It’s important to note that five- and ten-year data are not as relevant because Shopify’s earnings and free cash flow were not yet consistent in its earlier years.

To be honest, with its share price volatility, it hasn’t been easy for me to buy and hold on to Shopify’s shares.

My investments over the past six years have been a series of purchases, ranging from a price (adjusted for 1-to-10 split) of as low as US$37 to as high as US$151!

Taking a look at my past transactions now, my regret is selling 30-40% of my holdings in 2023 and 2024. But I’m glad I held on to more of my shares and also added to my holdings in March this year.

Going forward, I will continue to hold my current stakes to participate in Shopify’s future growth.

While I’m thrilled with my U.S. holdings, let’s take a look at a more stable Singapore-listed company in my portfolio that also released its results last evening, Venture Corporation (SGX: V03).

Venture: A glimpse of hope

As expected, Venture reported another quarter of declining sales and income.

Revenue and net profit for 2Q 2025 decreased by 10% YOY to S$645 million and S$57 million respectively.

Encouragingly, this quarter showed a slight improvement over the first, offering a glimpse of hope that the declining top and bottom lines since early 2022 might finally be reversing.

Moreover, there are also indications that management is acting on shareholders’ feedback from the last annual general meeting.

Besides providing the revenue breakdown of the two portfolios, Venture also declared a special dividend per share of S$0.05 on top of the S$0.25 interim dividend per share to reward shareholders.

Today’s market reaction of sending its share price up by more than 3% to above S$13, provides an indication that Singapore investors may generally prefer returns from dividends over share buybacks.

With its robust cash flow and strong balance sheet, I am confident that Venture can continue to dish out S$0.75 of ordinary dividend per share, which translates to an attractive yield of around 5.7%.

I will hold on to my current stake and continue to monitor the business in the coming quarters.

Help Me Raise Funds for Autism Resource Centre (SG)

I’m participating in this year’s fundraising event: A Very Special Photo Challenge.

A little background on this challenge.

ARC(S) is building and expanding services to support adults with Autism Spectrum Disorder (ASD), addressing their growing needs in areas such as employment, lifelong learning, independent living training, and residential housing.

Funds raised will go towards supporting these vital services to empower them to lead independent and meaningful lives beyond their school years.

If you’ve found value in my writings and insights, please consider donating to this cause by clicking here or scanning the QR code below.

Thank you.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.