iFAST Corporation (SGX: AIY) continues its impressive trajectory, reporting a robust performance in the second quarter of 2025.

Revenue surged by 28% year-on-year (YOY) to S$120 million, while net profit soared by almost 38% YOY to over S$22 million.

This strong growth was a collective effort across all geographical segments. Notably, Hong Kong accounted for over half of the profits, driven by its burgeoning ePension business.

Adding to this positive momentum, iFAST Global Bank (iGB) maintained its profitable streak since 4Q 2024, contributing S$0.70 million in profit for the quarter.

As if these achievements weren’t enough, iFAST anticipates an even stronger second half of the year.

Further sweetening the deal for shareholders, the company has proposed an S$0.02 dividend per share for this quarter, 33% higher YOY, and expected total dividend of S$0.08 for the full financial year (FY) 2025.

While iFAST has provided a comprehensive presentation of this quarter’s results (which you can access here), my aim is not to reiterate those details.

Instead, I’d like to share my insights on these latest results and iFAST’s future price potential.

Strong business momentum, volatile short-term price movement

You might recall iFAST’s share price plunged by 12% after its 1Q 2025 results.

This wasn’t due to poor performance – revenue and profit were up 24% and 31% YOY, respectively.

Rather, the market reacted negatively to the revised 2025 profit before tax (PBT) target for the Hong Kong segment, lowered from an initial HK$500million to HK$380 million.

To me, this reaction was irrational, given the company’s underlying robust performance. With this stronger second quarter and an even better second half anticipated, I’m pleased to see my assessment validated.

While I’d love to see the stock price soar when the market re-opens next Monday (especially since I’m not increasing my positions further), we all know the market doesn’t care about individual expectations.

There’s no point second-guessing short-term price movements.

My confidence lies firmly in iFAST’s longer-term price trajectory. As long as iFAST continues to execute its strategies effectively, its stock price will eventually be re-rated.

My assumptions and projections

Please note: The following is my personal projection and should not be construed as financial advice.

Based on the results, iFAST’s 1H 2025 earnings per share (EPS) stands at S$0.1368. Given the guidance of a stronger second half, it’s reasonable to expect EPS to be at least S$0.30 for the FY 2025.

Consequently, at its current price of S$7.42, iFAST is trading at a price-to-earnings (P/E) ratio of approximately 25x.

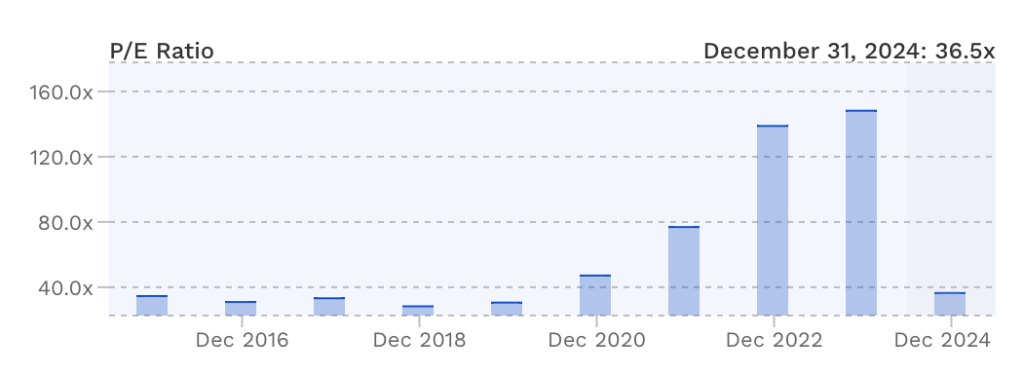

A glance at historical data (as shown in the chart below) reveals that iFAST has traded at a wide P/E range, from 28x to 148x, over the past decade.

Interestingly, its share price volatility isn’t solely attributable to its underlying fundamentals.

While the P/E spike in 2022 was indeed a result of the share price plunge (caused by broad market weakness and the impairment of its India Business), the share price continued to languish even in the subsequent year, despite iFAST posting a strong recovery.

Excluding these exceptional years, it’s fair to say the market typically values iFAST at a P/E of around 30x.

So, is the current P/E of 25x cheap?

There’s no straightforward answer, as it entirely depends on your conviction regarding iFAST’s ability to deliver sustained double-digit growth going forward.

If iFAST can achieve just 20% growth for the next three years, its EPS could exceed S$0.50. Consequently, its stock price would likely climb north of S$10.

Obviously, this is not guaranteed.

While I remain confident in management’s competency in steering iFAST’s growth, missteps such as the impairment of the India Business or lowered projections for the HK segment could still occur.

Hence, despite my excitement for iGB’s potential, I am prudently limiting my current exposure, which is approaching 8% of my total portfolio.

Related article

iFAST’s Share Price Plunged by 12%: Is the Fintech Company a Compelling Buy? (The Smart Investor)

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.

without a doubt, iFast will deliver on its potential. Strong management integrity, right segment (Fintech) and a clear played out objective. I’ve said this before, if you want to bet on a growth stock in the Singapore market, iFast has to be a very strong contender for your money.

Yeah, it’s a rare find in the SG market.

iFast has an amazing business model – a platform bussiness which operates in over 100 countries but with offices in only 5. That gives iFast a very long runway for a growth. Its digital bank IGB, is still very much in early days. To know its potential, take a look at Monzo’s deposit growth in the last 5 years.

Approaching 8% of your portfolio is indeed being underweight on such a rare gem.

Big money is made by being concentrated.

just look at how much WB betted on Apple.

i am a business investor. Over 90% of my portfolio is in only 3 companies and iFast is right on top. Cheers!

Thanks for sharing. We each have different investment goals, so our approach will be different.

Big money is made or loss by being concentrated.

Diversification suits me at this stage of my life and most importantly still provides me with the necessary returns.

Let’s continue to cheer for iFAST, so that it contributes to both our goals.