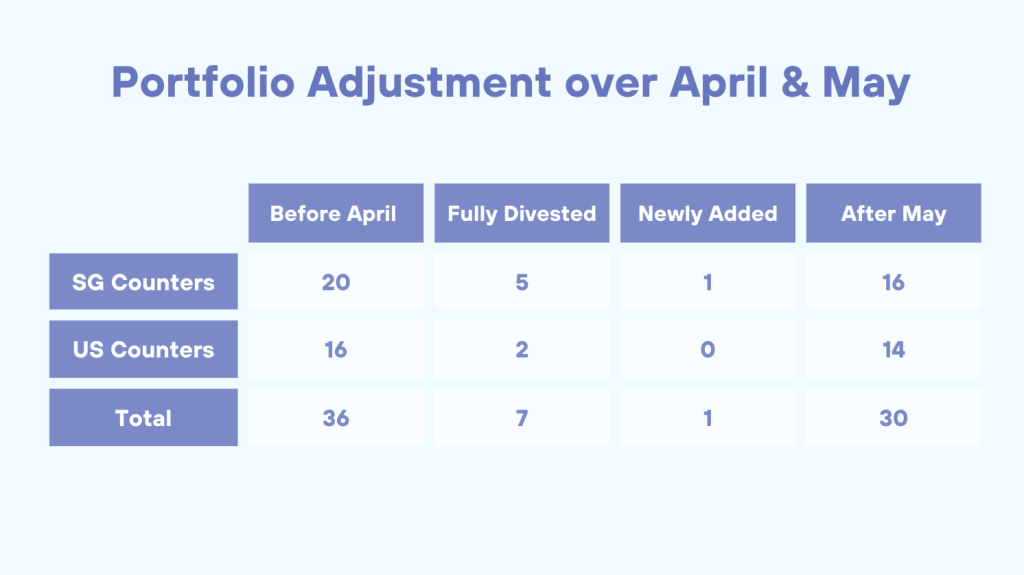

With the various buys and sells in April and May, there are some changes to the portfolio. In short, I have fully divested Capitaland China Trust, Frasers Logistics and Commercial Trust, SGX, Sheng Siong and UMS (sold in March) and initiated a position in Daiwa House Logistics Trust on the local bourse.

If you have missed what I wrote about them, you can access my previous posts from the following links.

- Raising Fund for Upcoming Purchases

- Buy in May and Go Away

- Added more Raffles Medical and initiated a position in Daiwa House Logistics Trust

- Added back Mapletree Logistics and Pan Asia Commercial

I have also fully divested Airbnb and Semler Scientific on the US markets. I don’t see myself adding more to ABNB, so I decided to sell and made a loss of 22%. The position is small, so only about a $750 loss.

As for SMLR, it is a painful lesson of $5.5k (-64%) loss. I bought too much and too fast on this small company in late 2021 and early 2022. That went against my usual practice of gradually adding to a new position. In any case, the company did well in the recent quarter but is facing headwind in terms of a change in healthcare regulatory on insurance claim for their product. While there is a 3 years timeline in phasing out the claims and the impact is still unknown, I decided to stop monitoring the progress.

Latest Portfolio Allocation

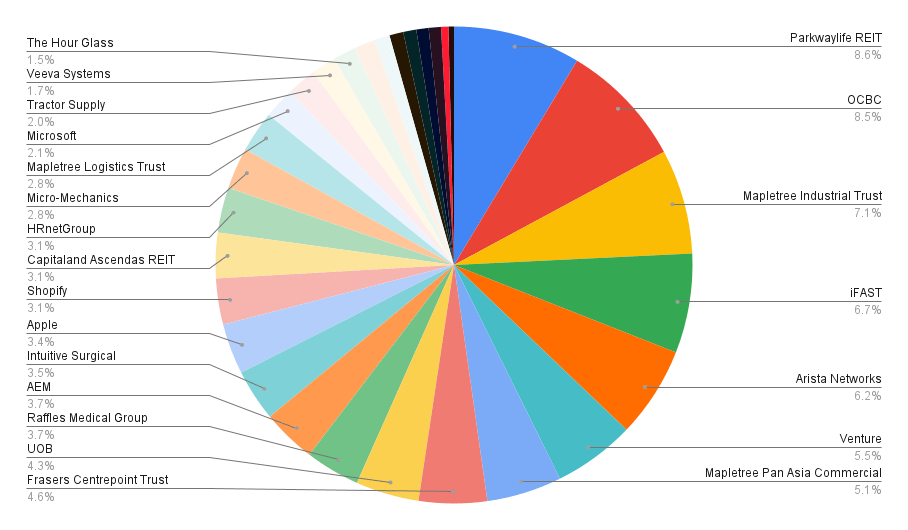

At the time of writing, the 22 named counters account for more than 92% of the portfolio. SG counters take up about 70% of the portfolio, with US counters making up the rest.

Besides cutting the number of counters from 36 to 30, the other notable change is Micro-Mechanics and AEM are no longer the top 10 positions. They are being replaced by UOB and Raffles Medical Group.

At the moment, I do not foresee much changes in the second half of the year. The caveat is with new information, my thinking might change.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.