Beginning of last year, I decided to have a closer track of the counters which I have a larger position size. I named this group my core holdings as I think I am more likely to hold them for a longer period of time since I am more familiar with their businesses.

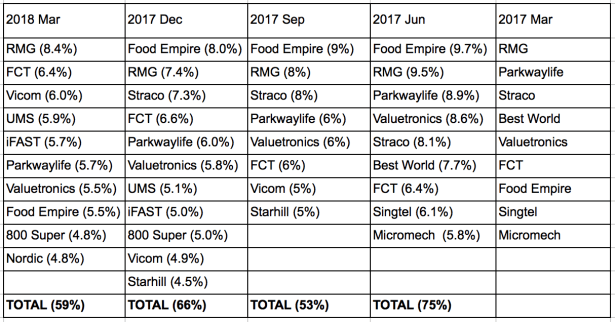

The initial nine of them were Raffles Medical Group, Parkwaylife REIT, Straco, Best World, Valuetronics, Frasers Centrepoint Trust, Food Empire, Singtel and Micro-mechanics. And along the year, it has morphed as shown below.

Observation 1

Only 5 of the 9 remain in the list and that is a duration of one year. At first look, the attrition rate seems pretty high and the holding period does not seem to fit one that is in the core list. However, a check on the spreadsheet shows the following.

- Best World was first bought in Sep 2015 before totally divested in July 2017. So the holding period was about 2 years.

- Singtel was first bought in Dec 2016 and just totally divested this month.

- Micro-mechanics was first bought in Sep 2016 and totally divested in Aug 2017.

- Straco was first bought in Sep 2015 and only trim my holding recently.

- The average holding period of the remaining 5 stands at 2.5 years.

Considering the above, I think it’s not too bad.

Observation 2

The total position size of the core holdings has dropped from the high of 75% in June 2017 to 59% in the latest quarter. Again, that does not seem right. Ideally for me, I would like the position size of these holdings to be at least in the high 60%. One reason for the drop in percentage is that there a few stocks which languish just outside the core holdings.

Going forward, I would like to increase the percentage back to high 60% as these are the counters that I am most familiar with.

Observation 3

With the exception of Nordic, I have a spreadsheet that recorded at least the past 5 years’ information of the company. The information includes the financial numbers and ratio and also key events.

Looks like I was too impulsive in my purchase of Nordic. After realising this early this month, I decided to trim my holding on Nordic recently.

Conclusion

While that core holding does not appear as core as it should be, I am satisfied with the current state. Going forward, I will probably add on to my core holdings as they will have the greatest influence on my portfolio performance.

Discover more from The Fat Investor

Subscribe to get the latest posts sent to your email.